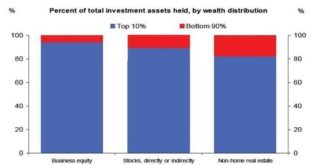

Should the wealth effect reverse as assets fall, capital gains evaporate and investment income declines, the top 10% will no longer have the means or appetite to spend so freely. Soaring wealth-income inequality has all sorts of consequences. As many (including me) have noted, the concentration of wealth and income in the top 0.1% has enabled the few to buy political influence to protect their interests at the expense of the many and the common good. In other...

Read More »Crypto crash fails to deliver death blow to Swiss ambitions

The crypto sector appears to be suffering an existential crisis, shedding jobs, client funds and credibility. Switzerland looks to have escaped with a glancing blow – if industry data is anything to go by. The collapse of the Terra stablecoin and the FTX crypto exchange last year sent negative ripples across the globe. Big name crypto firms such as the Coinbase and Huobi exchanges, Silvergate bank and Genesis are laying off large chunks of staff. That’s to avoid the...

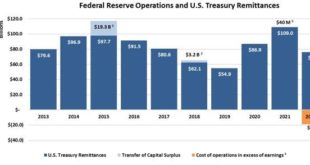

Read More »Why the Fed Is Bankrupt and Why That Means More Inflation

In 2011, the Federal Reserve invented new accounting methods for itself so that it could never legally go bankrupt. As explained by Robert Murphy, the Federal Reserve redefined its losses so as to ensure its balance sheet never shows insolvency. As Bank of America’s Priya Misra put it at the time: As a result, any future losses the Fed may incur will now show up as a negative liability (negative interest due to Treasury) as opposed to a reduction in Fed capital,...

Read More »The Rise and Fall of Good Money: A Tale of the Market and the State

Ludwig von Mises’s book The Theory of Money and Credit is a masterwork of monetary theory. Despite being written in the early twentieth century, its arguments and conclusions are still valid and interesting today. Mises describes five characteristics that are vital to the function of money: marketability, durability, fungibility, trustworthiness, and convenience. The history of money is straightforward. Markets developed and expanded as long as the private sector...

Read More »Unterschriftensammlung für das 3. Covid-Referendum

Obwohl Unterschriften sammeln nicht zu unseren Kernkompetenzen zählt, mischten sich 6 unerschrockene Freiheitskämpfer der Libertären Partei am letzten Samstag unter das Marktvolk auf dem Marktplatz Oerlikon. Aktuell gängeln gerade keine Covid-Massnahmen unser Leben. Doch der ganze Zwangsmassnahmenkatalog schwebt wie ein Damoklesschwert über den Köpfen von uns freien Bürgern. Wir müssen dem Staat die rechtliche Grundlage für diese menschenverachtende, spaltende und freiheitsfeindliche...

Read More »The BOJ Surprises by Standing Pat

Overview: The BOJ defied speculation and stuck to its current policy, which saw the yen sell-off sharply. The dollar rallied about 3.4 yen before falling back. The greenback is broadly lower against the other G10 currencies. However, for the fifth consecutive session, the euro has stalled around $1.0870. While UK headline inflation softened, mostly due to fuel, core prices were unchanged, and this may have helped sterling extend its recent gains to almost $1.2365....

Read More »The Fed Is a Purely Political Institution, and It’s Definitely Not a Bank.

Those who know Wall Street lore sometimes recall that Fed chairman William Miller—Paul Volcker’s immediate predecessor—joked that most Americans believed the Federal Reserve was either an Indian reservation, a wildlife preserve, or a brand of whiskey. The Fed, of course, is none of those things, but there’s also one other thing the Federal Reserve is not: an actual bank. It is simply a government agency that does bank-like things. It’s easy to see why many people...

Read More »With Trepidation, the Market Awaits the BOJ

Overview: With the market nearly ruling out a 50 bp hike by the Federal Reserve on February 1, the interest rate adjustment appears to have largely run its course. This may be helping to ease the selling pressure on the greenback. The general tone today is one of consolidation. There is a modest risk-off bias today. Although Japanese stocks advanced, China, Hong Kong, and South Korean equities slipped lower. Europe’s Stoxx 600 is snapping a four-day advance, and US...

Read More »WEF: Oxfam urges windfall tax on food companies

Food and energy are among the industries dominated by a small number of players that have effective oligopolies, and the lack of competition allows them to keep prices high, Oxfam says Keystone / Alessandro Della Bella Food companies making big profits as inflation has surged should face windfall taxes to help cut global inequality, anti-poverty group Oxfam said on Monday as the annual meeting of the World Economic Forum (WEF) gets underway in the Swiss mountain...

Read More »Australia: The Nation Founded by British Convicts Embraced Entrepreneurship

Australia’s superb performance on measures of international development has earned her the admiration of many. Few countries can boast such stellar achievements in economic and social affairs. Currently, Australia has the highest median wealth per adult in the world and outperforms the Organisation for Economic Co-operation and Development (OECD) average in civic engagement, health, education, and other dimensions of well-being. Australians are equally lauded for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org