As earnings season begins for Q1 2017 reports, there isn’t much change in analysts’ estimates for S&P 500 companies for that quarter. The latest figures from S&P shows expected earnings (as reported) of .70 in Q1, as compared to .87 two weeks ago. That is down only from October, which is actually pretty steady particularly when compared to Q4 2016 estimates that over the same time plummeted from .04 to .16. At .70, that would represent about 23% growth over Q1 2016. If history holds, of course, actual EPS will be substantially less than that. It has become standard ritual to watch each quarter unfold in considerable disappointment. Given that history, it was unusual to find that in just the two weeks since the March 23 estimates were published (to the latest of April 6) analysts have become suddenly more optimistic for later this year and especially 2018. Rarely do earnings estimates that far out get much if any boost, particularly because they start out so highly positive to begin with. The expectation for Q4 2017, for example, was on February 21 .12; cut down to .41 as of March 23. The latest for April 6, however, is suddenly .43; above even the figure from late February. For Q4 2018, estimates were .68 in February, .46 at the end of March, but now .70.

Topics:

Jeffrey P. Snider considers the following as important: as reported earnings, asset bubbles, cbo, currencies, depression, Earnings Per Share EPS, economic potential, economy, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, Output Gap, PE, pe ratio, real GDP, Recession, S&P 500, S&P 500 Index, S&P 500, S&P 500 Index, stock bubble, stocks, The United States, valuations

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

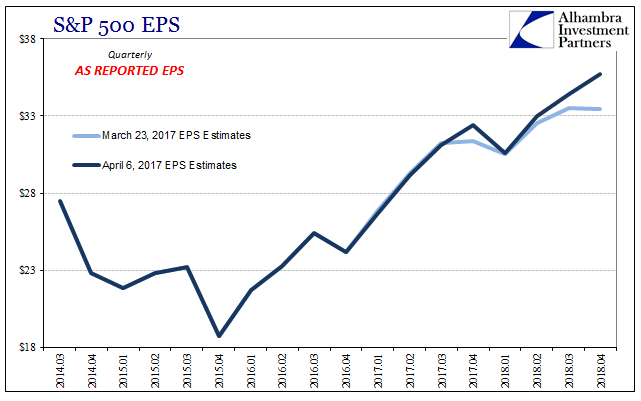

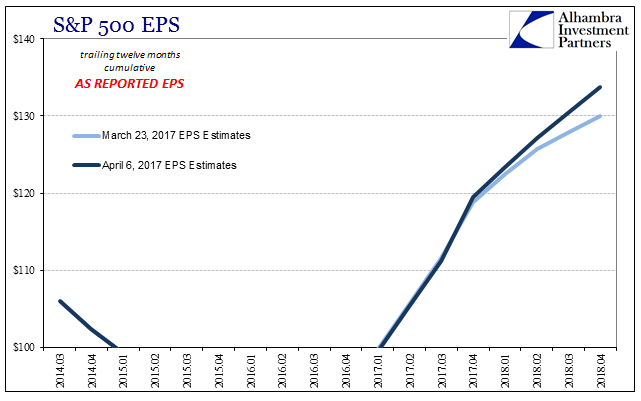

As earnings season begins for Q1 2017 reports, there isn’t much change in analysts’ estimates for S&P 500 companies for that quarter. The latest figures from S&P shows expected earnings (as reported) of $26.70 in Q1, as compared to $26.87 two weeks ago. That is down only $1 from October, which is actually pretty steady particularly when compared to Q4 2016 estimates that over the same time plummeted from $29.04 to $24.16. At $26.70, that would represent about 23% growth over Q1 2016.

| If history holds, of course, actual EPS will be substantially less than that. It has become standard ritual to watch each quarter unfold in considerable disappointment. Given that history, it was unusual to find that in just the two weeks since the March 23 estimates were published (to the latest of April 6) analysts have become suddenly more optimistic for later this year and especially 2018. Rarely do earnings estimates that far out get much if any boost, particularly because they start out so highly positive to begin with.

The expectation for Q4 2017, for example, was on February 21 $32.12; cut down to $31.41 as of March 23. The latest for April 6, however, is suddenly $32.43; above even the figure from late February. For Q4 2018, estimates were $34.68 in February, $33.46 at the end of March, but now $35.70. |

S&P 500 Earnings Per Share 2014-2018(see more posts on Earnings Per Share EPS, ) |

| Though I can’t know for sure what analysts are thinking, it seems reasonable to assume that their forecasts were changed by the FOMC “rate hike” in March. It appears as if they are translating what for the mainstream is more “hawkishness” by the textbook definition of it, meaning the Fed attempting to get ahead of an improving, perhaps rapidly, economy. |

S&P 500 EPS 2014-2018 |

| It is a wonder to behold because it shows the utter incapacity for learning, let alone scientific principles. The models are the models no matter how much empirical refutation they have been subjected to time and again. |

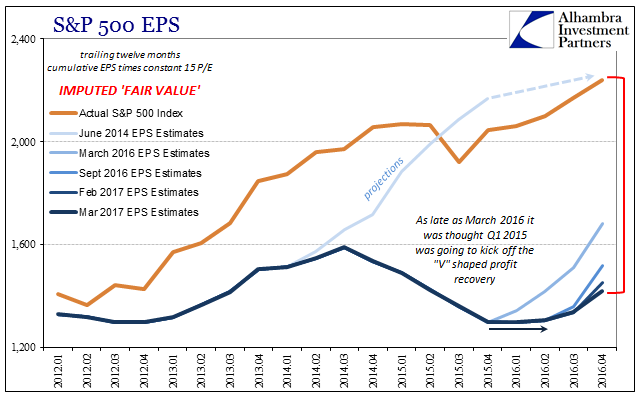

S&P 500 EPS Fair Value 2012-2017 |

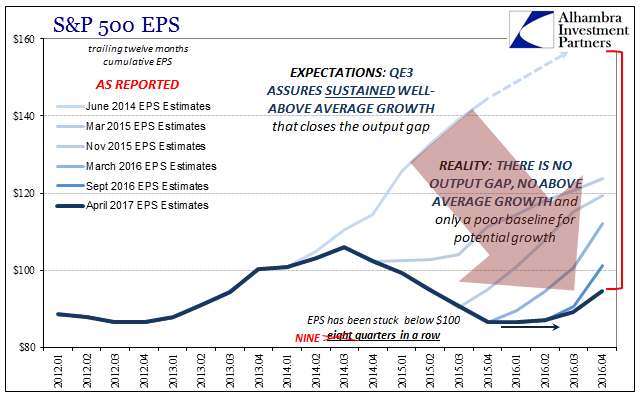

| It’s even worse in this case because of very recent history. Earnings departed from the QE3 path almost three years ago, and only to keep deviating from it all the while since. Admittedly, this recent upward adjustment isn’t a large one, but the very fact that it is upward makes it stand out in astonishment. In other words, the same reasons analysts may have used to perform these more optimistic calculations are the same reasons economists can’t figure out the bond market. |

S&P 500 EPS - Reported 2012-2017(see more posts on Earnings Per Share EPS, ) |

It is why the current recycling depression economy is by far the worst case. As I wrote a few months back:

The big problem with these cyclical upturns (depression cycle, not business cycle) is these positive interpretations. It will likely end up being hugely counterproductive (if it continues for long enough) in the same way as 2013-14 was attributed to QE3 and the belief that recovery was at that time not just possible but even likely (it’s amazing in review how in late 2014 the Federal Reserve was more concerned about “overheating” and how that view pervaded, uncritically, the whole mainstream description of what was going on). With that conventional perspective, there was and will likely be far less urgency to do what is necessary, even to (honestly) examine what it is that might be causing this sustained misery because there are seemingly plausible conditions (positive numbers) that suggest an end to the misery finally at hand. The economy ends up like a dog chasing its tail.

And analysts end up forecasting growth that “unexpectedly” disappears into the ether of textbook economics, we end up wasting that much more time, and round and round we go, nary a prayer for escaping this madness. That is what this truly is, because how can it be by any rational standards of empiricism and actual observation anything else?

Tags: as reported earnings,asset bubbles,cbo,currencies,depression,Earnings Per Share EPS,economic potential,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Output Gap,pe,pe ratio,real GDP,recession,S&P 500,S&P 500 Index,stock bubble,stocks,valuations