Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen – as he told CNBC two days ago – is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt....

Read More »On the State of Macroeconomics

In a paper, Ricardo Reis defends macroeconomics against various critiques. He concludes: I have argued that while there is much that is wrong with macroeconomics today, most critiques of the state of macroeconomics are off target. Current macroeconomic research is not mindless DSGE modeling filled with ridiculous assumptions and oblivious of data. Rather, young macroeconomists are doing vibrant, varied, and exciting work, getting jobs, and being published. Macroeconomics informs...

Read More »Are Rate Hikes Bad For Gold?

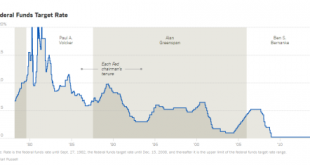

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Federal Funds Target RateThe above image from the New York Times article A History of Fed Leaders and Interest Rates. - Click to enlarge Here’s an alternative view courtesy of @HedgeEye. - Click to enlarge Let’s take the fist chart and see what correlations exist between...

Read More »WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but… growth, and inflation, and supply cuts, and growth again… Well that de-escalated quickly… As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th. WTI CrudeWTI Crude - Click to enlarge “The OPEC cuts are going to prevent some of the mega-glut,” said Olivier Jakob, managing director at Petromatrix GmbH in Zug,...

Read More »Former Treasury Secretary Summers Calls For End Of Fed Independence

Larry Summers - Click to enlarge At an event in Davos, Switzerland earlier today, Former U.S. Treasury Secretary, Larry Summers, argued that Central Bank independence from national governments should be scrapped in favor of a coordinated effort between politicians, central bankers and treasury to engineer inflation. Seems reasonable, right?…what could possibly go wrong? According to Market Watch, Summers argued that...

Read More »The Trouble with Macroeconomics

The “Trouble with Macroeconomics,” according to a working paper by Paul Romer that is posted on his website, relates to dishonest identification assumptions, in particular in DSGE models used for policy analysis. Romer singles out calibration, assumptions about distribution functions and strong priors as culprits. Romer argues that [b]eing a Bayesian means that your software never barfs and I agree with the harsh judgment by Lucas and Sargent (1979) that the large Keynesian macro models...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org