Bitcoin and Crypto Prices Being Manipulated Like Precious Metals? – FSN Interview GoldCore [embedded content] Kerry Lutz of the Financial Survival Network (FSN) interviewed GoldCore’s Mark O’Byrne about the outlook for crypto currencies, financial markets and precious metals. – Are bitcoin and crypto prices being manipulated like precious metals? – Is there a coordinated backlash against bitcoin from JPM and powerful interests? – 95% of cryptocurrencies and ICOs will likely go to zero – Good cryptos will thrive, most will disappear in “massive creative destruction” – Ponzi like nature of financial markets and fiat monetary system – Fundamentals do not justify the massive gains in US stocks in recent years (near

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| Bitcoin and Crypto Prices Being Manipulated Like Precious Metals? – FSN Interview GoldCore | |

| Kerry Lutz of the Financial Survival Network (FSN) interviewed GoldCore’s Mark O’Byrne about the outlook for crypto currencies, financial markets and precious metals.

– Are bitcoin and crypto prices being manipulated like precious metals? |

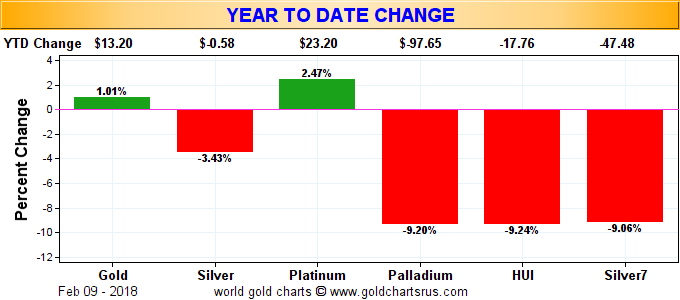

Metals Year to Date Change |

Tags: Daily Market Update,Featured,newslettersent