Summary:

Summary India Prime Minister Modi has started a cabinet shuffle. Freeport McMorAn ceded control of the world’s second largest copper mine to the Indonesian government. Central Bank of Russia took over Bank Otkritie, once Russia’s largest private bank. Kenya’s top court nullified last month’s presidential election. Fitch cut Qatar’s rating by one notch to AA- with negative outlook. Chile’s economic team saw a big shake-up. Banco de Mexico boosted its growth forecasts in the latest quarterly inflation report. Stock Markets In the EM equity space as measured by MSCI, Egypt (+4.8%), Russia (+4.1%), and Thailand (+3.0%) have outperformed this week, while Czech Republic (-1.5%), Mexico (-1.5%), and Indonesia (-1.3%)

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Summary India Prime Minister Modi has started a cabinet shuffle. Freeport McMorAn ceded control of the world’s second largest copper mine to the Indonesian government. Central Bank of Russia took over Bank Otkritie, once Russia’s largest private bank. Kenya’s top court nullified last month’s presidential election. Fitch cut Qatar’s rating by one notch to AA- with negative outlook. Chile’s economic team saw a big shake-up. Banco de Mexico boosted its growth forecasts in the latest quarterly inflation report. Stock Markets In the EM equity space as measured by MSCI, Egypt (+4.8%), Russia (+4.1%), and Thailand (+3.0%) have outperformed this week, while Czech Republic (-1.5%), Mexico (-1.5%), and Indonesia (-1.3%)

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

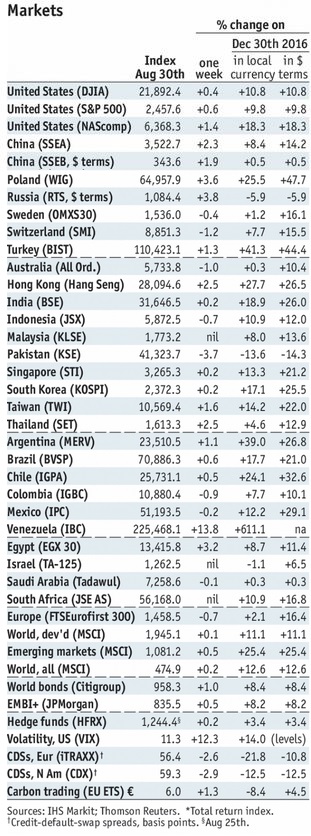

Stock MarketsIn the EM equity space as measured by MSCI, Egypt (+4.8%), Russia (+4.1%), and Thailand (+3.0%) have outperformed this week, while Czech Republic (-1.5%), Mexico (-1.5%), and Indonesia (-1.3%) have underperformed. To put this in better context, MSCI EM rose 0.6% this week while MSCI DM rose 1.1%.

In the EM local currency bond space, Brazil (10-year yield -16 bp), Russia (-11 bp), and Indonesia (-9 bp) have outperformed this week, while Argentina (10-year yield +29 bp), Hungary (+8 bp), and Korea (+4 bp) have underperformed. To put this in better context, the 10-year UST yield fell 3 bp to 2.13%.

In the EM FX space, RUB (+1.8% vs. USD), CLP (+1.7% vs. USD), and CNY (+1.4% vs. USD) have outperformed this week, while MXN (-1.1% vs. USD), cop (-0.7% vs. USD), and ARS (-0.3% vs. USD) have underperformed.

|

Stock Markets Emerging Markets, August 30th Source: economist.com - Click to enlarge |

IndiaIndia Prime Minister Modi has started a cabinet shuffle. Several minor ministers have already resigned, including Skill Development and Agriculture. Popular discontent appears to be rising as the economy struggles ahead of state elections this year, with Q2 growth coming in at a disappointing 5.7% y/y. This was the lowest since Q1 2014, and calls into question the FY2017/18 target of %.

IndonesiaFreeport McMorAn ceded control of the world’s second largest copper mine to the Indonesian government. Freeport agreed to reduce its stake in the Grasberg copper and gold mine to 49% (from over 90% currently) in exchange for operating rights lasting until 2041. It’s unclear how long the company will retain operational control. Nor is it clear how much it will be paid by the government for giving up its majority stake.

RussiaCentral Bank of Russia took over Bank Otkritie, once Russia’s largest private bank. In addition, the central bank said it will provide support for other lenders in an effort to preserve market confidence. Bank Otkritie was the first to be taken over by a government-backed fund set up by the central bank to help consolidate the banking sector.

KenyaKenya’s top court nullified last month’s presidential election. The opposition had claimed widespread fraud was behind Kenyatta’s victory. Chief Justice Maraga called a new election to be held within 60 days. While this could lead to a protracted period of political uncertainty, the court ruling is being hailed for strengthening Kenya’s institutional framework.

QatarFitch cut Qatar’s rating by one notch to AA- with negative outlook. The agency noted that “International mediation efforts are still ongoing but are not showing significant progress. In our view, the negotiating positions of Qatar and the boycotting countries remain far apart.”

ChileChile’s economic team saw a big shake-up. Finance Minister Valdes, his deputy Micco, and Economy Minister Cespedes all resigned with less than three months to go before elections. The cabinet was split over a decision to block a $2.5 bln iron ore project in northern Chile for environmental reasons. Valdes will reportedly be replaced by Nicolas Eyzaguirre, a former Finance Minister.

MexicoBanco de Mexico boosted its growth forecasts in the latest quarterly inflation report. 2017 growth is now forecast between 2.0-2.5% vs. 1.5-2.0% previously, while 2018 growth is now forecast between 2.0-3.0% vs. 1.7-2.7% previously. The bank said the revisions were due to stronger than expected exports and consumption.

|

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin