Overview: The capital markets have been choppy as pre-existing positioning meets new thoughts on the implications of a second Trump administration. The dollar has found better footing today after giving back a chunk of Wednesday's gains yesterday. The yen is an exception, but it is not exception that the dollar trades heavier against the yen as the US 10-year yield drifts lower. On the week, the most G10 currencies are holding on to gains against the dollar. Here...

Read More »What Is Consent?

James Buchanan and Gordon Tullock’s The Calculus of Consent—published over sixty years ago in 1962—has been one of the most influential books that apply economic ideas to politics. The authors were by no means libertarians, but they favored, for the most part, a limited state and the free market. An additional point in their favor was that both authors read my book reviews. In this week’s column, I’m going to discuss some points of interest in the book, some of which...

Read More »What Is Consent?

James Buchanan and Gordon Tullock’s The Calculus of Consent—published over sixty years ago in 1962—has been one of the most influential books that apply economic ideas to politics. The authors were by no means libertarians, but they favored, for the most part, a limited state and the free market. An additional point in their favor was that both authors read my book reviews. In this week’s column, I’m going to discuss some points of interest in the book, some of which...

Read More »QJAE: The Myth of the Price Premium

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Trump Presidency – Quick Thoughts On Market Impact

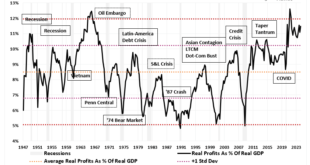

The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic growth, monetary and fiscal policy, and geopolitical events. Here are some quick thoughts about what we at...

Read More »JLS: Libertarian Film Critics in the Late Twentieth Century: A Brief Introduction

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »How Can Mining Asteroids in the Future Make Us Richer Today?

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »USD/CHF edges higher above 0.8700 amid renewed US Dollar demand

USD/CHF gains ground to near 0.8730 in Friday’s early European session. The Fed cut interest rates by a quarter point at the November meeting on Thursday. The safe-haven flows could underpin the Swiss Franc. The USD/CHF pair drifts higher to around 0.8730 during the early European session on Friday. The renewed Greenback demand provides some support to the pair. Traders brace for the advanced US Michigan Consumer Sentiment data for November...

Read More »After Victory, Trump Faces the Big Economic Problems

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »How the Government Created Exorbitant Insulin Prices

The high price of insulin is increasingly present in American political discourse as presidential candidates boast of interventions; whereas, the Federal Trade Commission, states, and even counties and school boards have brought forth lawsuits, alleging price gouging and collusion between pharmaceutical giants and pharmacies. However, as is par for the course in American politics, policymakers ignore the reality that they—not the market—created these problems, and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org