[Today is the fiftieth anniversary of Friedrich A. Hayek’s Nobel Prize Lecture, delivered at the ceremony awarding him the Nobel Prize in economics in Stockholm, Sweden, December 11, 1974. This lecture, along with “A Free-Market Monetary system,” can be found here in book form.]The particular occasion of this lecture, combined with the chief practical problem which economists have to face today, have made the choice of its topic almost inevitable. On the one hand the...

Read More »Can Trump Save the Dollar?

During his 2024 presidential campaign Donald Trump repeatedly and in grave terms highlighted the possibility of the US dollar losing its world reserve currency status. This occurred at summits with business leaders at the New York and Chicago Economic Clubs.Trump occupies a rather unique position in this debate since he recognizes the real possibility of the dollar losing its world currency status, he opposes this change and wishes to prevent it, and yet he is not a...

Read More »Progressivism and the Murder of a Health Insurance CEO

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »China Is No Longer The Marginal Buyer Of Oil

From 2010 through 2022, the US Energy Information Administration (EIA) calculates that global oil demand grew by 10 million barrels per day (Mb/d). Over 60% of the demand growth was due to China's phenomenal economic growth. For context, American demand increased by less than 10%. The graph below shows that China once drove global oil demand, but that is no longer true. Given the impact oil prices have on inflation, this is an essential macroeconomic factor to...

Read More »MicroStrategy And Its Convertible Debt Scheme

MicroStrategy (MSTR) stock is soaring alongside Bitcoin. In the wake of extreme confidence, we fear many MicroStrategy investors fail to grasp the inherent risks with its unique convertible bond funding and leverage scheme. A recent podcast featuring Tom Lee presented some positive facts about MicroStrategy's recent convertible bond offering but failed to tell the whole story. Left out of Tom Lee's enthusiastic outlook is that the "novel strategy" can also bankrupt...

Read More »The Fight against the Left Is an Ideological One

Unhumans: The Secret History of Communist Revolutions (and How to Crush Them) by Jack Posobiec and Joshua Lisec. Skyhorse Publishing, 2024; 258 pp.With their profoundly mediocre new book Unhumans: the Secret History of Communist Revolutions, Jack Posobiec and Joshua Lisec inadvertently illustrate some of the reasons why conservatives so often fail to counter the ideological victories of the Left. Like so many conservative activists before them, Posobiec and Lisec...

Read More »From the Editor—November / December 2024

Another national election has come and gone, and like many of our readers, I think the less awful candidate won. After all, a victory for Kamala Harris was likely to be interpreted as an endorsement of the status quo and a “mandate” for more of the same.Unfortunately, though, opposition to the status quo is not the same thing as support for peace, freedom, or free markets. Dissatisfaction with the regime is good, but it’s not enough. We will see this illustrated many...

Read More »What Modern Economists Can Learn from the Austrian School of Economics

The Austrian School of Economics represents a heterodox methodological approach to economics that significantly differs from the orthodox teachings represented by mainstream economics. The Austrian School’s approach is multidisciplinary, comprising not only economists but also historians, sociologists, jurists, and philosophers who aim to explain social phenomena stemming from human action, which serves as the fundamental pillar of the school. Below, we will explore...

Read More »There Is No Right to a Minimum Wage

One of the most popular economic fallacies of our time is the belief that the absence of a minimum wage would lead to limitless exploitation of employees in the economy. Minimum wage legislation prevents employees from being hired at pay rates below the mandated amount. Proponents of minimum wage laws claim that not having a minimum wage would lead to employees being paid very little for the amount of work they do. They also claim that everyone ought...

Read More »Gold price retreats from over two-week top; bulls turn cautious ahead of US CPI

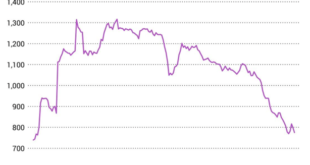

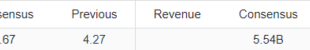

Gold price advances to over a two-week high and draws support from a combination of factors. Geopolitical risks, trade war fears and rate cuts by major central banks underpin the XAU/USD. Rising US bond yields underpin the USD and cap the yellow metal ahead of the US CPI report. Gold price (XAU/USD) prolongs its weekly uptrend for the third consecutive day on Wednesday and climbs to a two-and-half-week high during the Asian session. The commodity now looks to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org