Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings. The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest rate differentials less unfavourable to the franc. The upward pressure on the franc has forced the SNB to intervene repeatedly in the FX market to rein in franc strength in recent years. While, in theory, there is no limit to the scope of these interventions, an increase in investment flows out of

Topics:

Luc Luyet considers the following as important: 2) Swiss and European Macro, CHF, Featured, Macroview, newsletter, Pictet Macro Analysis, Swiss currency trends, Swiss Franc

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

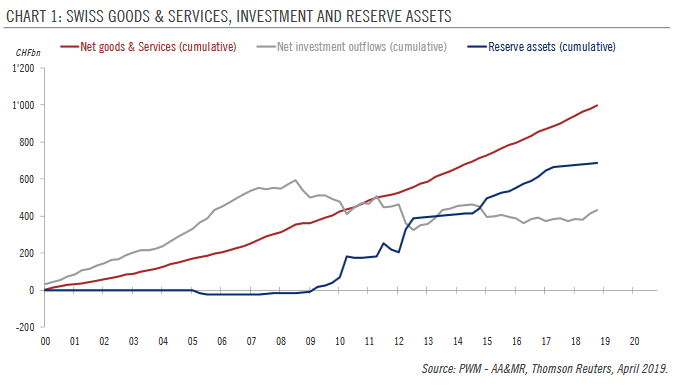

Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings. The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest rate differentials less unfavourable to the franc. The upward pressure on the franc has forced the SNB to intervene repeatedly in the FX market to rein in franc strength in recent years. While, in theory, there is no limit to the scope of these interventions, an increase in investment flows out of Switzerland would definitively help reduce the upward pressure on the Swiss currency. As things stand, our expectation that global economic growth will firm in the second half of the year coupled with abating political risks surrounding the euro area (e.g. Brexit) should sap franc strength, especially against the euro, in the coming months. In the longer term, however, reduced upward pressure on global yields, the moderation in global growth and residual risks surrounding the euro area mean the franc may not soften all that much. Our projections for the EUR/CHF rate are CHF1.14 on a three-month horizon, CHF1.15 on a six-month horizon and CHF1.14 on a 12-month horizon. |

Swiss Goods & Services, Investment and Reserve Assets |

Tags: $CHF,Featured,Macroview,newsletter,Swiss currency trends,Swiss Franc