The Prices of Gold and Silver Drift Apart Another interesting week, in that the price of silver separated from the price of gold. The former went no nowhere, while the latter gained over 4.5%. Inside the Sierra silver mine in Wallace, Idaho Photo credit: silverminetour.org We get the trading thesis, that if the precious metals are in a bull market, then silver should go up more than gold. Silver is the high-beta gold. It’s a smaller market, less liquid, and at the same time it’s the preferred vehicle for betting on a rising price. We don’t quite get the thesis that gold is going nowhere or even down, and bet on silver which is going to . Yet that is now our market reality. Excited silver bulls have watched as pushed silver up from in late January to . Meanwhile the price of gold went from ,100 to ,260 and then back down to ,230. The gold silver ratio initially rose from 78.5 to over 83, and down so far to 72.7. The growing consensus is bullish. As always, we’re more interested in the fundamentals than in opinions. Let’s look at the only true picture of supply and demand fundamentals. Developments in Supply-Demand Fundamentals The prices of gold and silver. Here is the graph of the metals’ prices. The prices of gold and silver – click to enlarge. Gold-silver ratio.

Topics:

Keith Weiner considers the following as important: Featured, Gold and its price, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Prices of Gold and Silver Drift Apart

Another interesting week, in that the price of silver separated from the price of gold. The former went no nowhere, while the latter gained over 4.5%.

We get the trading thesis, that if the precious metals are in a bull market, then silver should go up more than gold. Silver is the high-beta gold. It’s a smaller market, less liquid, and at the same time it’s the preferred vehicle for betting on a rising price.

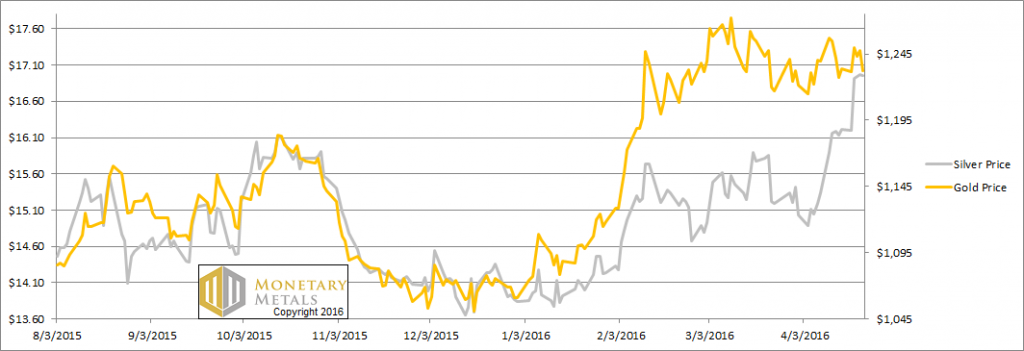

We don’t quite get the thesis that gold is going nowhere or even down, and bet on silver which is going to $50. Yet that is now our market reality. Excited silver bulls have watched as pushed silver up from $14 in late January to $17.

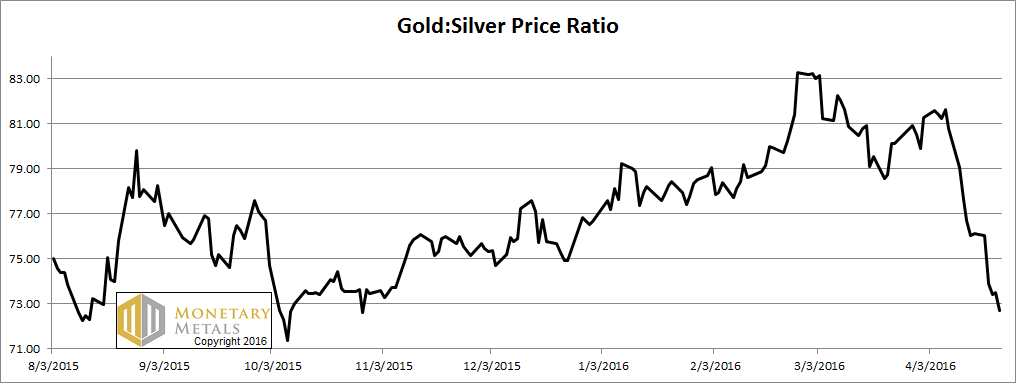

Meanwhile the price of gold went from $1,100 to $1,260 and then back down to $1,230. The gold silver ratio initially rose from 78.5 to over 83, and down so far to 72.7.

The growing consensus is bullish. As always, we’re more interested in the fundamentals than in opinions. Let’s look at the only true picture of supply and demand fundamentals.

Developments in Supply-Demand Fundamentals

The prices of gold and silver.Here is the graph of the metals’ prices. |

Gold-silver ratio.Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down sharply again this week. |

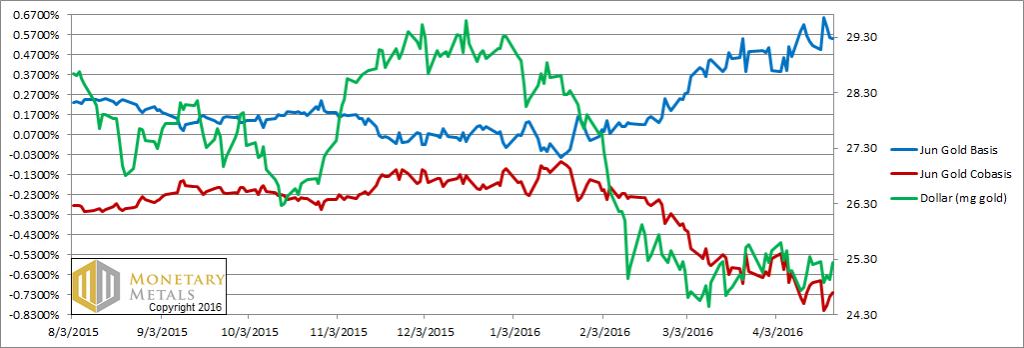

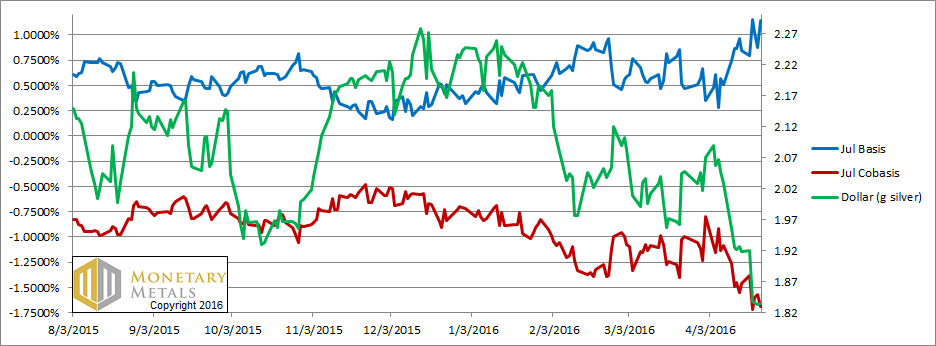

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

Gold basis and co-basis and the dollar price.Look at that. Carrying gold for June delivery is now even more profitable, over 55 basis points. This is up from last week at 51bps. The increase tells us something. However much gold was carried last week, it became incrementally more attractive to carry this week. |

A positive basis is a measure of abundance. This is because it tells us about the profitability of buying metal to warehouse in carry trades. If profitability is rising, then that means the marginal demand for metal is to put it into the warehouse.

Not a bullish sign, with a flat to falling price. Indeed our fundamental price for gold is still sagging, down another six Federal Reserve Notes this week.

Now let’s turn to silver.

Silver basis and co-basis and the dollar price.How much higher can the price of silver go? One talk show host appealed to the “silver faithful” with a promise of a price to skyrocket to levels even they will find “stunning”. Our response is to point to the basis (blue line). Note that we switched from May to July. |

If gold is showing some signs of abundance, silver is practically lying about in the market landscape. To carry silver for July delivery yields an annualized profit of over 1.1%. The flow of metal into the carry trade must be a torrent. If anything occurs that will stun the silver faithful, it will be the epic drop in the silver price. This will be decried as a smash-down.

Our calculated fundamental price did rise a dime this week, but it’s more than two fiat units below the market price. There are times when the basis analysis does not predict a price move. We certainly did not call for the price of silver to jump. It’s speculation, or “animal spirits” if you will. However, then the basis can predict the reversal of the speculative move.

To be conservative—though this risks missing a quick collapse—one should wait to see the momentum peter out. As we often say at times of bearishness, we never recommend naked shorting of a monetary metal. The way to play this move would be to go long gold and short silver. If the gold silver ratio is 70, short 70 ounces of silver for every ounce of gold you buy.

70 would be an attractive entry point (assuming momentum dies by then). If the ratio rises to 83, then you have a gain of over 18.5%. For example, if you buy 100 oz gold and short 7,000 oz silver, you will pick up over 15.6 ounces of gold.

Charts by: Monetary Metals

Dr. Keith Weiner is the president of the Gold Standard Institute USA, and CEO of Monetary Metals. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith is a sought after speaker and regularly writes on economics. He is an Objectivist, and has his PhD from the New Austrian School of Economics. He lives with his wife near Phoenix, Arizona.