Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February, but stimulus to the real economy may not be as strong.Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February. Monthly total social financing (TSF) came in at Rmb2.86 trillion, much stronger than the market consensus forecast of Rmb1.85 trillion. New bank loans also surprised on the upside at Rmb1.69 trillion, compared with the consensus forecast of Rmb1.25 trillion. In year-over-year (y-o-y) terms, the outstanding balance of TSF expanded by 10.6%, up from 10.0% in February.The latest data indicate that the slump in the shadow banking sector may have reached a trough, with growth in the main shadow banking sectors starting

Topics:

Dong Chen considers the following as important: China economy, Chinese lending, Chinese monetary policy, Macroview, PBoC policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February, but stimulus to the real economy may not be as strong.

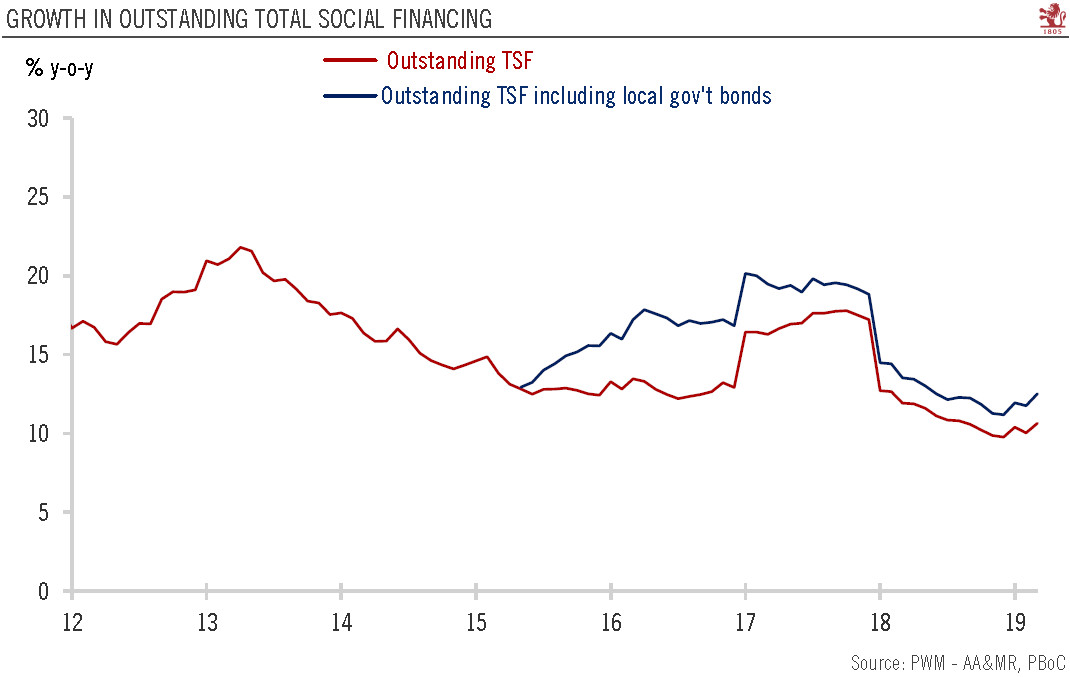

Chinese credit data surprised on the upside in March, following a surge in January and a sharp fall in February. Monthly total social financing (TSF) came in at Rmb2.86 trillion, much stronger than the market consensus forecast of Rmb1.85 trillion. New bank loans also surprised on the upside at Rmb1.69 trillion, compared with the consensus forecast of Rmb1.25 trillion. In year-over-year (y-o-y) terms, the outstanding balance of TSF expanded by 10.6%, up from 10.0% in February.

The latest data indicate that the slump in the shadow banking sector may have reached a trough, with growth in the main shadow banking sectors starting to turn less negative. Corporate credit was the main driver behind the strong credit growth in Q1, but a lot of it was short-term in nature, implying the demand from the real economy may not be as strong as the headline credit numbers suggest.

Looking ahead, we expect the PBoC to keep its accommodative policy stance for the rest of the year. A dovish Fed and the stabilisation in the Rmb have given the PBoC more leeway to stay on the easing side. In particular, we expect the PBoC to cut the required reserve ratio again in Q2 by at least 50 basis points to inject liquidity into the banking system. Part of these funds will likely be used to replace the maturing medium-term lending facility loans that the PBoC extended to commercial banks in previous quarters. At the same time, interest rates should be kept at low levels throughout the year.