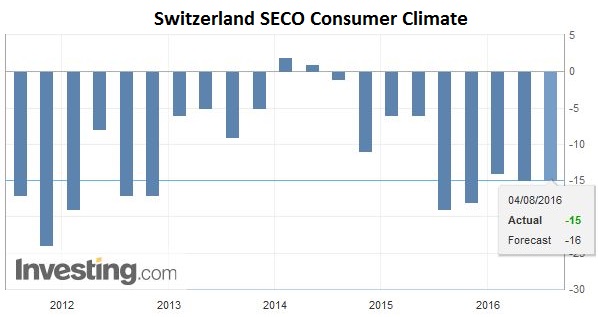

Bern, 04.08.2016 – Consumer sentiment remained unchanged between April and July 2016* and is now below the long-term average for the fifth quarter in a row. Most sub-indices also saw no major change, except regarding inflation, with the 1,200 or so individuals questioned expecting prices to rise more sharply over the next twelve months than they had in April. There was also a belief in July that prices had been rising faster over the previous twelve months than had been the case at the time of the April survey. Nevertheless, both indices remain well below the corresponding average. The Swiss consumer sentiment index has languished below the long-term average of -9 points since the survey undertaken in July 2015. It saw no change between April and July 2016, sticking at -15 points. There was virtually no variation between April and July 2016 in the responses given to the four questions used to calculate the consumer sentiment index**. Although views of the general economic situation remain fairly pessimistic (-30 points in April, -27 in July), the situation is continuing to brighten slightly. Forecast unemployment fell marginally (+70 points in April, +61 in July). Respondents made virtually the same assessment of their financial circumstances for the next twelve months (+1 point in April, −2 in July).

Topics:

SECO considers the following as important: Featured, newsletter, Swiss Macro, Switzerland SECO Consumer Climate

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Bern, 04.08.2016 – Consumer sentiment remained unchanged between April and July 2016* and is now below the long-term average for the fifth quarter in a row. Most sub-indices also saw no major change, except regarding inflation, with the 1,200 or so individuals questioned expecting prices to rise more sharply over the next twelve months than they had in April. There was also a belief in July that prices had been rising faster over the previous twelve months than had been the case at the time of the April survey. Nevertheless, both indices remain well below the corresponding average.

| The Swiss consumer sentiment index has languished below the long-term average of -9 points since the survey undertaken in July 2015. It saw no change between April and July 2016, sticking at -15 points. There was virtually no variation between April and July 2016 in the responses given to the four questions used to calculate the consumer sentiment index**. Although views of the general economic situation remain fairly pessimistic (-30 points in April, -27 in July), the situation is continuing to brighten slightly. Forecast unemployment fell marginally (+70 points in April, +61 in July). Respondents made virtually the same assessment of their financial circumstances for the next twelve months (+1 point in April, −2 in July). Finally, they shared a slightly bleaker view of their prospects of saving money over the next twelve months (+27 points in April, +20 points in July). |

Click to enlarge. Source Investing.com |

Consumers also saw rather less chance of them currently putting money aside (+45 points in April, +37 in July). They also believed now to be a somewhat less auspicious time to make major purchases (+1 point in April, 0 points in July).

There was a marked increase in perceived recent and future inflation. The sub-index that measures price trends in the past twelve months increased (+7 points in April, +17 points in July), while that for expected price trends also climbed (+22 points in April, +32 points in July). However, both sub-indices remain well below their long-term averages (+82 and +68 points respectively).

*In January, April, July and October, approximately 1,200 households selected at random are questioned at the request of the Swiss State Secretariat for Economic Affairs (SECO) with regard to their personal assessment of the economic situation, their own financial situation, price trends, job security, etc. The survey is conducted by the market research institute DemoScope.

**Assessment of the future economic prospects, the future development of unemployment, the anticipated development of the financial situation of domestic households and the savings possibilities over the next twelve months.