Summary:

Gold and the US Federal Reserve have a love-hate relationship. Hate because they both enjoy it when the other one performs badly, but love it because the Fed owns over 8,000 tonnes of gold and would rather no one else had any. So it was a funny thing when a former Chair of the Federal Reserve proposed measures this week that would go a long way to boosting many aspects of the gold market, including the price of gold bullion… Janet Yellen knows a lot about the economy. She has a 1971 Yale Ph.D. in economics. Yellen also authored countless papers and several books on the economy. She’s been a professor at Harvard University, London School of Economics, and the University of California Berkeley. She served in prominent positions in the U.S.

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Commentary, Economics, Featured, Gold, gold news, gold price, gold price analysis, News, newsletter, Precious Metals, silver, silver price

This could be interesting, too:

Gold and the US Federal Reserve have a love-hate relationship.

Hate because they both enjoy it when the other one performs badly, but love it because the Fed owns over 8,000 tonnes of gold and would rather no one else had any.

So it was a funny thing when a former Chair of the Federal Reserve proposed measures this week that would go a long way to boosting many aspects of the gold market, including the price of gold bullion…

Janet Yellen knows a lot about the economy.

She has a 1971 Yale Ph.D. in economics.

Yellen also authored countless papers and several books on the economy.

She’s been a professor at Harvard University, London School of Economics, and the University of California Berkeley.

She served in prominent positions in the U.S. government including the 15th Chair of the Federal Reserve and currently, she serves as the 78th Secretary of the U.S. Treasury.

Gold and the US Federal Reserve have a love-hate relationship. Hate because they both enjoy it when the other one performs badly, but love it because the Fed owns over 8,000 tonnes of gold and would rather no one else had any. So it was a funny thing when a former Chair of the Federal Reserve proposed measures this week that would go a long way to boosting many aspects of the gold market, including the price of gold bullion… Janet Yellen knows a lot about the economy. She has a 1971 Yale Ph.D. in economics. Yellen also authored countless papers and several books on the economy. She’s been a professor at Harvard University, London School of Economics, and the University of California Berkeley. She served in prominent positions in the U.S.

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Commentary, Economics, Featured, Gold, gold news, gold price, gold price analysis, News, newsletter, Precious Metals, silver, silver price

This could be interesting, too:

finews.ch writes Martin Hess: «Politik muss die Goldene Regel berücksichtigen»

finews.ch writes Wirz & Partners holt neuen Manager für Banken und Versicherungen

finews.ch writes Nidwaldner KB findet neuen CEO bei der Baloise Bank

finews.ch writes VAE: Deshalb strotzt Schweizer Community vor Optimismus

It’s Not On-shoring, It’s Friend- Shoring Now!

In a speech on April 13 at the Atlantic Council in Washington D.C., Janet Yellen invented a new phrase ‘friend-shoring’. This is related to the buzzword ‘on-shoring’, sometimes called ‘reshoring’. On-shoring is the idea that because the globalization of trade flows has become too complex for national security. Certain production facilities must be brought back on-shore for domestic production. We discussed this concept in our January 28, 2021 post: “Gold, the Tried-and-True Inflation Hedge for What’s Coming!” as reduced Globalization as ‘Made at Home’ policies is proliferating.| Personal protective equipment, became the poster child for on-shoring since the pandemic broke out. Many were shocked to discover that only China-made masks. As China had all the mask factories plus over a billion citizens to protect. China for a time refused to export any masks. Western countries were unable to obtain enough masks to protect their own citizens. Governments everywhere are now worried about mask production, and also the production of many other crucial items. Moreover, relying upon crucial imports from unfriendly places is not politically acceptable anymore. |

“We cannot allow countries to use their market position in key raw materials, technologies, or products to have the power to disrupt our economy or exercise unwanted geopolitical leverage. So let’s build on and deepen economic integration and the efficiencies it brings on terms that work better for American workers. And let’s do it with the countries we know we can count on.”To solve this issue Janet Yellen twisted the onshoring phrase to ‘friend-shoring’. She means that not every item needs to be made inside every country. As the economies that are friendly to one another would never stop trading during a crisis. Furthermore, she means products made inside unfriendly countries will not necessarily allow the products made by friendly countries to compete. Measuring the competition on aspects more complex than mere price; provenance will soon matter too. Yellen states:

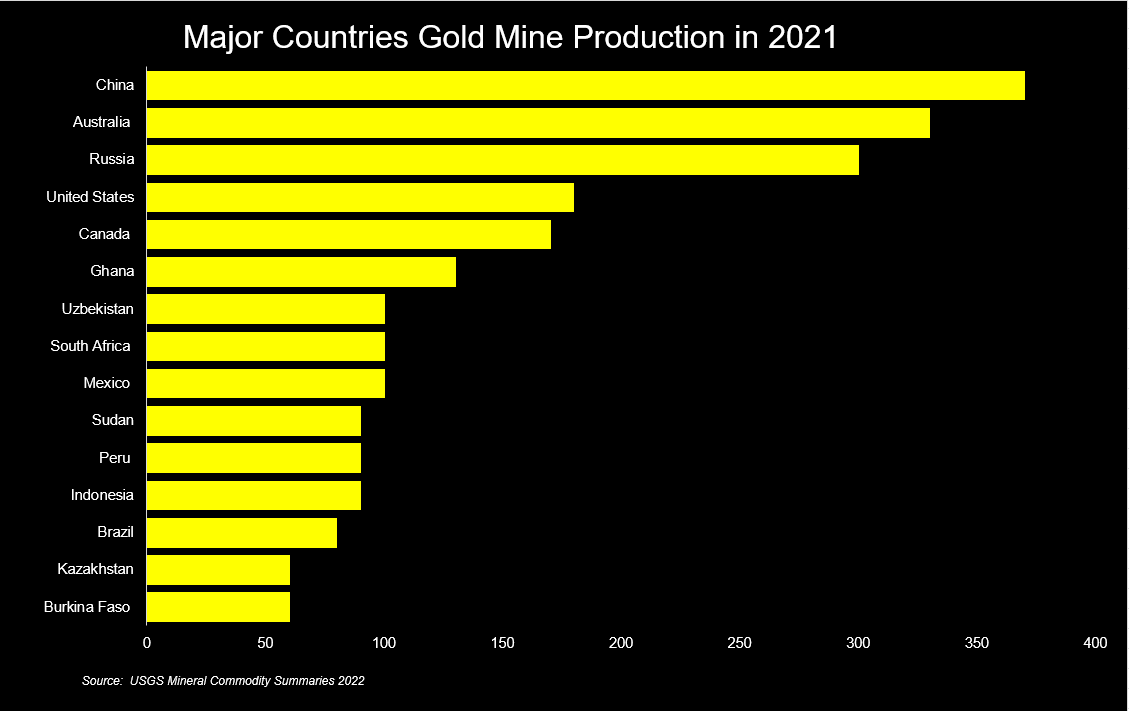

“Favoring the friend-shoring of supply chains to a large number of trusted countries, so we can continue to securely extend market access, will lower the risks to our economy as well as to our trusted trade partners. We should also consider building a network of plurilateral trade arrangements to incorporate elements of the modern economy. Which are growing in economic importance, especially digital services. We should harmonize our approaches to protecting the privacy of data. And a modernized trade system will also require the ability to effectively enforce trade policies and practices, both multilateral and bilateral.”So what would Janet Yellen’s new friend-shoring paradigm do to gold supply? Additionally, the table below displays the 2019 gold mine production. The 2019 data shows that two of the top three producer countries, China and Russia are ‘unfriendly countries’ at least from an Irish/UK/American perspective. Kazakhstan in addition to Uzbekistan is less obvious. Also, it is likely to be excluded or tariffed when selling to western consumers and investors.

Tags: Commentary,Economics,Featured,Gold,gold news,gold price,gold price analysis,News,newsletter,Precious Metals,silver,silver price