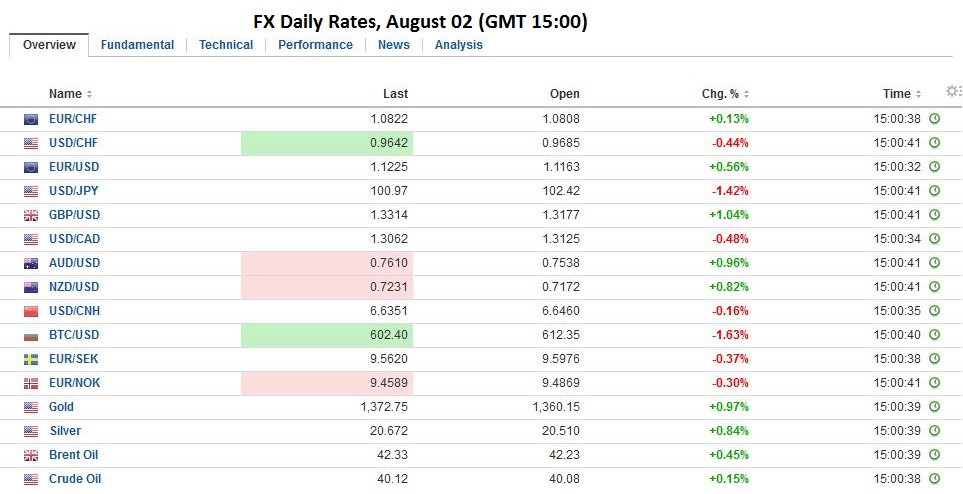

Swiss Franc The euro appreciated against both Swiss Franc and dollar. Swiss retail sales was again very weak, but emphasize our last month comment: The measurement of retail sales (and also GDP) ignore the active second-hand markets in Switzerland. The Swiss SVME PMI was at 50.1 close to contraction, another piece of bad data. Click to enlarge. FX Rates The US dollar is offered against the major currencies, but appreciating against many emerging market currencies, include the South African rand and Turkish lira. Oil prices are trying to stabilize with Brent near and WTI near , but the recent losses continue to weigh on the Malaysian ringgit and the Mexican peso. The dollar’s weakness against the major currencies is partly a correction to recent gains scored over the past month that was helped by the re-pricing of the risk of a Fed hike this year after a string of stronger than expected data. However, the extent to which current demand was being met through inventories rather than new production came as a rude surprise to investors in the initial estimate of Q2 GDP last week. The negativity toward the US dollar is offsetting the rate cut in Australia and further evidence that the UK domestic economy is taking a hit in the immediate post-referendum period.

Topics:

Marc Chandler considers the following as important: AUD, EUR, Featured, FX Daily, FX Trends, GBP, JPY, newsletter, U.K. Construction PMI, U.S. Personal Income, U.S. Real Personal Consumption, U.S. Savings Rate, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe euro appreciated against both Swiss Franc and dollar. Swiss retail sales was again very weak, but emphasize our last month comment: The measurement of retail sales (and also GDP) ignore the active second-hand markets in Switzerland. The Swiss SVME PMI was at 50.1 close to contraction, another piece of bad data. |

|

FX RatesThe US dollar is offered against the major currencies, but appreciating against many emerging market currencies, include the South African rand and Turkish lira. Oil prices are trying to stabilize with Brent near $42 and WTI near $40, but the recent losses continue to weigh on the Malaysian ringgit and the Mexican peso. The dollar’s weakness against the major currencies is partly a correction to recent gains scored over the past month that was helped by the re-pricing of the risk of a Fed hike this year after a string of stronger than expected data. However, the extent to which current demand was being met through inventories rather than new production came as a rude surprise to investors in the initial estimate of Q2 GDP last week. The negativity toward the US dollar is offsetting the rate cut in Australia and further evidence that the UK domestic economy is taking a hit in the immediate post-referendum period. The rate cut by the RBA was widely anticipated. The cash rate now stands at 1.5%. There was no forward guidance and the monetary policy statement at the end of the week is now looked upon for fresh insight. |

|

| On the face of it, the rate cut would appear to push the central bank back into a holding pattern, for what may be an extended period. That said, the June economic data was particularly poor. The trade deficit widened to A$3.195 bln from a revised A$2.418 bln in May (from A$2.218 bln initially). Separately, building approvals unexpectedly fell 2.9% in June after a revised 5.4% drop in May (initially -5.2%). The median forecast was for an increase of nearly 1%.

On the rate cut, the Aussie spiked lower by about half a cent to $0.7490 but quickly rebounded. It is now back above the $0.7560 area, where it generally held above in North American yesterday before breaking down in late dealing ahead of the decision. Offers near yesterday’s highs (~$0.7620) may stem today’s advance. The Australian dollar’s gains may be being helped by flows in the bond market. The 1.8% yield on the benchmark 10-year bond, a triple-A credit may be drawing foreign interest. A month ago it was yielding around 2%. The euro poked through the $1.12 level in early European turnover for the first time since June 24. However, it found some offers, and may have to retreat a bit to get a running start at it again. The next technical objective is in the $1.1230-$1.1265 area. |

|

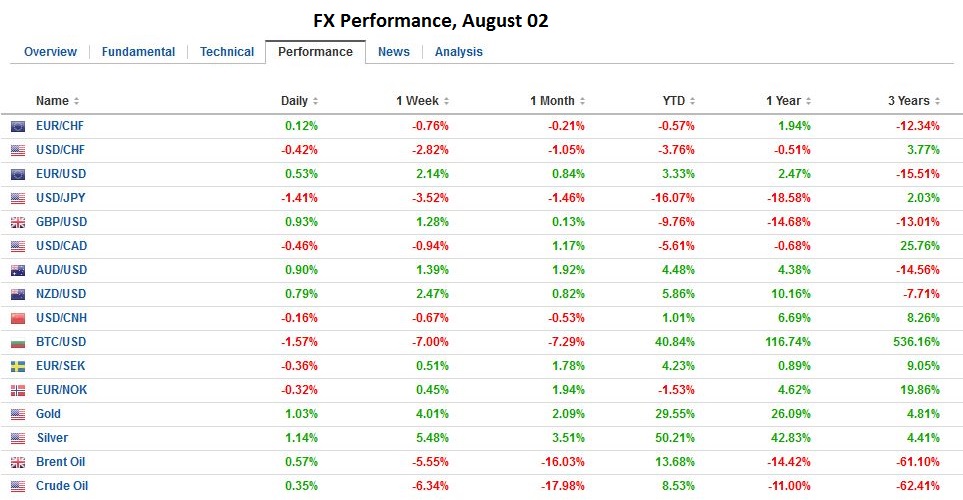

United KingdomSterling is trading inside yesterday’s range, which is inside last Friday’s range. It has been bid to session highs near $1.3250 in the European morning. The weaker US dollar environment is offsetting the poor UK news. Today it comes in the form of the construction PMI. The slippage is minor from 46.0 to 45.9. It is the second month below the 50 boom/bust level. It is consistent with the recent string of surveys pointing to a palatable shock to sentiment and forward-looking plans triggered by the Brexit decision. The derivatives market shows high confidence that Carney and Co. will deliver a rate cut later this week, and announce additional measures as well. Similar to the Australian dollar, we suspect sterling can probe yesterday’s highs, but we are not convinced that greater strength can materialize yet. |

Click to enlarge. Source Investing.com |

JapanOne of the most important developments today is the continuation of the JGB sell-off. The yield was near minus 30 bp last Wednesday. Today it traded at minus one bp. The yield rose six basis points today. The poor reception to today’s 10-year auction did it no favors, but the move was in place. The failure of the BOJ to either manage expectations better or announce more JGB purchases has unleashed dramatic volatility in the bond market. The sell-off in the JGB market appears to be having knock-on effects in Europe, where bond markets are also under pressures. Core yields are up 4-6 bp, with Gilts underperforming. Peripheral yields are up 1-3 bp. The US 10-year yield is a little more than a basis point firmer. |

Click to enlarge. Source Investing.com |

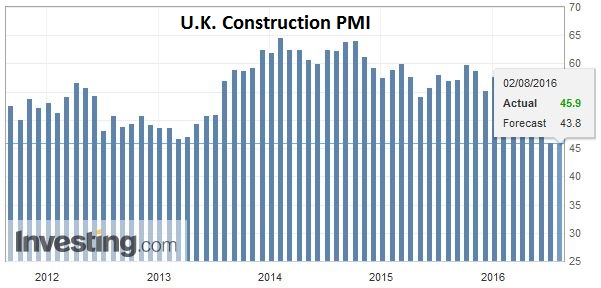

United StatesSavings are slumping (which means credit is surging) as the American consumer keeps on spending (+3.7% YoY near highest since May 2015) despite income growth at its slowest since Dec 2013 (+2.7% YoY). |

|

| The diverging trend of the last 6 months (higher spending, lower income) is unlikely to last but with the savings rate at 5.3% (down from 6.2%)at March 2014 lows, we suspect the run way is running out. |

Graphs and additional information on Swiss Franc by the snbchf team.