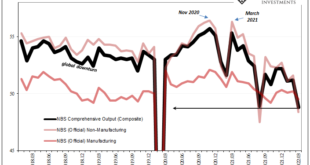

This is the difference, though in the end it only amounts to a matter of timing. When pressed (very modestly) on the slow pace of the ECB’s “inflation” “fighting” (theater) campaign, its President, Christine Lagarde, once again demonstrated her willingness to be patient if not cautious. Why? For one thing, she noted how Europe produces a lot of stuff that, at the margins of its economy, make the whole system go. Or don’t go, as each periodic case may be: Europe in...

Read More »Collateral Shortage…From *A* Fed Perspective

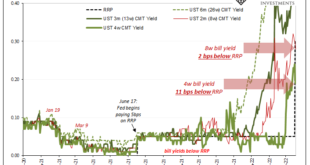

It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods. There was, as I wrote...

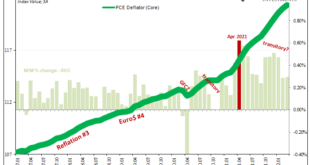

Read More »Some ‘Core’ ‘Inflation’ Difference(s)

The FOMC meets next week, with everyone everywhere expecting a 50 bps rate hike to be announced on Wednesday. Yesterday’s “unexpected” and “shocking” negative GDP is unlikely to deter anyone on the committee. Most have already dismissed it as nothing more than quirky, temporary factors, not unlike when they did the same to Q1 2014’s similarly negative result. At least that one had the Polar Vortex (uh oh). Jay Powell’s group can’t see beyond the US border, doesn’t...

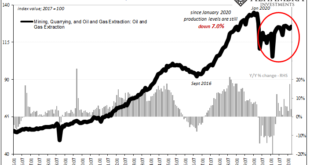

Read More »I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape. The 2022 FOMC has made itself plain, incredibly hawkish to an...

Read More »You Know What They Say About The Light At The End Of The Tunnel

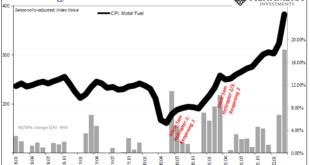

In any year when gasoline prices rise 18%, that’s not going to be good for anyone except maybe oil companies who extract its key ingredient from out of the ground (or don’t, as the case can be). Yet, annual rates of increase that size do happen. After August 2017 up to and including August 2018, the BLS’s CPI registered a seasonally-adjusted 20.5% year-over-year gain in its motor fuel component. Economic pain followed thereafter, though not entirely the fault of...

Read More »Concocting Inventory

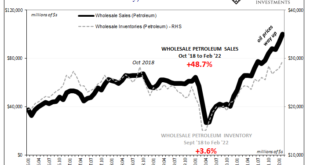

The Census Bureau provided some updated inventory estimates about wholesalers, including its annual benchmark revisions. As to the latter, not a whole lot was changed, a small downward revision right around the peak (early 2021) of the supply shock which is consistent with the GDP estimates for when inventory levels were shrinking fast. What’s worth noting about the figures now is how much of a problem there is in terms of petroleum. By that I mean two ways. First,...

Read More »Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two. Running red-hot to the point of near-horror, that’s “our” Federal Reserve. The FOMC minutes...

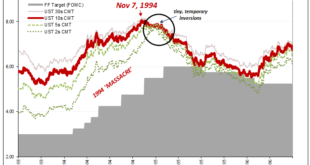

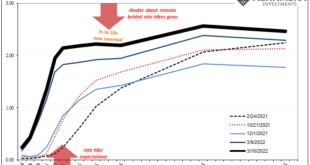

Read More »We Can Only Hope For Another (bond) Massacre

To begin with, the economy today is absolutely nothing like it had been almost thirty years ago. That fact in and of itself should end the discussion right here. However, comparisons will be made and it does no harm to review them. I’m talking about 1994, or, more specifically, the eleven months between late February 1994 and early February 1995. Fearing inflation (the only time in its history, including much of the Great Depression, the Fed didn’t fear inflation...

Read More »The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

The Federal Reserve didn’t just raise the range for its federal funds target by 25 bps, upper and lower bounds, it also added the same to its twin policy tools which the “central bank” says are crucial to maintaining order in money markets thereby keeping federal funds inside the band where it is supposed to be. The FOMC voted to increase IOER from 15 bps to 40 bps, and the RRP from 5 bps to 30 bps. That RRP, or reverse repo program, is meant to be something of a...

Read More »Media Attention All Over FOMC, Market Attention Totally Elsewhere

The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end. We shouldn’t care much about the Fed. Live look at Jay Powell’s press conference.#ratehikeshttps://t.co/leCyV8Wak4...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org