The US dollar starts what promises to be an eventful week giving back some the gains score in second half of last week against the euro and yen. Equity markets are extending their pre-weekend losses. Commodities are also trading with a heavier bias. Markets in Australia, New Zealand, and Italy are closed for national holidays. The consolidative tone may not be very surprising give the data to be released in the coming days and the FOMC and BOJ meetings. Investors will see the first...

Read More »Affairs of State: Erdogan and Böhmermann

Insulting Mr. Erdoğan Can Be Dangerous Most of our readers are probably aware by now that the German government finds itself in a rather awkward situation over its relations with Turkey’s government again – with which the EU has just struck a widely criticized and very expensive deal to help it stem the flood of refugees. One thing is absolutely certain about Turkey’s president Recep Tayyip Erdoğan: He has no sense of humor whatsoever. As of early March 2016, 1,845 lawsuits were pending...

Read More »Silver is on Fire

The Prices of Gold and Silver Drift Apart Another interesting week, in that the price of silver separated from the price of gold. The former went no nowhere, while the latter gained over 4.5%. Inside the Sierra silver mine in Wallace, Idaho Photo credit: silverminetour.org We get the trading thesis, that if the precious metals are in a bull market, then silver should go up more than gold. Silver is the high-beta gold. It’s a smaller market, less liquid, and at the same time it’s the...

Read More »Standard of living in Switzerland remains one of the highest in Europe

25.04.2016 09:15 – Eurostat; FSO, Income, Consumption and Living Conditions (0353-1603-00) Standard of living in Switzerland remains one of the highest in Europe Neuchâtel, 25.04.2016 (FSO) – In 2014 Switzerland was one of the countries with the highest living standards in Europe. This does not exclude financial difficulties, as 6.6% of the population, i.e. approx. 530,000 people were affected by income poverty. Roughly one person in ten cannot afford a week’s holiday away from home...

Read More »Statistics on tourist accommodation in 2015: Significant decrease in overnight stays in youth hostels, moderate decline for campsites

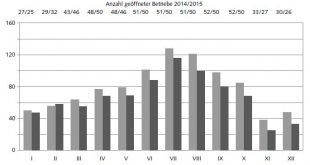

25.04.2016 09:15 – FSO, Tourism (0353-1604-50) Statistics on tourist accommodation in 2015 Significant decrease in overnight stays in youth hostels, moderate decline for campsites Neuchâtel, 25.04.2016 (FSO) – Switzerland’s 51 registered youth hostels generated 814,000 overnight stays in 2015, i.e. a decrease of 14.4% compared with 2014. As for the 410 campsites surveyed, 2.7 million overnight stays were recorded, representing a decline of 0.6% compared with the previous year. These...

Read More »The Week Ahead: FOMC, BOJ and More

The last week of April is eventful. The Reserve Bank of New Zealand, the Federal Reserve and the Bank of Japan hold policy meetings. The UK, eurozone, and the US provide the first estimates of Q1 GDP. Japan, the eurozone, and Australia report consumer prices, while the US updates the Fed’s preferred (targeted) inflation measure, the core deflator of personal consumption expenditures. These events will not take place in a vacuum. The backdrop is an improving tone in the global capital...

Read More »Chinese Dragon: Breathing Credit Fumes

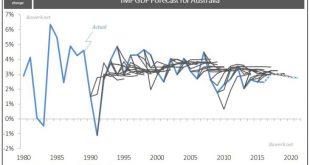

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate. However, spending millions of dollars to do the job of a ruler doesn’t seem like wise...

Read More »Germany’s AFD leader Frauke Peter wants ‘more Switzerland for Germany’

Frauke Petry, leader of the Alternative for Germany (AFD) Frauke Petry, leader of the Alternative for Germany (AfD), believes Germany “needs more Switzerland … more democracy” and that Switzerland is some way ahead of her country when it comes to a “culture of democracy”. Petry, who in January suggested German police should be allowed to shoot refugees trying to enter Germany, was a guest speaker at the general meeting of the Campaign for an Independent and Neutral Switzerland (CINS, in...

Read More »Switzerland Readies Military In Preparation For A New Wave Of Migrants

According to The BBC, the most asylum claims in 2015 occurred in Germany, which saw >500,000... With the main route (reportedly shut down) being from Turkey to Greece, and up through the Balkans... With Syrians making up the bulk of migrants trying to enter Europe. But now, in response to Balkan countries closing down traditional migrant routes to Europe, Switzerland's military is taking steps to prepare for a potential new wave of immigrants in case it becomes part of a new route....

Read More »Weekly Speculative Positions: Reduction of US Dollar Exposure at What may be the Bottom

Speculators in the futures market continued to press a bearish view of the US dollar the CFTC reporting week ending April 19.According to the Commitment of Traders report, speculators added to their gross long currency futures position in seven of the eight currencies we track. The exception was the British pound, where speculators liquidated a minor 1.1k contracts, leaving them with 32.8k gross long sterling future contracts. That said, most gross currency adjustments were small, but...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org