Opportunities in the Junior Mining Sector Maurice Jackson of Proven and Probable has recently interviewed Jayant Bandari, the publisher of Capitalism and Morality and a frequent contributor to this site. The topics discussed include currencies, bitcoin, gold and above all junior gold stocks (i.e., small producers and explorers). Jayant shares some of his best ideas in the segment, including arbitrage opportunities...

Read More »Swiss Labour Force Survey in 4th quarter 2017: 0.6 percent increase in number of employed persons; unemployment rate based on ILO definition at 4.5 percent

Swiss Labor Force Survey in the fourth quarter of 2017: Job Offer The number of persons in employment increases by 0.6 percent; Unemployment rate according to ILO is 4.5 percent Neuchâtel, 15 February (FSO) – The number of employed persons in Switzerland rose by 0.6% between the 4th quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) declined...

Read More »Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

Monetary policy in 2018 is all about the Phillips curve. The extent to which wage growth and inflation respond to falling unemployment will shape the monetary tightening cycle. If recent price action is any guide, any surprise on that front could result in market overreaction and volatility spikes. The most elegant description of the current state of research was provided by ECB Executive Board member Benoît Coeuré...

Read More »FX Daily, February 15: Stocks Jump, Bonds Dump, and the Dollar Slumps

Swiss Franc The Euro has fallen by 0.24% to 1.1535 CHF. EUR/CHF and USD/CHF, February 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The significant development this week has been the recovery of equities after last week’s neck-breaking drop, while yields have continued to rise. The dollar has taken is cues from the risk-on impulse from the equity market and the...

Read More »Bitcoin and Crypto Prices Being Manipulated Like Precious Metals?

Bitcoin and Crypto Prices Being Manipulated Like Precious Metals? – FSN Interview GoldCore [embedded content] Kerry Lutz of the Financial Survival Network (FSN) interviewed GoldCore’s Mark O’Byrne about the outlook for crypto currencies, financial markets and precious metals. – Are bitcoin and crypto prices being manipulated like precious metals? – Is there a coordinated backlash against bitcoin from JPM and powerful...

Read More »What Just Changed?

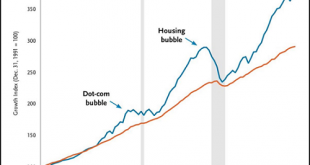

The illusion that risk can be limited delivered three asset bubbles in less than 20 years. Has anything actually changed in the past two weeks? The conventional bullish answer is no, nothing’s changed; the global economy is growing virtually everywhere, inflation is near-zero, credit is abundant, commodities will remain cheap for the foreseeable future, assets are not in bubbles, and the global financial system is in a...

Read More »Seasonality of Individual Stocks – an Update

Well Known Seasonal Trends Readers are very likely aware of the “Halloween effect” or the Santa Claus rally. The former term refers to the fact that stocks on average tend to perform significantly worse in the summer months than in the winter months, the latter term describes the typically very strong advance in stocks just before the turn of the year. Both phenomena apply to the broad stock market, this is to say, to...

Read More »SNB-Jordan verkündet Kommunistisches – und lädt zum Gratis-Buffet

- Click to enlarge Es geht um die Sache und Institution – nicht um eine Person. Die Schweizerische Nationalbank (SNB) und ihr Chef Thomas Jordan sind aber mittlerweile dermassen eng miteinander verflochten, dass eine getrennte Beurteilung gar nicht mehr möglich ist. Thomas Jordan ist zum Gesicht der SNB und diese eine „One-Man-Show“ geworden. Man kann Thomas Jordan sogar zum Gesicht der Schweiz erküren. Er...

Read More »Europe chart of the week – Italian productivity

With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard. Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history. However, cyclical strength is...

Read More »FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

Swiss Franc The Euro has fallen by 0.08% to 1.1533 CHF. EUR/CHF and USD/CHF, February 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org