Das VBS hat seit dem neuen Jahr eine Cheffin. Anlässlich der SOG-DV vom 16. März 2019 hat sie sich an die Offiziere gewandt und dabei einige interessante Äusserungen (Hervorhebungen durch den Autor) gemacht, so etwa zu den “Entwicklungen im internationalen Streitkräftebereich”: “Wir stellen steigende Verteidigungsausgaben, eine Ausrichtung auf die Bekämpfung hybrider Bedrohungsformen, ein erneutes Schwergewicht auf die...

Read More »Parliament rejects reform of health insurance scheme

A doctor’s visit – patients have to cover a level of costs before the health insurance pays in Switzerland (© Keystone / Christian Beutler) Patients will not have to pay out extra money for health services before the health insurance covers the costs, after parliament surprisingly threw out the controversial proposal on Friday. In a previous decision earlier this month, parliament had agreed to increase the deductible...

Read More »FOMC: Above Trend Growth Requires Continued Monetary Support

The Federal Reserve sounded more dovish than many expected and this prompted a 5-7 bp drop in US rates, and the dollar fell to new lows for the week against many of the major currencies. The median Fed forecast now anticipates no hike this year but one next year. The Fed will also taper the roll-off of its balance sheet and completing it by the end of September. In December, 11 officials anticipated two or three hikes...

Read More »Which Nations Will Crumble and Which Few Will Prosper in the Next 25 Years?

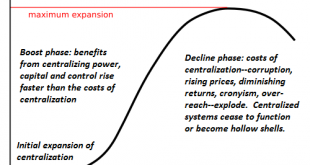

Adaptability and flexibility will be the core survival traits going forward. What will separate the many nations that will crumble in the next 25 years and those few that will survive and even prosper while the status quo dissolves around them? As I explain in my recent book Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic, the factors that will matter are not necessarily cultural or...

Read More »FX Daily, March 22: Dreadful EMU PMI and US Machinations Rival Brexit for Attention

Swiss Franc The Euro has fallen by 0.52% at 1.1221 EUR/CHF and USD/CHF, March 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 recovered from the post-FOMC reversal to close a new 5-month high yesterday, led by technology. Financials were the only main sector to retreat. The large equity markets in Asia, Japan, China, Australia, South Korea, and...

Read More »Pound falls against the Swiss franc owing to third meaningful vote uncertainty

The pound has once again felt the impact of the uncertainty caused by Brexit and the pound has fallen against the Swiss franc during yesterday afternoon’s trading session. We are now just over a week away from when the UK is due to leave the European Union and the latest update is that the EU will allow an extension until the end of June if Theresa May can get her deal backed in the next few days. Last night the Prime...

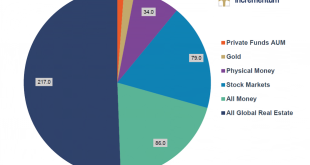

Read More »In Gold We Trust 2019 – The Preview Chart Book

The new IGWT report for 2019 will be published at the end of May… …and for the first time a Mandarin version will be released as well. In the meantime, our friends at Incrementum have decided to release a comprehensive chart book in advance of the report. The chart book contains updates of the most important charts from the 2018 IGWT report, as well as a preview of charts that will appear in the 2019 report. A brief...

Read More »Swiss companies make contingency plans amid Brexit uncertainty

In 2018, the UK was Switzerland’s sixth-biggest export market (Keystone) As the Brexit saga continues, Swiss companies are preparing for the worst and hoping for the best. But optimism is waning among companies that are trying to minimise disruptions from any deal/no-deal scenarios. With the UK’s departure from the EU scheduled for March 29, British Prime Minister Theresa May on Wednesday asked the EU bloc to postpone...

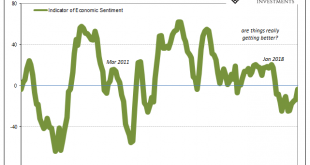

Read More »Slump, Downturn, Recession; All Add Up To Sideways

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6. That’s up from -24.7 back in October, though sentiment had likewise improved at one point last year, too. In July, the number...

Read More »The Real End of the Bond Market

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke). But as esoteric as all that may be, recent corporate statements leave much less doubt at least as to the primary effect....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org