On his blog, John Cochrane reports about a Hoover panel including him, Charles Plosser, and John Taylor. Cochrane focuses on the liability side. He favors a large quantity of (possibly interest bearing) reserves for financial stability reasons. Plosser focuses on the asset side and is worried about credit allocation by the Fed, for political economy reasons. Taylor favors a small balance sheet. Cochrane also talks about reserves for everyone, but issued by the Treasury.

Read More »Tax Evasion in a (the) New World

In the FT, Vanessa Houlder reports about the tax evasion business. The new regulatory environment has led to portfolio adjustments and new types of behavior, and it exposes vast differences in enforcement across countries: Diamonds in vaults rather than financial assets. Trusts in South Dakota rather than anonymous bank accounts. Moving to a different country rather than just shifting assets. FATCA versus the Common Reporting Standard. The article also links to an article by Kara Scannell...

Read More »Short-Term Debt Measures to Help Greece

The Eurogroup has approved short-term debt measures for Greece. The explanations on the ESM website are not very precise. A chronology of the Greek debt crisis and the European institutions.

Read More »Determinants of (Low) Real Interest Rates

On his blog, James Hamilton summarizes a Bank of England working paper by Lukasz Rachel and Thomas Smith on the determinants of low real interest rates.

Read More »Seignorage and Cantillon Effects in India

On Alt-M, Larry White discusses three aspects of the Indian “demonetization” experiment. The transition from old notes blocks “honest” currency transactions, reduces income, and harms the poor who don’t have access to alternative means of payment. Because not all old notes will be redeemed, the transition into new notes will generate seignorage revenue for the government on the order of USD 40 billion, according to White’s estimates. Not all groups or industries get access to the new...

Read More »Bundesbank Considers Electronic Money

In the Welt, Karsten Seibel reports about the Bundesbank pondering over digital money. The Riksbank does the same.

Read More »In Switzerland, the “Elites” Represent Voters

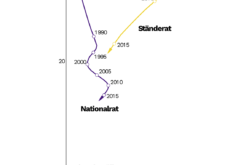

In a post on DeFacto, Michael Hermann argues that in Switzerland the conflict between voters and “political elites” actually has receded. According to Hermann, popular votes helped clarify where voters disagreed with parliamentarians, and this led policy makers to adjust. The figures illustrate how over time, votes in the two chambers of parliament converged towards outcomes in popular votes. Campaigns supported by the right-wing SVP party may have contributed to these developments....

Read More »God and Money

In the NZZ, Thomas Fuster comments on the Catholic church’s critical perspective on capitalism. Der Theologe Martin Rhonheimer hat schon recht: Die Kirche stellt die falsche Frage. Zu ergründen gälte es nicht, wie Armut entsteht, zumal Armut dem ursprünglichen Zustand des Menschen entspricht. Fragen sollte sie sich, wie Wohlstand entsteht. Täte sie dies, hätte der gewinnorientierte Unternehmer, der mit seinen Investitionen zahllosen Menschen ein Auskommen ermöglicht, wohl einen besseren...

Read More »Roger Farmer’s “Prosperity for All”

On his blog, Roger Farmer advertizes his new book, “Prosperity for All,” and argues that governments should stabilize asset prices: Following the Great Stagflation of the 1970s, economists backtracked and revived the classical economic theory that had dominated academic economics for a hundred and fifty years, beginning with Adam Smith in 1776 and culminating in the business cycle theory described by Keynes’s contemporary Arthur Pigou in his 1927 book, Industrial Fluctuations. That...

Read More »Richard Baldwin’s “The Great Convergence”

Link to slides of a presentation at the Peterson Institute. According to Baldwin, the new globalization (since 1990) reflects the fact that ICT enabled G7 firms to precisely control what goes on inside developing-nation factories.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org