Journal of Finance. HTML (local copy). Abstract: We analyze the role of retail central bank digital currency (CBDC) and reserves when banks exert deposit market power and liquidity transformation entails externalities. Optimal monetary architecture minimizes the social costs of liquidity provision and optimal monetary policy follows modified Friedman rules. Interest rates on reserves and CBDC should differ. Calibrations robustly suggest that CBDC provides liquidity more efficiently than...

Read More »“Money and Banking with Reserves and CBDC,” CEPR, 2023

CEPR Discussion Paper 18444, September 2023. HTML (local copy). Abstract: We analyze the role of retail central bank digital currency (CBDC) and reserves when banks exert deposit market power and liquidity transformation entails externalities. Optimal monetary architecture minimizes the social costs of liquidity provision and optimal monetary policy follows modified Friedman (1969) rules. Interest rates on reserves and CBDC should differ. Calibrations robustly suggest that CBDC provides...

Read More »Plans for a Deposit Token in Switzerland

Swiss Banking proposes a “Deposit Token,” New Money for Switzerland. This white paper focuses on the question of how banks can best support the Swiss economy when it comes to settling transactions in digital assets and executing payments in a digitalised economy. As the digital transformation sweeps through the economy and society at large, it requires support from efficient, generally accepted and secure means of payment. Against this background and considering developments such as the...

Read More »David Graeber’s “Debt”

Goodreads rating 4.19. Graeber’s book contains many interesting historical observations but lacks a concise argument to convince a brainwashed neoclassical economist looking for coherent arguments on money and debt. After 60 pages, 340 more seemed too much. Chapter one: … the central question of this book: What, precisely, does it man to say that our sense of morality and justice is reduced to the language of a business deal? What does it mean when we reduce moral obligations to debts? …...

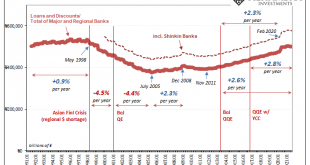

Read More »You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s. If none handy, then just read what officials and central bankers write about their own programs (or those of their close and affectionate counterparts). After nearly a decade of Abenomics in Japan, the latest Japanese Prime Minister Fumio Kishida...

Read More »The Great Eurodollar Famine: The Pendulum of Money Creation Combined With Intermediation

It was one of those signals which mattered more than the seemingly trivial details surrounding the affair. The name MF Global doesn’t mean very much these days, but for a time in late 2011 it came to represent outright fear. Some were even declaring it the next “Lehman.” While the “bank” did eventually fail, and the implications of it came to be systemic, those overly melodramatic descriptions actually served to downplay the event in public imagination. The world...

Read More »Money vs. Savings: Gluts, Current Accounts, Triffin, Capital Flow Correlations

On bankunderground, Michael Kumhof, Phurichai Rungcharoenkitkul, and Andrej Sokol question that foreign savings is an important driver of US current account deficits: Consider how US imports can be paid for in the real world: first, by transferring existing domestic or foreign bank balances to foreigners, which involves no new financing. Second, by borrowing from domestic banks and transferring the resulting bank balances to foreign households, which involves domestic but not foreign...

Read More »Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘. The Sovereign Money referendum...

Read More »“Vollgeld – Was spricht dagegen? (Sovereign Money—What are the Problems?),” RABE, 2018

Radio Bern RaBe, May 15, 2018. HTML with link to podcast (interview starts at 08:15). Interview with Radio Bern RaBe about Vollgeld and the Vollgeld initiative.

Read More »“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

[embedded content] Wer soll Franken herstellen dürfen? Nur die Schweizerische Nationalbank, oder auch die Geschäftsbanken wie UBS, CS oder die Kantonalbanken? Ginge es nach der Vollgeld-Initiative, über die wir am 10. Juni abstimmen, wäre künftig klar: Geld als gesetzliches Zahlungsmittel gäbe es nur von der SNB. Offsetmaschine zum Druck von Schweizer Banknoten bei der Schweizerischen Nationalbank. Keystone - Click to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org