In den letzten beiden Wochen hat Ethereum Classic an Fahrt aufgenommen. Nachdem es vor ein paar Jahren zu einer Fork gekommen war, die uns den von Buterin unterstützen Ethereum und einen Alternative Cryptocoin mit dem Namen Ethereum Classic brachte, ist der Classic Cryptocoin schrittweise aus den vorderen Positionen des Marktes verschwunden. Doch diese Woche ist der Classic Coin sogar wieder in den Top 20 gelandet. Ethereum News: Ethereum Classic erlebt intensive...

Read More »Regional Territories: A Decentralization Plan for the USA

There is more talk of secession and civil war in the United States today than at any time since the 1850s, and popular confidence in government appears to be at an all-time low. As a foreigner, I have no particular red or blue loyalties, but I have deployed with Americans on many occasions, and in some ways, their history is also mine. There is a chance that history will look at the culture wars of the 2010s as a prelude to the great disintegration of the 2020s, so...

Read More »Austrians vs. Neoclassicists on Monopolies

A monopoly is often seen as one of the gravest and most concerning manifestations of market failure. In the neoclassical tradition, the existence of a monopolist in a market is generally seen as sufficient justification for government intervention to put a halt to the monopolist's exploitative ways. The Austrian tradition, however, has historically remained skeptical of this alleged problem of monopoly. Two of the most prolific Austrian theorists, Murray Rothbard and...

Read More »No money likely from Swiss National Bank after large loss

Like most central banks the Swiss National Bank (SNB) is tasked with monetary stability. However, in the process it can inadvertently generate large profits and losses. SNB – BernWhen monetary policy is expansionist and the resulting assets held by the SNB rise in value it can generate large profits as it has over the last few years. However, when the Swiss franc strengthens and asset values slump the bank can generate large losses as it did in the first half of...

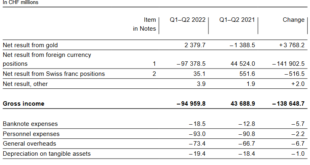

Read More »Interim results of the Swiss National Bank as at 30 June 2022

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Low Inflation, Crashes and Central Bank Money Printing The crisis caused by the Covid19 virus,is a typical crisis with low inflation (at least for now). During such a crisis, central bank money...

Read More »EMU GDP Surprises, while the Yen’s Short Squeeze Continues

Overview: The month-end and slew of data is making for a volatile foreign exchange session, while the rash of earnings has generally been seen as favorable though weakness was seen among the semiconductor chip fabricators. China, Hong Kong, and Japanese equities fell but the other large markets in the region rose. Europe’s Stoxx 600 is up around 0.8%. It is the eighth advance in the past 10 sessions. US futures are higher and the S&P 500’s advance of nearly 7.6%...

Read More »Swiss National Bank reports massive losses

High losses had been expected, but the figure is higher than economists had predicted. © Keystone / Peter Klaunzer The Swiss National Bank (SNB) has taken a hit of CHF95.2 billion ($100 billion) for the first half of this year, mainly owing to losses on foreign currency positions. After a loss of CHF32.8 billion in the first quarter, another CHF62.4 billion was added in the second quarter. High losses had been expected, but the figure is higher than economists had...

Read More »A muddled message from The Fed

If you have decided to buy gold bullion or to buy silver coins in the last few months then you may have been delighted with how last night’s Fed press conference went. If you’re still wondering if or how to invest in gold then it might be worth paying attention to what central banks are doing in the coming weeks. After all, how do central banks make their decisions when it comes to monetary policy? In years before it might have been quite straightforward...

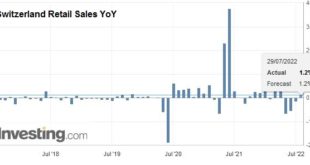

Read More »Swiss Retail Sales, June 2022: +3.2 percent Nominal and +1.2 percent Real

29.07.2022 – Turnover adjusted for sales days and holidays rose in the retail sector by 3.2% in nominal terms in June 2022 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 1.2% in June 2022 compared with the previous year. Real growth takes...

Read More »The Government Runs the Ultimate Racket

“Seniors hurt in Ponzi scam” headlined the story of elderly Southern Californians bilked in a pyramid scheme. While sad, the story reminded me of Social Security, since it is also a Ponzi scheme involving those older, with high payoffs to early recipients coming from pockets of later participants. With Social Security, however, it benefits those older at others’ expense. Pyramid scams collapse when they run out of enough new “investors” to pay earlier promises. Some...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org