In 2019 The New York Times launched their 1619 project, which “aims to reframe the country’s history by placing the consequences of slavery and the contributions of black Americans at the very center of our national narrative.” In the NYT retelling of American history, black troops who fought for the Union in the 1861-65 war are to be commemorated, but black Confederates must be summarily erased. The aim of this article is to argue against this erasure of black...

Read More »Caplan’s Errors on the UAE and Open Borders

Arguments advanced to support a political position often fail to withstand the slightest scrutiny. Rather, they are meant to make an impression on the impressionable—those who lack the context required to make an evaluation—and draw large numbers of the uninformed to one side of a political debate. Such is the case with libertarian economist Bryan Caplan’s recent article in favor of unrestricted immigration, wherein he uses the United Arab Emirates as a supposed...

Read More »USD/CHF Price Forecast: Reaches overbought levels

USD/CHF is in a strong uptrend which keeps making higher highs. However it has reached overbought levels according to the RSI momentum indicator This means bulls should be aware of the increased risk of pullbacks. USD/CHF continues rising in its established uptrend but it has now reached overbought levels (above 70) according to the Relative Strength Index (RSI) momentum indicator. When this occurs it advises long-holders not to add to their...

Read More »Price Inflation Accelerated in October Following the Fed’s Rate Cut

According to the Bureau of Labor Statistics’ latest price inflation data, CPI inflation in October accelerated and month-to month increases in CPI inflation hit multi-month highs.The seasonally adjusted Consumer Price Index (CPI) rose 0.24 percent month over month in October, rising to a six-month high. Year over year, the CPI rose 2.49 percent in October, not seasonally adjusted. That’s a three-month high.The ongoing price increases largely reflect growth in prices...

Read More »“NAFTA Fever” and the Myth of Government-Created Free Markets

Left or right, the enemy is the free market. Every problem is the fault of the free market. On the left, the supposed radical deregulation of the 1980s paved the way for the financial crisis and the destruction of the environment. On the right, free trade is responsible for the gutting of manufacturing. The free market is made out in this mythos to have had its heyday in the 1980s and ‘90s and destroyed everything. Even free market advocates fall into this trap,...

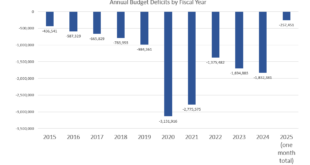

Read More »We’re Already on Track for a $2 Trillion Deficit this Year

The Treasury Department posted its latest revenue and spending totals this week, and deficits continue to mount at impressive speed. During October—the first month of the 2025 fiscal year—the federal deficit was more than a quarter of a trillion dollars, coming in at $257.4 billion. Tax revenue in October had totaled $326 billion, but spending totaled $584 billion. Now one month into the new fiscal year, the federal government is on pace to add more than $2 trillion...

Read More »FX and Rates Unwind Yesterday’s Powell Effect, US Index Futures Slide

Overview: The dollar bounced, and US rates rose yesterday afternoon in response to comments by Fed Chair Powell. But he did little more that reiterate what he had said at the recent press conference. Powell expressed a lack of urgency to move after having led the central bank in delivering a 50 bp cut to start the easing in September while indicating that direction of travel will be to a less restrictive rate. The dollar has come back lower today against the G10...

Read More »Stanley’s Orwellian Anti-Fascism

Erasing History: How Fascists Rewrite the Past to Control the Future. By Jason Stanley. Atria One Step Publishing, 2024; 256 pp.Jason Stanley is a well-regarded philosopher of language, but you would never realize it from this rambling and incoherent book. Stanley rightly says that control of public education is an essential characteristic of fascism. By “fascism,” I should add, he includes Nazism. He also notes that fascists wanted to restrict the curriculum so that...

Read More »It’s Greek to Us: Angry Generation Z Women Reenact “Lysistrata” Post-Election

In the aftermath of Donald Trump’s decisive victory over Kamala Harris on November 5, millions of American women—especially those of Generation Z, born between 1997 and 2012, currently aged from 12 to 27—are despondent and dismayed that Democrats’ campaign focus on abortion policy did not convince more voters to choose Harris. They are convinced that their “my body, my choice” freedom has been stolen from them by the Supreme Court’s 2022 decision in Dobbs v. Jackson...

Read More »Totalitarianism Begins With A Denial of Economics

In the history of the social sciences, no other field of study has attracted so great a level of hostility as the science of economics. Since the inception of the science, the onslaught against it has been on the rise, extending across individuals and groups. And the outlook for a favorable reception of the science is bleak, given that a significant number of people are incapable of following through the extended chains of reasoning required for comprehending...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org