La baisse du taux de conversion à 6% ne serait-elle qu’un début? Avec Prévoyance 2020, vos rentes LPP pourraient bien subir un jour ou l’autre quelques réajustements supplémentaires. Il suffirait d’une nouvelle crise financière… Alors que des milliers de foyers helvétiques comptent sur les revenus de leurs capitaux LPP pour maintenir leur niveau de vie à la retraite, de telles espérances pourraient très bientôt...

Read More »Nestlé Skin Health to shed almost 200 jobs

Nestlé Skin Health plans to transfer manufacturing activities from the Egerkingen site to manufacturing facilities around the world(Keystone) - Click to enlarge Nestlé Skin Health will cease operations at its Egerkingen factory in canton Solothurn and move manufacturing activities abroad, threatening 190 positions. “Production volumes in Egerkingen are and have been very low, resulting in underutilisation of assets and...

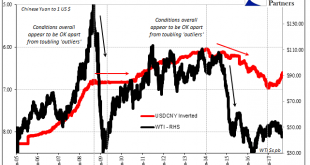

Read More »Cool Video: CNBC Clip Tactical and Strategic Dollar Outlook

- Click to enlarge I appeared on CNBC earlier today to talk about the dollar. I was given the time to briefly sketch out my view of the dollar. Near-term, I am concerned about the political and economic events in September, but I am looking for a better Q4 for the greenback. I have not given up the idea that the dollar’s pullback this year is a correction to the bull move that began in mid-2014. The euro...

Read More »Why Wages Have Lost Ground in the 21st Century

The problem with stagnant wages is our socio-economic system requires ever-higher incomes to function. One of the enduring mysteries for conventional economists is why wages aren’t rising for the bottom 95% even as unemployment is low and hiring remains robust. According to classical economics, the limited supply of available workers combined with strong demand for workers should push wages higher. Why have wages for...

Read More »Highest Swiss Property Prices Recorded in Zurich

Zurich remains the dearest location for Swiss property at CHF12,250 ($13,000) per square metre. However, houses in Lucerne have gained the most in value over the past decade, with one square metre costing CHF8,500, up 82% on 2007. In particular demand are homes in lake regions, according to a report published on Thursday by the federal institute of technology ETH Zurich and the online comparison service Comparis. The...

Read More »Spending cuts for asylum seekers proposed

After last year’s vote to speed up procedures in national centres, the government now plans to cut subsidies for rejected asylum seekers. (Keystone) The government wants to cut its financial contributions to asylum seekers as part of efforts to tighten the asylum procedure in Switzerland. The payments for individuals, currently around CHF6,000 ($6,312), could be reduced by a third, according to the Swiss News Agency....

Read More »Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

– Trump could be planning a radical “reboot” of the U.S. dollar– Currency reboot will see leading nations devalue their currencies against gold– New gold price would be nearly 8 times higher at $10,000/oz– Price based on mass exit of foreign governments and investors from the US Dollar– US total debt now over $80 Trillion – $20T national debt and $60T consumer debt– Monetary reboot or currency devaluation seen...

Read More »Cool Video: Bloomberg Discussion of Opioid Epidemic and US Labor

I had the distinct of honor of being on Bloomberg television today with David Gura and Francine Lacqua. Dino Kos, formerly of the NY Fed and now at CLS, joined this segment as well. The broad topic was the Jackson Hole Symposium, and the challenge is fostering more dynamic growth. While short-term market participants are hoping for some clues into the Fed and ECB thinking, We are not convinced that our information set...

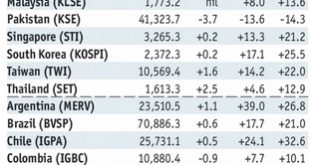

Read More »Emerging Markets: What has Changed

Summary India Prime Minister Modi has started a cabinet shuffle. Freeport McMorAn ceded control of the world’s second largest copper mine to the Indonesian government. Central Bank of Russia took over Bank Otkritie, once Russia’s largest private bank. Kenya’s top court nullified last month’s presidential election. Fitch cut Qatar’s rating by one notch to AA- with negative outlook. Chile’s economic team saw a big...

Read More »Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org