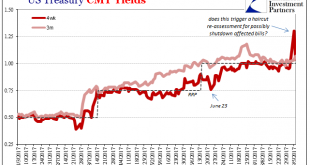

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. US Treasury, Jan - Sep 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Within two days of that move in bills, the GC market for UST 10s had gone...

Read More »FX Daily, September 29: Dollar’s Gains Pared, but Set to Snap Six Month Losing Streak Against the Euro

Swiss Franc The Euro has risen by 0.17% to 1.1449 CHF. EUR/CHF and USD/CHF, September 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Supported by a sharp rise in interest rates and ideas of tax reform, the US dollar is closing one of its best months of the year. The Dollar Index is snapping a six-month decline, and the euro’s monthly advance since February is ending....

Read More »Swiss want TV tax cut by half, according to survey

© Jacek Chabraszewski | Dreamstime - Click to enlarge Some who move to Switzerland might not be aware that they are almost certainly required to pay one of the world’s highest broadcasting fees. An annual Swiss licence costs CHF 451.10 per household. A successful vote in 2015 changed the rules on who must pay the fee. From 2019, it will be compulsory for anyone with a primary or secondary residence in Switzerland to...

Read More »Gold Standard Resulted In “Fewer Catastrophes” – FT

– “Going off gold did the opposite of what many people think” – FT Alphaville – “Surprising” findings show benefits of Gold Standard– Study by former Obama advisor in 1999 and speech by Bank of England economist in 2017 make case for gold– UK economy was ‘much less prone to extremes’ under than the gold standard – research shows– ‘Gold standard seems to have produced fewer catastrophes for Britain’ – data shows – FT...

Read More »The Real Estate View For A Second Lost Decade

The National Association of Realtor (NAR) reports today that sales of existing homes in the US were down 1.7% in August 2017 from July. At a seasonally-adjusted annual rate of 5.35 million, that’s the lowest pace for resales since July 2016. It is yet another data point reflecting the almost certain end of “reflation” in the economic sense. US Existing Home Sales, Jan 2011 - Jul 2017(see more posts on U.S. Existing...

Read More »KOF Economic Barometer: Outlook for the Swiss Economy Remains Favourable

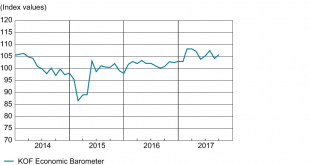

In September 2017, the KOF Economic Barometer increases by 1.6 points. It thus partially reverses its previous month’s decline. With a new reading of 105.8, the Barometer still points to a level clearly above its long-term average. This indicates that the outlook remains favourable – the Swiss economy should continue to grow at above average rates in the near future. In September 2017, the KOF Economic...

Read More »Precious Metals Supply and Demand Report

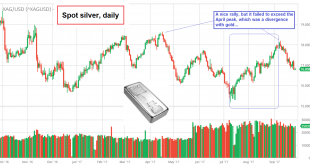

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Precious Metals Supply and Demand Report The price of gold dropped $24, and that of silver 60 cents this week. This is a far cry from Sep 8, when the price of silver hit $18.21. Since then, it’s been almost all downhill. What happened? Since the beginning of last month, the price of silver had been rising and at the basis...

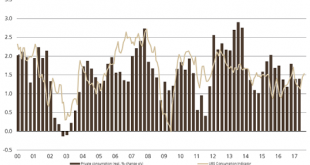

Read More »Switzerland UBS Consumption Indicator August: A pleasant end to summer

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS consumption indicator increased to 1.53 points in August thanks to robust new car registrations and encouraging numbers of hotel stays by Swiss residents, indicating consumption growth slightly above the...

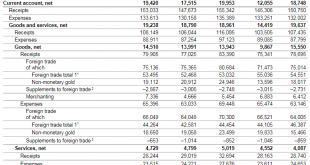

Read More »Swiss Balance of Payments and International Investment Position: Q2 2017

Q2/2017 Change vs. Q2/2016 Changein % Current Account +18.7 bn. +19.4 bn. -3.7% of which Goods Trade net +19.6 bn. +19.2 bn. +2.0% of which Services Trade net +4.1 bn. +4.7 bn. -14.6% of which Investment Income net +7.4 bn. +9.6 bn. -29.7% Financial Account +12.5 bn. +6.0 bn. +52% of which Direct Investments net -63.0 bn. +6.4 bn. -89.8% of which Portfolio Investments net +26.5 bn. -0.5 bn. +98.1% of...

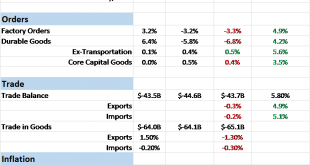

Read More »Bi-Weekly Economic Review: As Good As It Gets

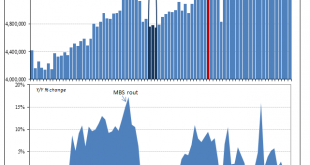

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org