James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

Authored by Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels and...

Read More »Distinct Lack of Good Faith, Part ??

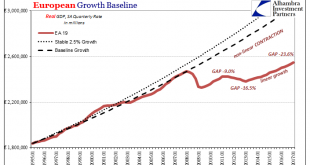

It was a busy weekend in retrospect, starting with Janet Yellen and other central bankers uncomfortably facing a global media that has become (for once) increasingly unconvinced. Reporters, really, don’t have much choice. The Federal Reserve Chairman might not be aware of just how much she has used the “transitory” qualifier since 2015, but others can’t be helped from noticing. At the Group of Thirty’s International...

Read More »Eurozone: Distinct Lack of Good Faith

The erosion of social order in any historical or geographic context is gradual; until it isn’t. Germany has always followed a keen sense of this process, having experienced it to every possible extreme between the World Wars. Hyperinflationary collapse doesn’t happen overnight; it took three years for the Weimar mark to disintegrate, and then Weimar Germany. Even Nazism wasn’t all it once. What was required was...

Read More »Industrial Production: Irreführende Statistiken

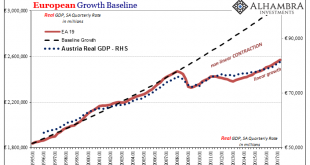

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year. The move was considered by many if not most in the mainstream a prime example of Mario Draghi’s...

Read More »Global Asset Allocation Update: Not Yet

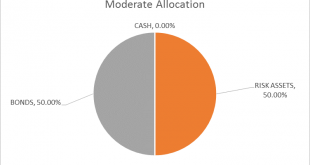

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months. The most significant change from last month is the continued...

Read More »FX Weekly Review, April 24 – 29: Dollar Remains the Fulcrum

Swiss Franc Currency Index Trade-weighted index Swiss Franc, April 29(see more posts on Swiss Franc Index, ) Source: markets.fx.xom - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 33% of the...

Read More »FX Weekly Review, April 17 – 22: Dollar Technicals Trying to Turn, but…

Swiss Franc Currency Index While the dollar index had another bad week with a 0.75% less, the Swiss Franc currency index could accumulate the corresponding gains. Main reason is that the EUR/CHF rose over 1.07. The euro is still the main component of the Swiss Franc index, but the dollar is recovering thanks to rising pharmacy exports to the U.S. Trade-weighted index Swiss Franc, April 22(see more posts on Swiss...

Read More »FX Weekly Review, April 10-14: Swiss Franc loses against the Yen, but wins against Dollar

Swiss Franc Currency Index Last week the Swiss Franc improved against both euro and dollar, but – compared to its safe-haven counterpart Japanese Yen – it had a bad performance. We expect strong SNB interventions, that reflect the demand for CHF safe-haven. Trade-weighted index Swiss Franc, April 14(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org