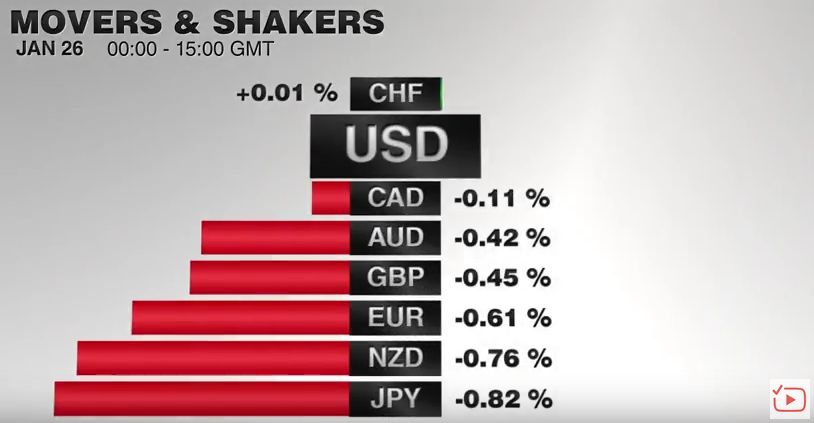

Swiss Franc The euro collapsed today, both against USD and CHF. One reason might be the new record for Swiss exports and for the Swiss trade balance. EUR/CHF - Euro Swiss Franc, January 26(see more posts on EUR/CHF, ) - Click to enlarge Sterling gains almost 2% against the Swiss Franc in 3 days, will the Pound continue to climb from here? The Pound has continued to climb throughout the week, after it was announced earlier this week by the Supreme Court that the UK government will require parliamentary approval before invoking Article 50. It appears that now that there is certainty regarding the UK government stance moving, investors are warming to the Pound and it’s gained value versus all most major currency pairs throughout the week. After losing so much value against the Swiss Franc in recent times I believe that the Pounds recovery against CHF in particular could be aggressive. The current GBP/CHF rate is around it’s lowest level over the past decade but the recovery does appear to be in full swing. If investors around the world develop an increased appetite to risk the Swiss Franc could suffer, as one of the main reasons the currency has been so strong is investors have been keen to hold funds within low yielding yet safe haven currencies due to such a busy year politically.

Topics:

Marc Chandler considers the following as important: EUR, Featured, FX Trends, GBP, Germany GfK Consumer Climate, Interest rates, JPY, newslettersent, SPY, Switzerland Trade Balance, U.K. Gross Domestic Product, U.S. Initial Jobless Claims, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe euro collapsed today, both against USD and CHF. |

EUR/CHF - Euro Swiss Franc, January 26(see more posts on EUR/CHF, ) |

Sterling gains almost 2% against the Swiss Franc in 3 days, will the Pound continue to climb from here?The Pound has continued to climb throughout the week, after it was announced earlier this week by the Supreme Court that the UK government will require parliamentary approval before invoking Article 50. It appears that now that there is certainty regarding the UK government stance moving, investors are warming to the Pound and it’s gained value versus all most major currency pairs throughout the week. After losing so much value against the Swiss Franc in recent times I believe that the Pounds recovery against CHF in particular could be aggressive. The current GBP/CHF rate is around it’s lowest level over the past decade but the recovery does appear to be in full swing. If investors around the world develop an increased appetite to risk the Swiss Franc could suffer, as one of the main reasons the currency has been so strong is investors have been keen to hold funds within low yielding yet safe haven currencies due to such a busy year politically. This morning will see the release of UK GDP figures and the expectation is for a reading of 0.5% throughout the 4th quarter of last year. If the figure sways from this expectation it’s likely that we will see the volatility between GBP exchange rates. Feel free to get in touch if you wish to be kept up to date regarding news releases such as this one in future. |

GBP/CHF - British Pound Swiss Franc, January 26(see more posts on GBP/CHF, ) |

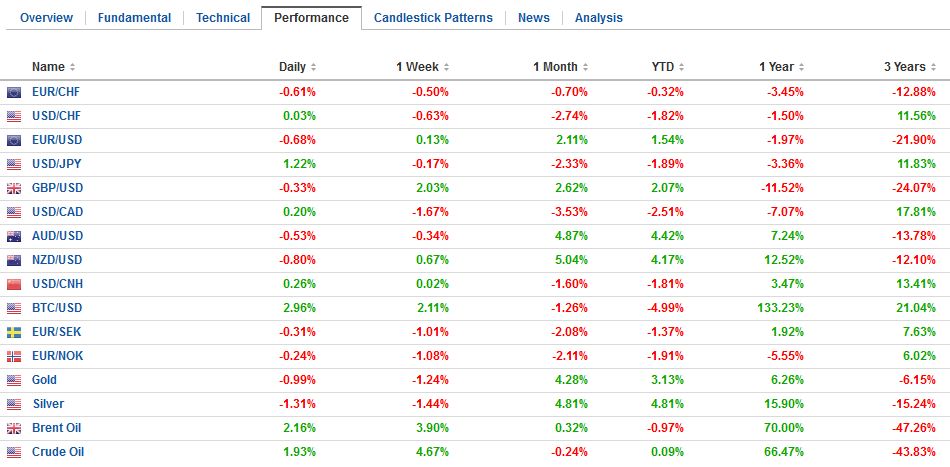

FX RatesThe US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels. The Nikkei and Topix gapped higher too, helping lead the MSCI Asia Pacific Index to a 1% gain and the third rise this week. It is at levels not seen since Q3 15. Note that Australian and Indian markets were closed for local holidays. |

FX Performance, January 26 2017 Movers & Shakers Source: Dukascopy - Click to enlarge |

| European equities are following suit. The Dow Jones Stoxx 600 is up about 0.5% near midday in London, led by financials and health care. This is the second consecutive session that it has gapped higher. Note, the beleaguered Italian banks are extending yesterday’s 3.4% advance with another 1.3% gain today. Barring a reversal ahead of the weekend, it will be the second consecutive weekly advance and seven of the past nine weeks. The FTSE Italia bank index has risen almost 60% since last July. However, the index peaked in July 2015 near 18,555. By last July, it had fallen to 6420. It is now near 10,100. |

FX Daily Rates, January 26 |

| Equities are rising as bonds sell-off. Unlike the last leg-up for yields, they are note being driven by US Treasuries. While the US 10-year yield is at new highs for the year (~2.54%), it is still about 10 bp below the peak recorded the day after the Fed hiked rates in December. European yields, on the other hand, consider that the 50 bp yield on the 10-year Bund is the highest since last January. The French 10-year yield is pushing above 1.0% for the first time since Q4 15. Over the past five sessions, the US 10-yield has risen almost eight bp, while the same yield in Germany is up 11 bp, 16 bp in France, and 20 bp in Italy.

Japan’s 10-year yield is up 1.5 bp over the past week to yield eight basis points. The failure of the dollar to perform better against the yen as US yields and equities rise is frustrating many short-term traders. According to MOF data, Japanese investors sold foreign bonds last week for the first time this year, breaking a three-week buying spree. That said, the dollar may be carving out a double bottom against the yen after the penetration of last week’s low did not generate much follow through selling. A move above the JPY114.50 would boost the chances that the dollar’s low is in place, thought to confirm the double bottom, a move above last week’s high near JPY115.60 is needed. The measuring objective of the double bottom is back toward the JPY118.50 seen at the start of the year. |

FX Performance, January 26 |

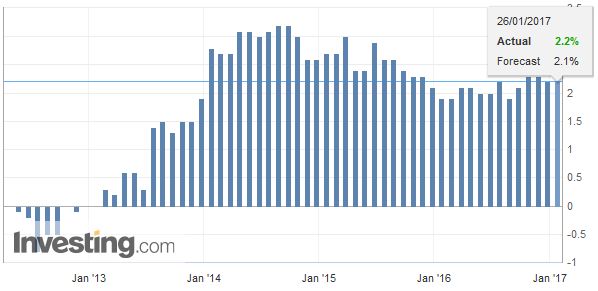

United KingdomThe main economic news has been the UK’s first estimate of Q4 GDP. It came in at 0.6%, a touch above consensus, leaving the year-over-year pace unchanged at 2.2%. This estimate is based on a little less than half of the data that will eventually be in the final estimate. Still, the pattern is clear. Growth was narrowly based on services, while industrial production and construction were flat. Within industrial production, though, manufacturing did increase (~0.7%). The UK expanded by 2% in 2016, after 2.2% growth in 2015. Although some economists expected an immediate hit to the economy by the Brexit decision, which did not materialize, many still expect the UK economy to weaken as a result. The median forecast this year from the Bloomberg survey is 1.2%. Sterling reached almost $1.2675, the best level since the Fed hiked last month, before finding sellers who knock it back down. Although we have suggested that a few chart patterns and retracements converge near $1.28, we do think this is a counter-trend/correction and want to be on-guard for a failure. To be anything significant from a technical point of view, sterling would need to be sold through $1.2500-$1.2520. |

U.K. Gross Domestic Product (GDP) YoY, December 2016(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

GermanyFor its part, the euro is in the range that it has been in all week. For the fourth session, the euro has been stymied near $1.0770. We continue to believe the euro’s correction from below $1.04 is nearly over. Although US rates have risen, German rates have risen more. Consider that the two-year differential peaked at the end of last year near 2.06% and now is near 1.88%. The US premium on 10-year money peaked on December 16 jut below 3.40% and is now near 3.15%. We would see a break of the $1.0680-$1.0700 area being supportive of our view, and a close below $1.0660 would suggest a top may be in place. |

Germany GfK Consumer Climate, December 2016(see more posts on Germany GfK Consumer Climate, ) Source: Investing.com - Click to enlarge |

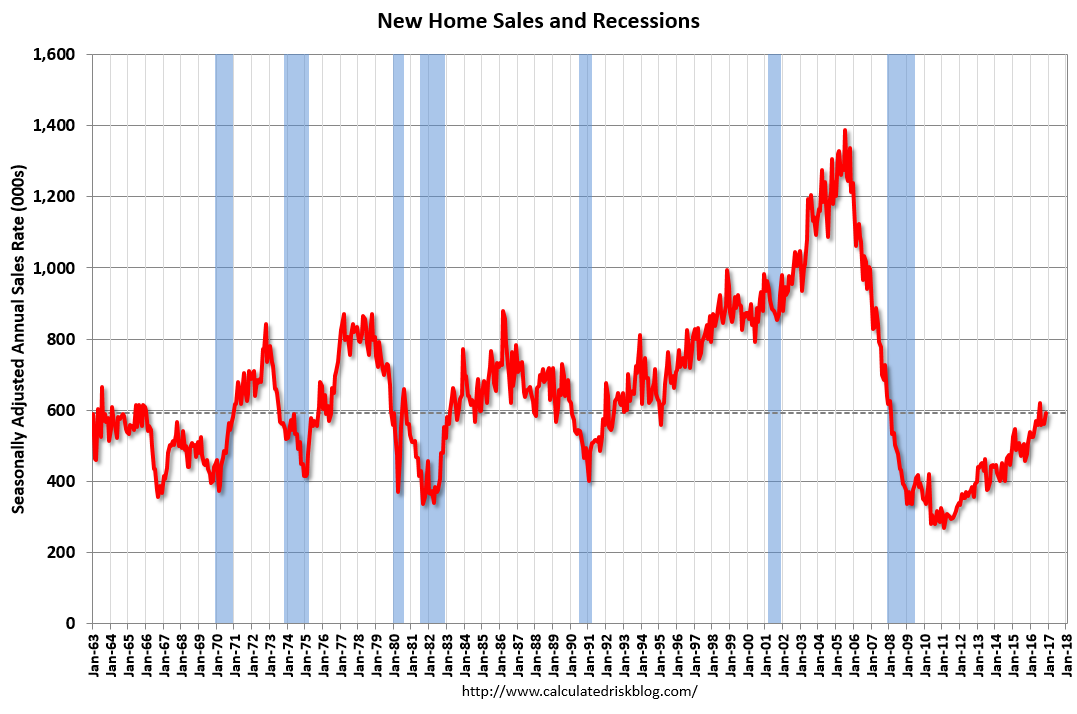

United StatesThe US has a full slate of economic data, including December merchandise trade and wholesale and retail inventories. These will allow economists to tweak Q4 16 estimates ahead of tomorrow’s official report. Before today’s data, the Atlanta Fed’s GDP tracker estimates a 2.8% pace in Q4, down from 3.5% in Q3. The median from the Bloomberg survey is 2.2%, which matches the NY Fed’s GDP tracker estimate of 2.1%. |

U.S. New Home Sales, December 2016(see more posts on U.S. New Home Sales, ) Source: Calculatedriskblog.com - Click to enlarge |

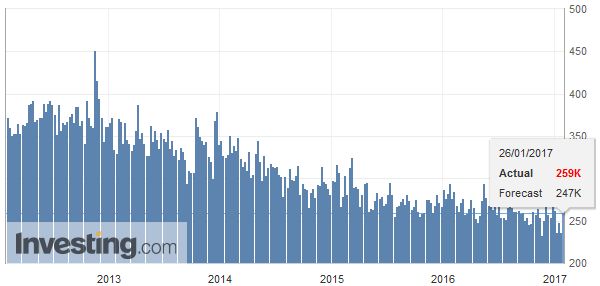

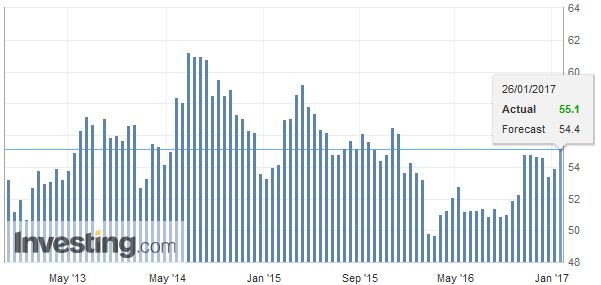

| There is also January data today in the form of Markit service and composite PMI, the Kansas City Fed manufacturing survey, and the weekly initial jobless claims. Recall that last week’s jobless claims report, which covered the same week as the non-farm payroll survey, showed a fall to 234k, which is 1k above the low point in the cycle recorded the week of the US election. The four-week moving average, however, fell to the new cyclical low of 247, which is where the report is expected to show this time. Last week’s report may have been depressed by the US holiday. |

U.S. Initial Jobless Claims, December 2016(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

| Lastly, we note that the US breakevens (the difference between the conventional bond and TIPS yields) are rising. The 10-year breakeven is elevated at 2.07%. The peak since September 2014, was recorded a week ago at 2.09%. However, yesterday was the first time since 2014 that the five-year breakeven also poked through 2.0%. We hear more clients talking about this and the possibility that the Fed may be slipping behind the curve. Bloomberg calculations suggest a little more than a one-in-three chance of a hike in March has been discounted by the Fed funds futures. The CME’s calculation sees a one-in-four chance is discounted. |

U.S. Services PMI, December 2016(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

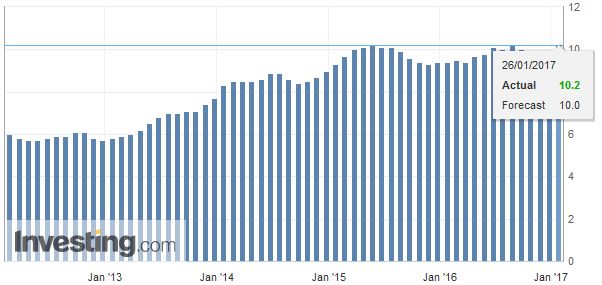

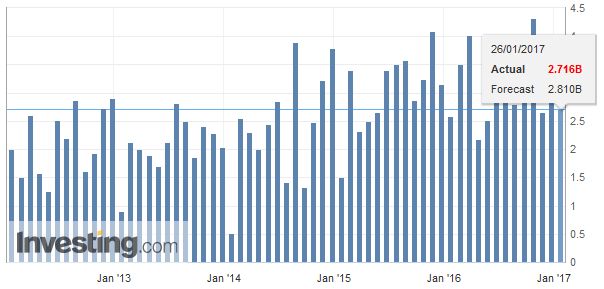

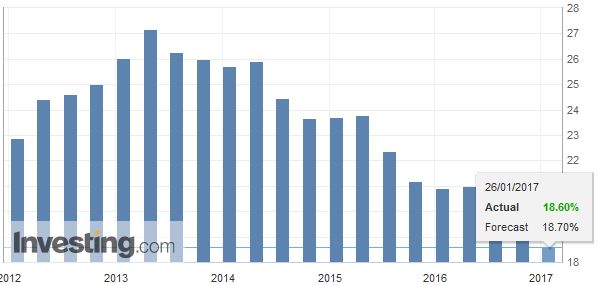

SwitzerlandBoth Swiss exports and the Swiss trade balance achieved new record highs. |

Switzerland Trade Balance, December 2016(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge |

Spain |

Spain Unemployment Rate, Q4 2016(see more posts on Spain Unemployment Rate, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,Featured,Germany GfK Consumer Climate,Interest rates,newslettersent,SPY,Switzerland Trade Balance,U.K. Gross Domestic Product,U.S. Initial Jobless Claims