It wasn’t that long ago that Apple was the most beloved stock by the hedge fund community, and although in recent months the company’s popularity faded somewhat among the 2 and 20 crowd it is still one of the most popular names among the professional investing community. Which on a day that saw AAPL stock tumble as much as 10% is clearly bad news. As Bloomberg notes, eight hedge funds that own large stakes in Apple have seen the value of their holdings plunge about .13 billion since the company cut its revenue outlook, with AQR Capital Management suffering some of the biggest losses as it saw its holdings decline by about 2 million on Thursday. The firm held 8.8 million shares as of Sept. 30, according to data

Topics:

Tyler Durden considers the following as important: 5) Global Macro, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| It wasn’t that long ago that Apple was the most beloved stock by the hedge fund community, and although in recent months the company’s popularity faded somewhat among the 2 and 20 crowd it is still one of the most popular names among the professional investing community. Which on a day that saw AAPL stock tumble as much as 10% is clearly bad news.

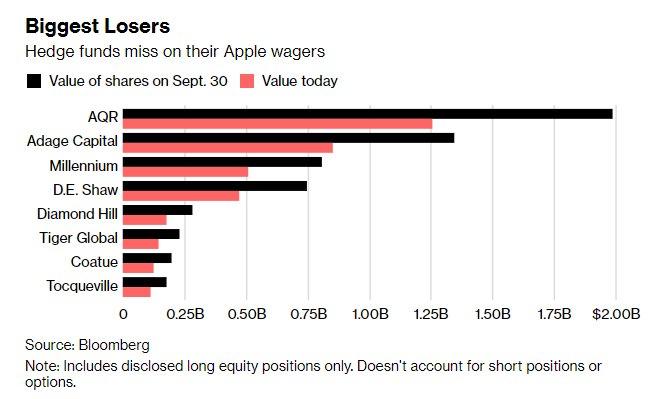

As Bloomberg notes, eight hedge funds that own large stakes in Apple have seen the value of their holdings plunge about $2.13 billion since the company cut its revenue outlook, with AQR Capital Management suffering some of the biggest losses as it saw its holdings decline by about $732 million on Thursday. The firm held 8.8 million shares as of Sept. 30, according to data compiled by Bloomberg. Adage Capital, which has Apple as the firm’s biggest holding as of Sept 30, was hit by a $500 million loss assuming it has not changed its holdings since Sept 30 when it held about 6 million shares valued at $1.35 billion. |

Biggest Losers |

| Separately, Bloomberg also observes that AAPL’s price plunge will also have a significant impact on exchange-traded funds. The company is held by 266 U.S. ETFs, representing total allocations of $46 billion, or more than 1% of all U.S. ETF assets, and is among the top two holdings of four of the five largest ETFs.

As Eric Balchunas writes, the S&P 500 ETF Trust (SPY), for example, owns the most Apple of any ETF with $8.1 billion, but that represents only a 3.3% weighting. The Invesco QQQ Trust Series 1 (QQQ) holds $5.8 billion worth, but has Apple at a 10% weighting. As a result, QQQ feels Apple’s moves more acutely, despite owning less in absolute terms Swiss National BankAnd then there is the Swiss National Bank, which as of Sept 30 held 15.8 million shares of AAPL stock. Assuming no changes to its holdings, the central bank has suffered nearly $1.4 billion in losses on its AAPL stake alone in just the last three months. |

|

Tags: Featured,newsletter