Black Friday 2021 saw the largest stock market sell-off since 1931. Is this the start of a bigger crash, has the trend changed or is this just a one-time blip? We ask Gareth Soloway of InTheMoneyStocks.com what his charts are suggesting and why he is so bullish on gold [embedded content] Make sure you don’t miss a single episode… Subscribe to our YouTube channel [embedded content] You Might Also Like...

Read More »COT Black: No Love For Super-Secret Models

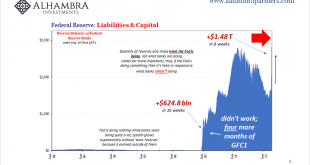

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust. Because of this set of numbers, officials here as well as elsewhere around the world chose the most extreme form of pandemic mitigations, trusting...

Read More »Oil market: supply disruption is here

The risk that similar attacks to the ones seen this weekend in Saudi Arabia could disrupt oil supplies, but it does not fundamentally change our medium-term scenario. We still forecast USD50 per barrel for Brent in 2020.After this weekend’s drone attack on the world’s most important crude oil facility, the Saudi Arabian authorities have announced that 5.7 million barrels per day (mbd), half of its daily oil production and 5% of the world total, will be taken off-line. Iran-aligned Houthi...

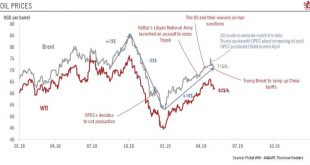

Read More »Oil prices decline despite the end of Iran waivers

We believe prices will remain volatile in the short term, before a possible oil glut becomes an issue toward year’s end.The increase in prices that followed President Trump’s 22 April decision to end waivers on Iranian oil imports did not last, with Brent prices falling from almost USD75 on 24 April to below USD70. Nonetheless, we continue to see heightened risk of oil price spikes above USD80 for Brent in the short-term.Trump’s recent threat to increase US tariffs on Chinese imports could...

Read More »OPEC+ discipline will be key for oil prices in 2019

An extension of the December agreement to cut production, plus a slight increase in demand, could potentially bring the oil market into balance this year.Global oil supply is undergoing a structural shift. The US oil industry is growing in importance relative to the OPEC. As a result increased production from non-OPEC producers more than compensated for the output collapse among important OPEC producers such as Iran and Venezuela in 2018.Slowing global growth, and new US pipelines facilities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org