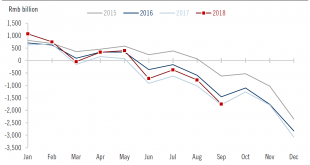

The government is ramping up spending and tax cuts to households to relieve pressure on the economy. Corporates may also benefit from fiscal measures.As the economy continues to decelerate, the Chinese government is ramping up fiscal policy, in order to offset downward pressure. Since June, the government’s fiscal spending has picked up significantly, although it remains fairly modest compared with previous years.In the first five months of the year, China’s fiscal policy was on the tight...

Read More »Weekly View – Tech-tonic shifts

The CIO office’s view of the week ahead.Last week’s continued equities sell-off was driven by disappointment with the earnings reporting season. Having propped up market returns for much of this year, tech’s poor performance was particularly noteworthy. Last week, below-expectation metrics from Amazon and Alphabet (Google’s parent company) flattened the S&P 500’s returns for 2018, while European equities have been much more disappointing. Excepting financials, top-line data are driving...

Read More »Credit Conditions in the Euro Area Remain Supportive of Investment Recovery

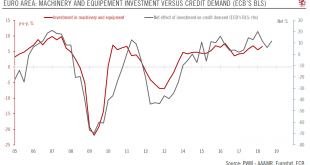

We are sticking to our forecast of 2.0% euro area GDP growth for 2018, but with risks tilted to the downside. Investment is an important driver of the business cycle and a key determinant of potential growth. In the euro area, total investment makes up about 20% of GDP. Construction, machinery and equipment (including weapons systems), intellectual property rights and agricultural products account, respectively, for...

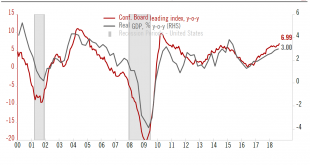

Read More »US economy continues to chug along, with no slowdown in sight

Investment and consumption remain the twin engines of US growth.The first estimate for Q3 GDP (3.5% quarter-on-quarter annualised) confirmed that the US business cycle remains solid. Whereas consumption was stronger than in previous quarters, investment was softer than in Q3—but the underlying story is that solid investment continues to support US growth.This data confirms our annual GDP forecast of 3.0%. This remains above the post-financial crisis average growth rate of 2.3%, and above the...

Read More »Credit conditions in the euro area remain supportive of investment recovery

We are sticking to our forecast of 2.0% euro area GDP growth for 2018, but with risks tilted to the downside.Investment is an important driver of the business cycle and a key determinant of potential growth. In the euro area, total investment makes up about 20% of GDP. Construction, machinery and equipment (including weapons systems), intellectual property rights and agricultural products account, respectively, for 48%, 32%, 18% and 2% of total investment. Machinery and equipment spending...

Read More »Rewarding excellence

IMD and Pictet join forces to celebrate and reward leading family enterprises.IMD Lausanne is a world-leading business school based in the Lausanne region. Its Global Family Business Centre, which has operated for more than 30 years, was the first institute to focus on family businesses, their values, the principles they champion and their particular characteristics.In October 2018, Pictet joined forces with IMD to the IMD Global Family Business Award, a prestigious annual prize presented to...

Read More »Gloomy Signals for Euro Area Manufacturing

Weakness in the sector signals continuing downward trend. The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines. Part of the drop may reflect issues in...

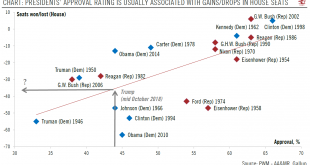

Read More »Republicans face uphill battle in retaining their House majority

But this may say little about Trump’s 2020 prospects.Most opinion polls suggest that the Democrats will win a majority in the House in the 6 November midterms, while the Republicans will retain their majority in the Senate.The historical relationship between the president’s approval rating and seats lost by his party in the midterms further corroborates the likelihood of a loss of House seats for the Republicans. The incumbent president’s party tends to face an erosion of seats, with a few...

Read More »Gloomy signals for euro area manufacturing

Weakness in the sector signals continuing downward trend.The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines. Part of the drop may reflect issues in the car industry, but trade tensions, uncertainty over Brexit and...

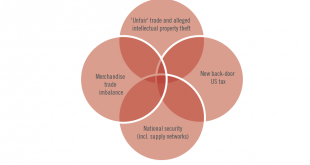

Read More »US-China Relations: A ‘politics bull trend’ creates a fertile ground for trade tensions

As the US vies to maintain world leadership beyond commerce, its policies will continue to create waves for markets.Today we are witnessing a redefinition of international relations and a new, although likely unstable, global equilibrium. The trade dispute unfolding today between the US and China should be seen in light of shifting structural trends that have developed over the last few decades. We expect rationality will eventually prevail, but the outlook is muddled by the Trump...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org