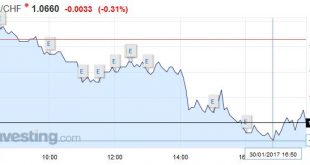

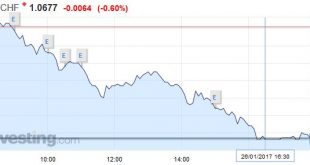

Swiss Franc The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 – 1.0700 that constituted the previous intervention area. Reasons can be found in the weak U.S. GDP weak, in Trump’s foreign trade policy and in the strong Swiss trade balance. Who has understand the principles of the balance of payments, knows that private investors and the SNB must export the equivalent of the current account...

Read More »Why 2017 Could See the Collapse of the Euro – Stiglitz

2017 could be the year that the euro collapses according to Joseph Stiglitz writing in Fortune magazine and these concerns were echoed over the weekend by former Bundesbank vice-president and senior European Central Bank official, Jürgen Stark, when he said that the ‘destruction’ of the Eurozone may be necessary if countries are to thrive again. Stark and Stiglitz are too of many respected commentators, from both the so...

Read More »Adventures in Currency Debasement

Rekindling the Dollar Debasement Strategy The U.S. dollar, as measured by the dollar index, has generally gone up since mid-2014. The dollar index goes up when the U.S. dollar gains strength (value) against a basket of currencies, including the euro, yen, pound, and several others. Conversely, the dollar index goes down when the U.S. dollar loses value. Between July 30, 2014 and December 28, 2016, the dollar’s value,...

Read More »FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

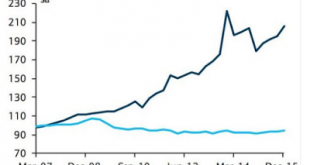

Swiss Franc Currency Index The Swiss Franc index has a solid performance of 2.5% in the last month, while the dollar index is down nearly 3%. Trade-weighted index Swiss Franc, January 28(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three...

Read More »Great Graphic: Mexico and China Unit Labor Costs

Summary: Mexico has been gaining competitiveness over China before last year’s depreciation of the peso. The depreciation of the peso, and other US actions can contribute to the destabilization of Mexico. An economically prosperous and stable Mexico has long been understood to be in the US interest. This Great Graphic was posted by David Merkel on his AlephBlog with a hat tip to Sober Look. It looks at the...

Read More »2016: Swiss Exports and Swiss Trade Balance at New Record-Highs: Swiss Franc Shock Digested

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to trade partners.On the other side, a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to...

Read More »FX Daily, January 26: EUR/CHF collapses to 1.670

Swiss Franc The euro collapsed today, both against USD and CHF. One reason might be the new record for Swiss exports and for the Swiss trade balance. EUR/CHF - Euro Swiss Franc, January 26(see more posts on EUR/CHF, ) - Click to enlarge Sterling gains almost 2% against the Swiss Franc in 3 days, will the Pound continue to climb from here? The Pound has continued to climb throughout the week, after it was...

Read More »Switzerland’s Gold Exports To China Surge In December

Switzerland’s Gold Exports To China Surge To 158 Tonnes In December Switzerland’s gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November – a jump of 416%. According to Eddie van der Walt as reported on the Bloomberg terminal this morning, total Swiss gold exports surged to 287.6 tons in December (valued at CHF 10.8b) according to data on the website of...

Read More »Cool Video: Bloomberg’s Daybreak–Trump and Rates

On what Trump’s first working day as POTUS, I had the privilege to be on Bloomberg’s Daybreak to talk about the wagers on US interest rates in the futures market. In the most recent CFTC reporting week, which ended on January 17, speculators in the 10-year note futures market reduced the record net short position. It is only the second week reduction since the end of November. Anchor Alix Steel noted that while the...

Read More »Swiss fact: work days lost to strikes in Switzerland close to one ninth of neighbouring countries

Across the ten years to 2008, Switzerland lost an average of 3 working days per 1,000 workers to strikes a year. This compares to 32 days in Austria, 33 days in France, and 55 days in Italy. Germany was close behind Switzerland with 4 days. The combined average for Switzerland’s neighbours: Austria, Germany, France and Italy, was 26 days. Switzerland’s 3 day average was one ninth or 11% of this. © Ifeelstock |...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org