If you want to identify tomorrow’s superpowers, overlay maps of fresh water, energy, grain/cereal surpluses and arable land. The status quo measures wealth with “money,” but “money” is not what’s valuable. “Money” (in quotes because the global economy operates on intrinsically valueless fiat currencies being “money”) is wealth only if it can purchase what’s actually valuable. As the world slides into an era of...

Read More »FX Weekly Preview: The Evolution of Three Issues are Key in the Week Ahead

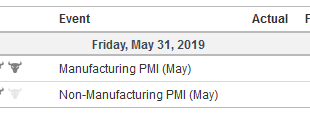

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces–trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies. ...

Read More »Swiss pay more for magazines and clothes than other countries

Swiss consumers pay a premium to read their favourite titles – unless they go over the border to get a copy. (Keystone / Martin Ruetschi) Swiss consumers pay a “high price island” premium of up to 245% for magazines and clothing compared to prices being charged for the same goods in neighbouring countries. A consumer group study found the price differential to be higher in Italy and France than in Germany. For many...

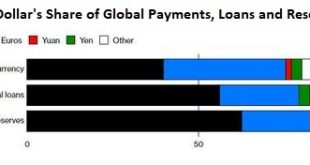

Read More »China’s Insurmountable Global Weakness: Its Currency

If China wants superpower status, it will have to issue its currency in size and let the global FX market discover its price. Quick history quiz: in all of recorded history, how many superpowers pegged their currency to the currency of a rival superpower? Put another way: how many superpowers have made their own currency dependent on another superpower’s currency? Only one: China. China pegs its currency, the yuan (RMB)...

Read More »Image of Swiss banks improves among public

Swiss banks are generally considered reliable and secure by the public The image of Swiss banks has returned for the first time to pre-financial crisis levels, according to a survey by the Swiss Bankers Association (SBA). Cybercrime remains a concern, however. “The banks’ positive image is the result of a combination of their commercial success and social responsibility, and the respondents’ positive experiences with...

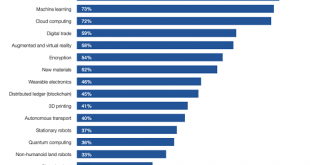

Read More »Technology Is Not Just Disruptive, It’s Disastrously Deflationary

Deflation eats credit-dependent, mass-consumption economies alive from the inside. While AI (artificial intelligence) garners the headlines, the next wave of disruptive technologies extend far beyond AI: as the chart of technologies rapidly being adopted shows, this wave includes new materials and processes as well as the “usual suspects” of machine learning, natural language processing, data mining and so on. While...

Read More »OECD lowers Swiss growth forecasts for 2019-2020

Swiss exports are expected to stagnate this year before recovering in 2020. (Keystone / Steffen Schmidt) The Organisation for Economic Cooperation and Development (OECD) has revised its growth forecasts for Switzerland downwards for the next two years due to a global economic slowdown. After a strong 2018 (+2.5%), gross domestic product (GDP) growth should slow in 2019 (+1%), the OECD said on Tuesday. This compares...

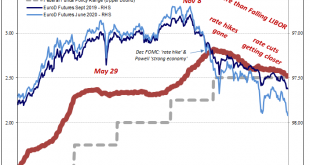

Read More »The Transitory Story, I Repeat, The Transitory Story

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand. Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to...

Read More »FX Daily, May 23: Trade, Brexit, and Disappointing Flash PMIs Weigh on Global Markets

Swiss Franc The Euro has fallen by 0.43% at 1.121 EUR/CHF and USD/CHF, May 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The deterioration of the investment climate is spurring the sales of stocks and the buying of bonds. The dollar is firm. China and the US appear to be digging as if the trade tensions will remain for some time and the breech is beginning...

Read More »Rising downside risks to euro area growth

While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected. A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China. The euro area is not directly affected, but its indirect exposure to this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org