© Syda Productions | Dreamstime.com - Click to enlarge A report published by the Swiss Federal Office of statistics, shows that only 4.3% of full-time1 workers earn less than CHF 3,000 per month2. The monthly figure is net of social security deductions, but includes one twelfth of the 13th bonus month typically paid in Switzerland. CHF 3,000 per month is CHF 36,000 a year, equivalent to US$ 36,250 or GBP 28,250,...

Read More »FX Daily, February 03: US Jobs Trump Europe’s Service PMIs

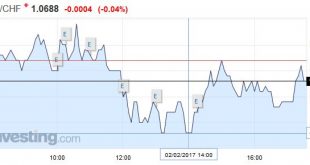

Swiss Franc EUR/CHF - Euro Swiss Franc, February 03(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Ahead of the weekend, there are two series of economic reports. The first are Europe’s service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market. It is important too to recognize the...

Read More »The Future of Globalization

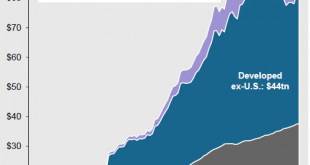

(draft of monthly column for a Chinese paper) The cross-border movement of goods, services, and capital increased markedly for the thirty years up to the Great Financial Crisis. Although the recovery has given way to a new economic expansion in the major economies, global trade and capital flows remain well below pre-crisis levels. It had given rise to a sense globalization is ending. The election of Donald Trump as...

Read More »Ignore Sabre-Rattling Between Trump and The World, Buy Gold

Gold hits 12-week high USD Gold price up 4.85% in last month Sabre-rattling from Trump administration set-to benefit gold Iran upset and Middle East tensions could drive oil and gold prices up. Financial Times foresees “not only currency wars but a fully fledged trade confrontation that could be disastrous for the world economy.” Royal Mint producing 50 % more gold bullion coins and bars compared to 2016 Utah moves to...

Read More »FX Daily, February 02: Dollar Remains on Back Foot After ADP and FOMC

Swiss Franc EUR/CHF - Euro Swiss Franc, February 02(see more posts on EUR/CHF, ) - Click to enlarge GBP / CHF Sterling vs the Swiss Franc exchange rate remains tentative this morning with the release of the Brexit strategy due to come out later today. A white paper is going to be published later with MPs backing the European Bill by 498 vote against 114 last night. The bill will be debated further in parliament...

Read More »Great Graphic: French Premium over Germany Continues to Grow

Summary: European premiums over Germany typically increase in a rising interest rate environment. France’s premium is at the most in two years. France is still set to turn back the challenge from Le Pen. The rise of interest rates in Europe have seen premiums over Germany increase. This is not unusual. Often the intra-European spreads are sensitive to the underlying direction of rates. The premiums often...

Read More »Thoughts about the Fed’s Balance Sheet

Summary: Several regional Fed presidents want to begin talking about shrinking Fed’s balance sheet. Leadership does not appear to have great urgency, so don’t expect anything in this week’s statement. First step more hikes, then refrain from reinvesting payments and maturities, but slowly. The Federal Reserve meets this week, but there is, for all practical purposes, no chance that a rate hike is delivered....

Read More »Why Our System Is Broken: Cheap Credit Is King

You want to fix the economic system, reduce political bribery and reduce rising income inequality? Shut off the cheap unlimited credit spigot to banks, financiers and corporations. Cheap credit–newly issued money that can be borrowed at low rates of interest–is presented as the savior of our economic system, but in reality, it’s why our system is broken. The conventional economic pitch goes like this: cheap credit...

Read More »Trump and the Dollar

Summary: US official comments on the FX market appear to have increased in frequency. They are mostly warnings about a strong dollar, but not all comments are dollar-negative. Policy is the ultimate driver but comments pose headline risk. Although in office less than a fortnight, the new US Administration is showing a disregard not only for the domestic convention but international agreements like on...

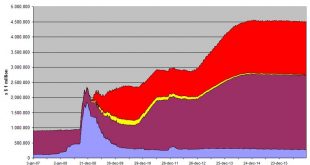

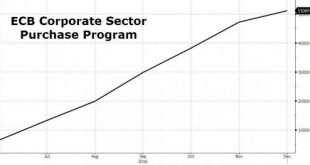

Read More »ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org