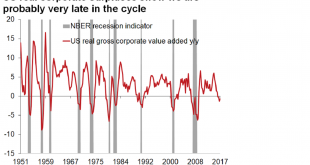

A number of people have forwarded this Bloomberg article – Wall Street Banks Warn Downturn Is Coming – to me over the last couple of days. That fact alone is probably a good argument to ignore it but I can’t help but read articles like this if for no other reason than to know what the crowd is thinking. The gist of the article is that a bunch of sell side analysts think we are nearing the end of the current business...

Read More »Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it. I don’t waste much time on it myself because it is subject to large revisions and has little predictive capability. In...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

Read More »Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

The following article by David Haggith was first published on The Great Recession Blog: We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a...

Read More »Hopefully Not Another Three Years

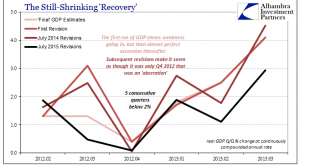

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions...

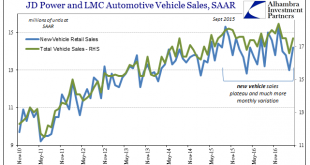

Read More »Auto Pressure Ramps Up

The Los Angeles Times today asked the question only the mainstream would ask. “Wages are growing and surveys show consumer confidence is high. So why are motor vehicle sales taking a hit?” Indeed, the results reported earlier by the auto sector were the kind of sobering figures that might make any optimist wonder. Across the board, and for the fourth straight month, there was almost all negatives, some still large....

Read More »Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »Now You Tell Us

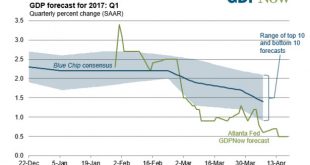

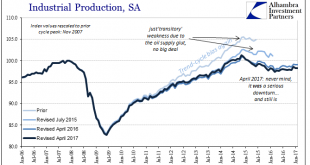

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions. There is, obviously, great...

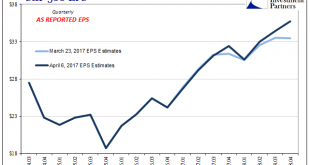

Read More »Earnings per Share: Is It Other Than Madness?

As earnings season begins for Q1 2017 reports, there isn’t much change in analysts’ estimates for S&P 500 companies for that quarter. The latest figures from S&P shows expected earnings (as reported) of $26.70 in Q1, as compared to $26.87 two weeks ago. That is down only $1 from October, which is actually pretty steady particularly when compared to Q4 2016 estimates that over the same time plummeted from $29.04...

Read More »Saxo Warns Reflation Trade Ends In Q2 With “Healthy Correction”

The reflation trade that started before Donald Trump’s victory in the US presidential elections accelerated in Q1 as global economic data improved and surprised against expectations. Global equities are up 6.5% in dollar terms with markets such as Hong Kong, emerging markets, and Brazil the clear outperformers. In its Q2 2017 Outlook report, Saxo Bank warns that the reflation trade will end in Q2 with a healthy correction in global equities. The biggest perception-versus-reality...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org