As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust. Because of this set of numbers, officials here as well as elsewhere around the world chose the most extreme form of pandemic mitigations, trusting that the strong economy wouldn’t just immediately buckle. And they were pushed in this direction by absolutely dire estimates for how COVID-19 was going to ravage large swaths of the globe. It hasn’t happened yet and increasingly looks like it never will. Federal Reserve: Liabilities & Capital,

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Commitment of Traders, commodities, COT, crude stocks, currencies, Dollar, economy, eurodollar system, Featured, Federal Reserve/Monetary Policy, gasoline stocks, GFC1, GFC2, jay powell, Liquidity, Markets, newsletter, oil market, oil prices, steve mnuchin, stimulus, stocks, WTI, wti futures

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

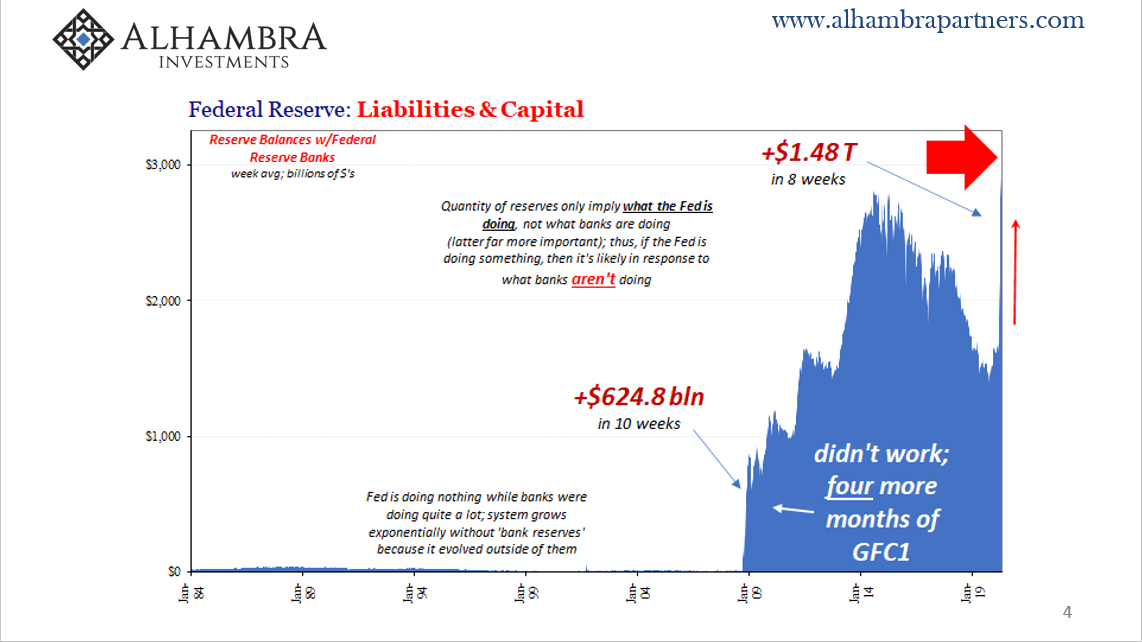

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust. Because of this set of numbers, officials here as well as elsewhere around the world chose the most extreme form of pandemic mitigations, trusting that the strong economy wouldn’t just immediately buckle. And they were pushed in this direction by absolutely dire estimates for how COVID-19 was going to ravage large swaths of the globe. It hasn’t happened yet and increasingly looks like it never will. |

Federal Reserve: Liabilities & Capital, 1984-2019 |

| Having prioritized carpet bombing the economy, now they claim the models are projecting how everything will bounce back quickly. Sure, oh-for-two so far, for the most important period in the world’s history since the 1930’s we should just rely on the same sort of predictive capacities.

Except, the mainstream econometric models aren’t quite that sanguine. These say the economy will bounce back…mostly. And that’s the most optimistic case. Or was. Never mind those, says Treasury Secretary Mnuchin. We can’t rely on any of these stochastic constructions because this is new ground we’re trying to slog over. Instead, his super-secret figures are even more assuring as to how quickly the recovery will happen and how thoroughly we all make it the whole way back. On FoxNews, he told Chris Wallace:

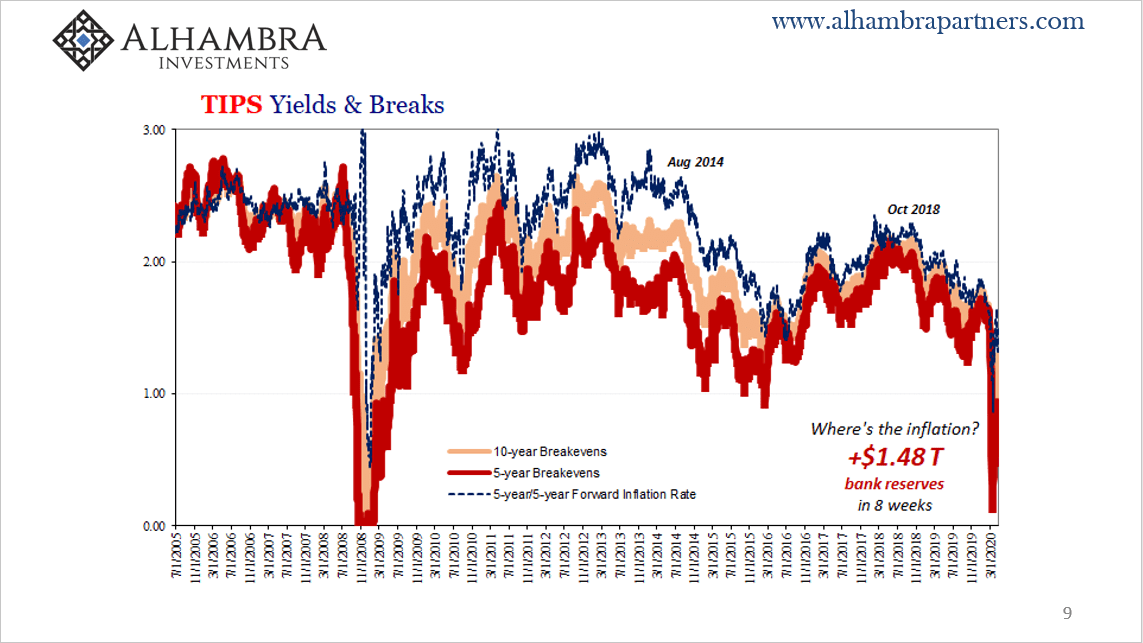

Then he added, “My own opinion is, again, we have unprecedented amount of liquidity in the system.” Oh dear. At least he noted how it is only his opinion as to the monetary system; which, is already an odd sort of development given he’s the damn Treasury Secretary. |

TIPS Yields & Breaks, 2005-2020 |

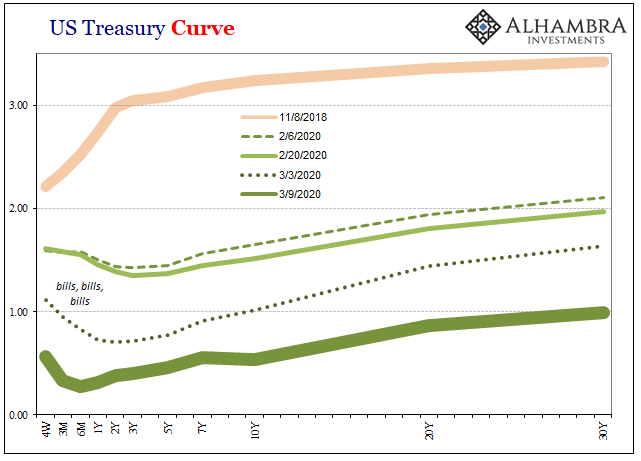

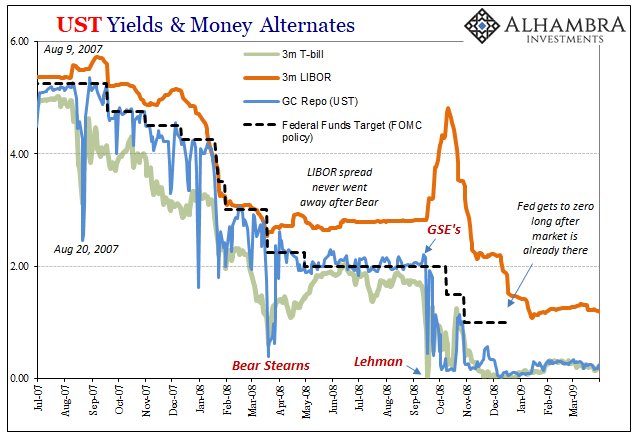

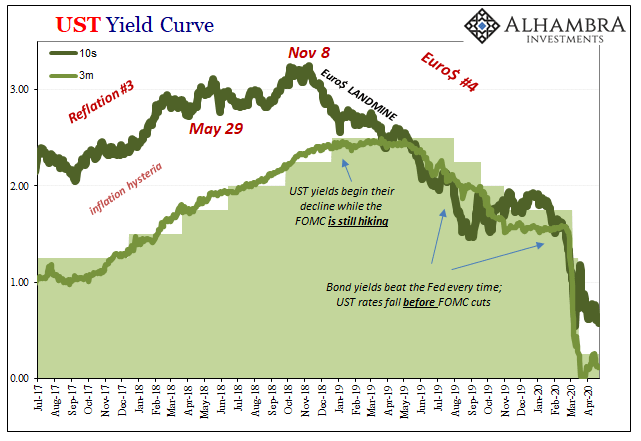

| No offense, Mnuchin, but you may not have noticed the similarities between the last two months and those of 2007-09; when, despite all the same assurances there definitely was a financial crisis because the same kinds of “liquidity” programs being implemented by Jay Powell today so conspicuously failed Ben Bernanke twelve years ago.

This isn’t the Financial Crisis; he’s right. It’s the second one. There is no longer “the” Financial Crisis, there is now GFC1 as well as GFC2. Don’t take the Fed’s word for it; for anything, especially liquidity. Not even the dip buyers on the NYSE are so sure like they once had been. |

|

| There wasn’t a day in late 2019 that didn’t go by when someone made the reference to the “obvious” money printing correlation between size of the Fed’s balance sheet and the direction of share prices in the aggregate. Suddenly, March 2020, “repo” operations and balance sheet expansion aren’t so sexy. |

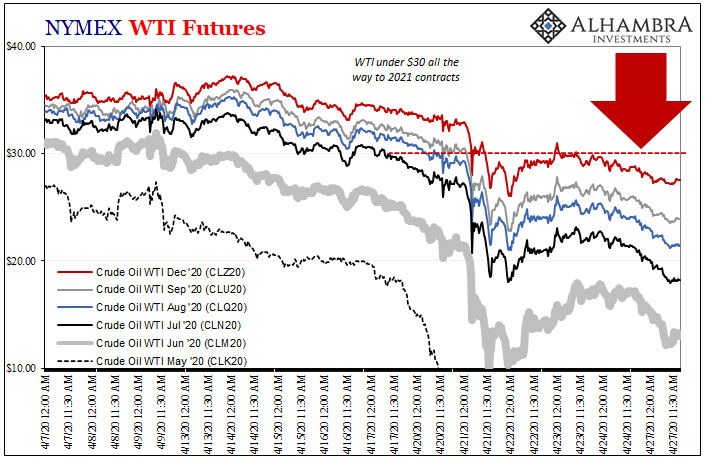

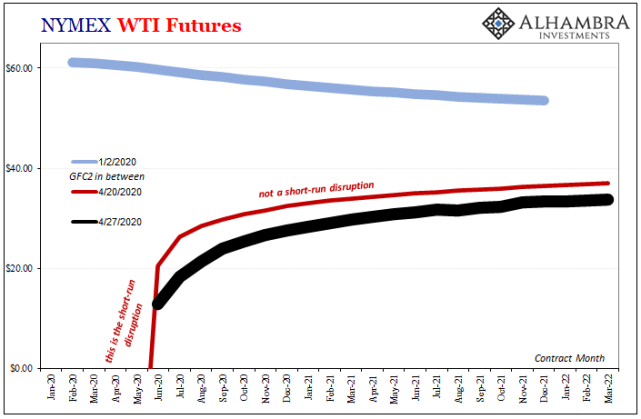

NYMEX WTI Futures, 2020 |

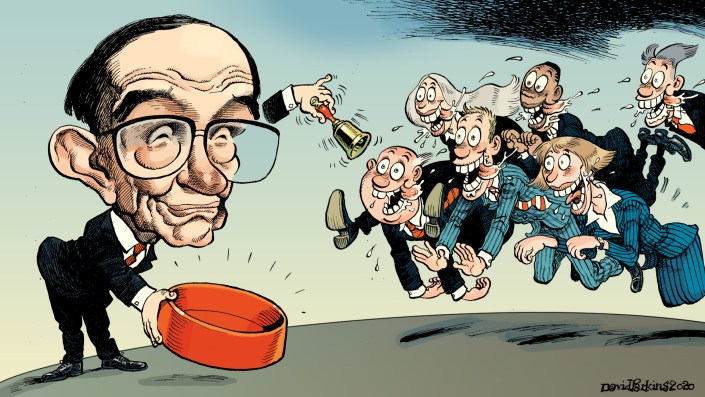

| In other markets less devoted to entertainment, situated far more closely to the real economy, what liquidity and stimulus? We are one week removed from oil prices hitting -$36. And while that spoke to short run chaos, it also meant a herd of investors which had come running at the sound of the Greenspan put learning to regret that very thing.

Greenspan’s put was always an empty bowl. |

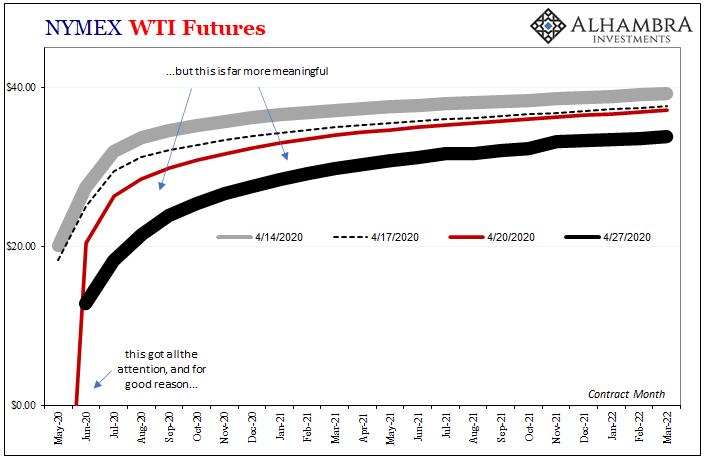

NYMEX WTI Futures, 2020-2022 |

|

Away from oil future’s front month, the real bad news as far as Secretary Mnuchin and Fed Chairman Jay Powell should be concerned is the intermediate WTI curve. Oil prices are now sub-$30 as far as March 2021. Definitely not a statistical model, this real-world market is more aggressively discounting any chance of hitting the “V” shape. |

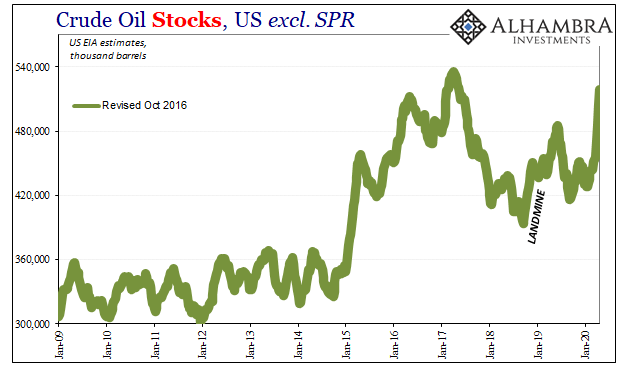

Crude Oil Stocks, US excl. SPR 2009-2020 |

| As far as the numbers go in Cushing, we’ve only begun to see product overflow. Crude oil stocks are looking very 2014-ish and it’s only just the start. In gasoline, what should be seasonal flows drawing down levels have instead become record high inventory. |

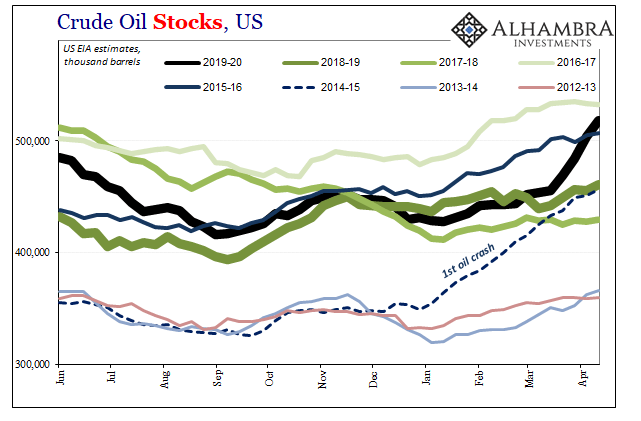

Crude Oil Stocks, US 2012-2019 |

Gasoline Stocks, US 2012-2019 |

|

NYMEX WTI Futures, 2020-2022 |

|

|

Those results plus the way the WTI curve is shifting are the market pricing an intermediate future that isn’t at all what the Treasury Secretary hopes. The enormous inventories won’t be worked through quickly over the summer, the lack of demand plus the lack of liquidity combining to seriously menace a great many optimistic oil speculators who might be left. |

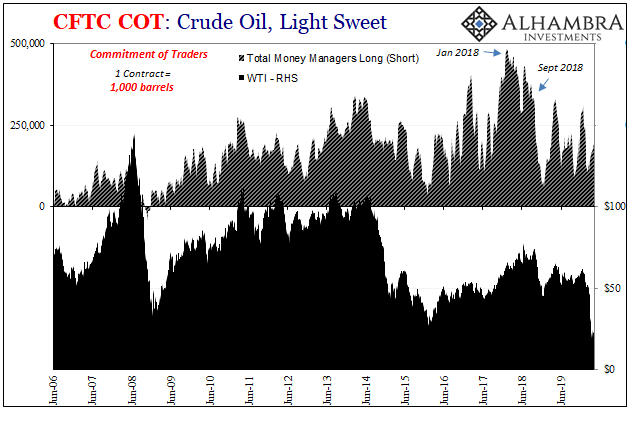

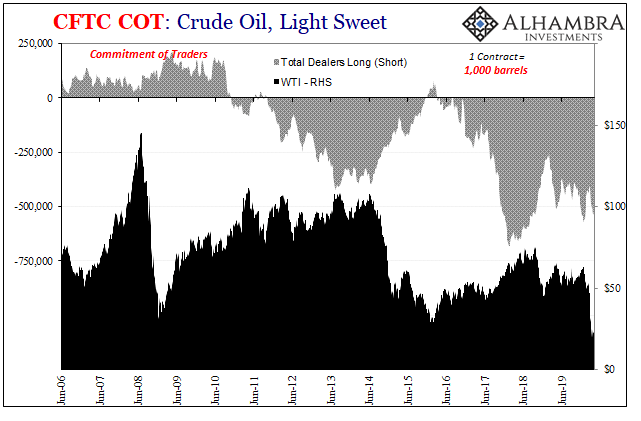

CFTC COT: Crude Oil, Light Sweet, 2006-2019 |

| Just who these specs are, it isn’t quite clear yet. The Commitment of Traders (COT) report didn’t show any out-of-character position changes last week. There was a spike in net longs among money managers, but nothing we haven’t seen before and nothing that would indicate large positions being trapped by last week’s highly unusual trading.

Was it everyone betting on Stimulus Steve? |

CFTC COT: Crude Oil, Light Sweet, 2006-2019 |

|

In other words, Secretary Mnuchin’s extra-special models forecasting a quick turnaround are grounded by the same thing which forms the basis of all extra-special super-secret prediction methods; the Fed’s imaginary “liquidity” and the assumption of “stimulus.” For a reminder about those, take it away Stan Fischer:

Everything about the current period smacks of GFC, right down to the stupid monetary policies central bankers are using to claim this is not a GFC. |

|

| In oil markets, it’s even worse, much worse GFC2 compared to GFC1.

And this thing is still getting started, with massive crude inventory yet to flow in (May deliveries) standing in for the enduring lack of demand economy-wide. The system which today is scheduled to be bouncing back in July, August, and September the oil market says that in July, August, and September we’ll be hearing how the big, complete rebound is definitely going to happen…in October, November, and December. And then it will be January, February, and March 2021 – for sure, the official modelers all promise. The first two sets of models screwed us, but this third one’s really going to hurt. |

CES: Civilian Labor Force Level, 2007-2020 |

Tags: Bonds,Commitment of Traders,commodities,COT,crude stocks,currencies,dollar,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,gasoline stocks,GFC1,GFC2,jay powell,Liquidity,Markets,newsletter,oil market,oil prices,steve mnuchin,stimulus,stocks,WTI,wti futures