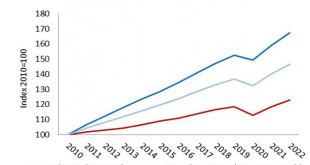

The current surge in inflation is not due to a shortage of supply as central banks want us to believe. It is primarily due to soaring consumer demand fueled by monetary creation. Original Article: For central bankers and mainstream analysts the recent inflation outburst is only a transitory phenomenon which has nothing or very little to do with the massive monetary and fiscal stimuli unleashed during the pandemic. Although the Fed has recently conceded that price...

Read More »Perfect Time To Review What Is, And What Is Not, Inflation (and why it matters so much)

It is costing more to live and be, so naturally people are looking for who it is they need to blame. Maybe figure out some way to stop it. You know and feel for the basics since everyone’s perceptions begin with costs of just living. This is what makes the subject of inflation so difficult, even more so in the era of QE. Money printing, duh. By clarifying the situation – demonstrating over and over how there is no money printing therefore there can’t be inflation –...

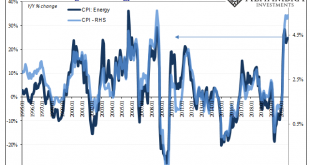

Read More »The Dollar Slips Ahead of CPI

Overview: The US dollar is trading with a lower bias ahead of the September CPI report due early in the North American session. Long-term yields softened yesterday and slipped further today, leaving the US 10-year yield near 1.56%. European benchmark yields are 3-4 bp lower. The shorter-end of the US coupon curve, the two-year yield is firmer. Equities are enjoying a slightly better tone, though Japan, Taiwan, and Australia’s markets traded heavily in the Asia...

Read More »Palisades Gold Radio Interview

Monetary Metals CEO Keith Weiner was back on the Palisades Gold Radio podcast being interviewed by Tom Bodrovics. Keith revealed one key feature that gold has, which bitcoin does not. [embedded content] First, Keith discusses how economists and experts tend to say the strangest things and most of their statements don’t pass basic scrutiny, what Keith calls the “sniff test”. Gold has been accumulated for the last 5000 years. As a result physical scarcity is not...

Read More »The Great Eurodollar Famine: The Pendulum of Money Creation Combined With Intermediation

It was one of those signals which mattered more than the seemingly trivial details surrounding the affair. The name MF Global doesn’t mean very much these days, but for a time in late 2011 it came to represent outright fear. Some were even declaring it the next “Lehman.” While the “bank” did eventually fail, and the implications of it came to be systemic, those overly melodramatic descriptions actually served to downplay the event in public imagination. The world...

Read More »Poll: Most Swiss back 30km/h speed limit in urban areas

In September the city of Lausanne introduced a 30km/h speed limit on 122 streets between 10pm-6am to reduce noise pollution – a Swiss first. Keystone / Jean-christophe Bott Most Swiss residents would be in favour of a 30 kilometre (18 miles) per hour speed limit in urban areas, a survey has found. A poll by the Swiss Council for Accident Prevention (BPA), published on TuesdayExternal link, found that 52% of respondents support a 30km/h speed limit on city streets. An...

Read More »Fabrice Testa on Super Entrepreneurship

Entrepreneurship is a method, and it’s also a mindset. Fabrice Testa has written a book that brilliantly integrates the two: he calls the integration “Super Entrepreneurship,” and his book title is therefore Super Entrepreneurship Decoded (Mises.org/E4B_139_Book). He has the appropriate credentials as a proven super-entrepreneur who has created and nurtured numerous great companies (and successfully sold a couple of them). Fabrice knows the true meaning of the...

Read More »The Euro Remains Within Last Wednesday’s Range

Overview: A weak close in US equity trading yesterday and the widening of China's "cultural revolution" for a two-month investigation of the financial sector stopped a three-day advance in the MSCI Asia Pacific Index. China, South Korea, and Taiwan saw more than a 1% decline in their major indices. All the major indices weakened. South Korea's Kospi fell to a new marginal low for the year and took the won with it. The Dow Jones Stoxx 600 in Europe is off around...

Read More »Global capital flows: how poor countries finance the rich

Switzerland’s economic conditions make it attractive for financial flows from developing countries © Keystone / Gaetan Bally It’s an economist’s conundrum: global capital, instead of flowing from rich countries to poor countries, actually moves in the other direction. Each year hundreds of billions of dollars leave developing countries and land in the coffers of rich countries like Switzerland. An “unprecedented” $160 billion (CHF149 billion) – about the same amount...

Read More »Swiss unemployment down, especially among young

© Mcherevan | Dreamstime.com Unemployment fell from 2.7% to 2.6% in September 2021 in Switzerland, with a sharp drop among those aged 15 to 24, reported RTS. By the end of September 2021, just over 200,000 people were looking for employment in Switzerland according to Switzerland’s standard measure, which is focused on those registered with the official unemployment office, something required to collect unemployment benefits. However, it means some who run out the 2...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org