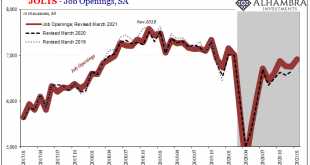

There were a few surprises included in the BLS JOLTS data just released today for the month of November (note: the government has changed its release schedule so that JOLTS, already one month further in arrears than the payroll report, CES & CPS, will now come out earlier so that its numbers are publicly available for the same monthly payrolls before the next CES & CPS get released). Not really about the JOLTS figures themselves, though there are...

Read More »A Global JOLT(s) In July

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million. It wasn’t a record high, though, as that was set back in July. Yes, the number remains upward in the stratosphere, but it has been in the same general area of it...

Read More »Weekly Market Pulse: Growth Scare?

A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved. I wrote nearly 2000 words last week about that change in inflation expectations and I’m so glad you took the time to read it. And now you can forget it because over the next four days all but 2 basis points of the move in the...

Read More »JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

According to newly revised BLS benchmarks, the labor market might have been a little bit worse than previously thought during the worst of last year’s contraction. Coming out of it, the initial rebound, at least, seems to have been substantially better – either due to government checks or, more likely, American businesses in the initial reopening phase eager to get back up and running on a paying basis again. The JOLTS labor series annual revisions took about...

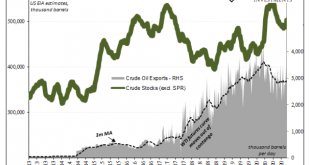

Read More »Inflation Hysteria #2 (WTI)

Sticking with our recent theme, a big part of what Inflation Hysteria #1 (2017-18) also had going for it was loosened restrictions for US oil producers. Seriously. Legacy of the 1970’s experience depending too much on OPEC, subject to embargoes, American oil companies had been prohibited for decades from exporting oil. Not that it would have mattered before 2014, the country never producing near enough to have ever done so. Export limitations removed, shale boom...

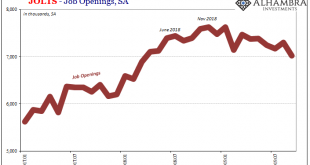

Read More »From Friends to Nemeses: JO and Jay

It was one of the first major speeches of his tenure. Speaking to the Economic Club of Chicago in April 2018, newly crowned Federal Reserve Chairman Jerome Powell was full of optimism. At that time, however, optimism was being framed as some sort of bad thing. This was the height of inflation hysteria, where any sort of official upgrade to the economic condition was taken as further “hawkishness.” Things were so good, they said, the situation was in danger of...

Read More »From JOLTS Series Shift To Series of Rate Cuts

I’ve said all along that they would be dragged into them kicking and screaming. After all, the Federal Reserve undertook its last rate hike in December 2018 – just as the markets were making clear he was completely mistaken in his view of the economy. What followed was the ridiculous “Fed pause” which pretty much everyone outside of the central bank and the Economics profession knew wasn’t the end of it. You know the story. When he finally gave in at the end of July,...

Read More »The JOLTS of Drugs

Princeton University economist Alan Krueger recently published and presented his paper for Brookings on the opioid crisis and its genesis. Having been declared a national emergency, there are as many economic as well as health issues related to the tragedy. Economists especially those at the Federal Reserve are keen to see this drug abuse as socio-demographic in nature so as to be absolved from failing in their primary...

Read More »Forced Finally To A Binary Labor Interpretation

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014. At that time, the BLS in its various data series suggested an almost perfect labor market acceleration...

Read More »Defining Labor Economics

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org