Business travel commitments keep me from updating the blog until the weekend, but I wanted to share a few thoughts post-Fed. First, the Fed was more hawkish, and the median dot sees 125 bp increase in the target rate in Q4. The hawkish thrust was also evident in projecting that the target rate will remain higher for longer. Even in 2025 sees the target rate above the longer-term (neutral) level. Second, the market still does not fully accept the Fed's message....

Read More »Putin and Powell Lift Dollar

Overview: Between Putin’s mobilization of 300k Russian troops and Fed Chair Powell expected to lead the central bank to its third consecutive 75 bp hike later today, the dollar rides high. It has recorded new two-year highs against the dollar bloc and Chinese yuan, while sterling was sent to new lows since 1985. Asia Pacific bourses were a sea of red for the sixth decline in the regional benchmark in the past seven sessions. Surprisingly, Europe’s Stoxx 600 is...

Read More »Why the Fed Usually Ignores its Mandate for “Stable Prices”

In recent years, Congress has attempted to add various new mandates to the Federal Reserve’s mission. In 2020, Democrats introduced the “Federal Reserve Racial and Economic Equity Act.” Then, in 2021, pundits and politicians were telling us that it’s the Fed’s job to “combat climate change.” These are just the latest efforts to use the enormously powerful central bank to achieve political ends to the liking of elected officials. This is a helpful reminder, of...

Read More »Marked slowdown on the horizon

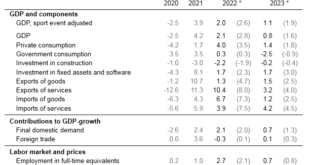

Economic forecast: marked slowdown on the horizon The expert group on business cycles has significantly downgraded its expectations for Switzerland’s GDP growth to 2.0% for 2022 and 1.1% for 2023 (GDP adjusted for sporting events). After a positive first half of the year 2022, the Swiss economy now faces a deteriorating outlook. A tense energy situation and sharp price increases are weighing on economic prospects, especially in Europe.1 As expected, the Swiss...

Read More »Swiss National Bank monetary policy meeting preview

The SNB announcement is due on Thursday at 0730 GMT. This in brief via Standard Chartered: expect SNB to hike by 100bp Stan Chart were at +50bp but have ramped their expectation much higher. Add that this takes: the base rate to 0.75% from -0.25%, and out of negative territory for the first time since 2014 More: We believe positive currency rhetoric from the SNB and increasing hawkishness among major central banks support our larger-than-consensus rate hike forecast;...

Read More »Review: Free Market: The History of an Idea

Free Market: The History of an Idea by Jacob Soll Basic Books, 2022; viii + 326 pp. Jacob Soll is a distinguished historian, and Free Market contains much of value, but the book cannot be considered a success, and indeed as it reaches the twentieth century, it becomes a disaster. Even in the parts of the book worth reading, Soll is in the iron grip of a central thesis, one that his historical approach by its nature makes impossible to prove. In some books, discerning...

Read More »Market Currents – Is The Economy Contracting?

Is the economy contracting? Alhambra’s Steve Brennan poses that question to CEO Joe Calhoun. [embedded content] [embedded content] Tags: Alhambra Research,Bonds,commodities,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,Real Estate,stocks

Read More »Energy worries likely to slow Swiss growth, say experts

Russia’s invasion of Ukraine and the subsequent worries about energy sources make the economic outlook uncertain. (c) Copyright 2022, Dpa (www.dpa.de). Alle Rechte Vorbehalten Swiss economic growth forecasts for 2022 and 2023 have been revised significantly downwards, amid uncertainty over energy supply and inflation. A government expert group has downgraded its expectations for GDP growth to 2% in 2022, compared with the 2.6% it predicted in June. For 2023, its...

Read More »Zahl der Cryptocoin-SCAMS auf YouTube explodiert

Obwohl YouTube angekündigt hatte, Inhalte mit Cryptocoins intensiver unter die Lupe zu nehmen, ist die Anzahl der SCAMs im Zusammenhang mit Bitcoin und Co. auf der Plattform in diesem Jahr deutlich gestiegen. Crypto News: Zahl der Cryptocoin-SCAMS auf YouTube explodiertEine IT-Sicherheitsfirma aus Singapur berichtet in einem Report von einem Anstieg von 335 Prozent in der ersten Jahreshälfte im Vergleich zum Vorjahr. Allein 2.000 Domains wurden in Beschreibungen und...

Read More »Riksbank Hikes 100 bp but the Krona gets No Love

Overview: Yesterday’s late rally in US shares carried into the Asia Pacific session where all of the large markets advanced. However, the bears are not abdicating and Europe’s Stoxx 600 is off for the sixth consecutive session and US futures are trading lower. The sell-off in the bond market continues. European benchmark yields are mostly 8-10 bp higher and the US 10-year Treasury yield is up nearly five basis points to approach 3.54%. The two-year continues to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org