A common issue with economists and political economists from left to right is that they misunderstand the market economy as simply being a set of production processes. We see this in Lenin’s statement that the Soviet Union should be run like one big factory. We see it in market socialists from Frederic Taylor to Oskar Lange attempting to respond to (and resolve) Mises’s argument that socialist economic calculation is impossible. And we see the same thing in the...

Read More »Markets on Edge as New Week Begins

The coronavirus death toll is just over 900, exceeding the SARS epidemic; the dollar remains firm President Trump will unveil his budget proposal for FY2021 beginning October 1 today The faltering eurozone economy comes just as political uncertainty is picking up in Germany Norway inflation spiked in January; Turkish local rates spiked after regulators cut the FX swap limits for local banks Japan reported December current account data; China January CPI came in at...

Read More »FX Daily, February 10: Quiet Start to the New Week in which Politics may Dominate

Swiss Franc The Euro has fallen by 0.19% to 1.0681 EUR/CHF and USD/CHF, February 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets have begun the new week on a cautious tone as investors seek to assess the latest news on the new coronavirus. Nearly all the markets in Asia fell but China. European bourses are lower as well, with the Dow Jones Stoxx 600 off about 0.3%. US shares are...

Read More »Credit Spy: Ende gut, alles gut?

Was ist es, was uns im Falle des Überwachungsskandals der CS so stark verstört hat? Mir fallen drei Punkte auf. Erstens die Tatsache, dass die Schweizer Grossbank offensichtlich einen eigenen internen geheimen Überwachungsdienst unterhält, der Arbeitnehmer auch ausserhalb des Arbeitsplatzes und ihrer Arbeitszeiten überwacht respektive bespitzelt. Zweitens ist es verstörend, dass sich der betreffende verdeckte Überwachungsmann, der einen Badge der CS hatte, das Leben...

Read More »FX Weekly Preview: US Soars while Rivals are Hobbled

We are approaching the mid-point of the first quarter, and the coronavirus from China is the new key development for businesses and investors. The economic impact appears to be still growing as the disruption to supply chains, production, and demand continues. The re-opening of China from the extended Lunar New Year holiday brought some relief to the markets as officials ensured ample liquidity, leaned against short selling, and offered concessions to businesses...

Read More »Credit Suisse chairman hopeful to see out term

Rohner speaking at a news conference last October, following the discovery that the Credit Suisse management spied on former executives including wealth manager Iqbal Kahn. (Keystone/Ennio Leanza) The chairman of the Credit Suisse bank says he does not expect to be voted out of office before his term ends next year following the departure of the bank’s CEO on Friday amid a surveillance scandal. Urs Rohner says he has received “clear responses” from shareholders...

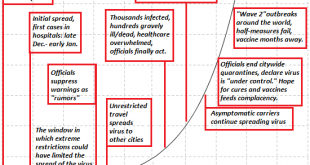

Read More »Controlling the Narrative Is Not the Same as Controlling the Virus

Are these claims even remotely plausible for a highly contagious virus that spreads easily between humans while carriers show no symptoms? It’s clear that the narrative about the coronavirus is being carefully managed globally to minimize the impact on global sentiment and markets. Authorities are well aware of the global economy’s extreme fragility, and so Job One for authorities everywhere is to scrub the news flow of anything that doesn’t support the implicit...

Read More »The Fight for Liberty and the Beltway Barbarians

In the conservative and libertarian movements there have been two major forms of surrender, of abandonment of the cause. The most common and most glaringly obvious form is one we are all too familiar with: the sellout. The young libertarian or conservative arrives in Washington, at some think-tank or in Congress or as an administrative aide, ready and eager to do battle, to roll back the State in service to his cherished radical cause. And then something happens:...

Read More »Central banks weigh up response to Libra and bitcoin

Creating money may soon look entirely different in the digital age. (Keystone / Lm Otero) Central banks are contemplating a response to alternative money systems, such as bitcoin or Libra, with new digital versions of their own currencies. They go by the name of Central Bank Digital Currencies, or CBDCs. Libra’s stablecoin project launched in Geneva last year was a “watershed” moment that “kicked everyone in the pants”, Michael Sung, a professor at Fudan University,...

Read More »Drivers for the Week Ahead

Risk-off sentiment intensified last week; the dollar continues to climb This is another big data week for the US; the US economy remains strong Fed Chair Powell testifies before the House Tuesday and the Senate Wednesday; the Senate holds confirmation hearings for Fed nominees Shelton and Waller Thursday President Trump will unveil his budget proposal for FY2021 beginning October 1 this Monday Eurozone and UK have heavy data weeks Riksbank meets Wednesday and is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org