So far, there has been little clarity as to which specific trade policies the new president will introduce, but given how high trade ranks on his agenda, this will likely change quickly. But what actual powers does a US president have in the area of trade, and what measures might Mr. Trump implement?...

Read More »Economic Normalization vs. Political Polarization

The global economy appears to be enjoying a solid start to 2017. Business surveys such as the Purchasing Managers' Indices (PMI) indicate that momentum accelerated toward the end of 2016 in nearly all major economies. Still low interest rates, stable commodity prices, as well as a generally...

Read More »Policy Makers – Like Generals – Are Busy Fighting The Last War

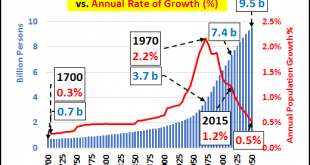

Submitted by Chris Hamilton via Econimica blog, The Maginot Line formed France’s main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success…as the Germans never seriously attempted to attack it’s...

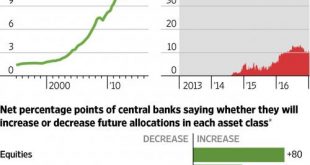

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Trade Friction a Key Risk as Trump Takes Power

The incoming US president Donald Trump has often struck a belligerent tone with regard to trade relations. Much of his anti-trade narrative – made public in tweets and remarks made on the campaign trail – has focused on China, raising concerns over trade frictions, if not an outright trade war. Yet what powers does the US president have in the area of...

Read More »Davos Elite Eat $40 Hot Dogs While “Struggling For Answers”, Cowering in “Silent Fear”

For those unfamiliar with what goes on at the annual January boondoggle at the World Economic Forum in Davos, here is the simple breakdown. Officially, heads of state, captains of industry, prominent academics, philanthropists and a retinue of journalists, celebrities and hangers-on will descend Tuesday on the picturesque alpine village of Davos, Switzerland, for the World Economic Forum. Unofficially, it’s the world’s...

Read More »Davos: In Defense Of Populism

Submitted by Mike Krieger via Liberty Blitzkrieg blog, DAVOS MAN: “A soulless man, technocratic, nationless and cultureless, severed from reality. The modern economics that undergirded Davos capitalism is equally soulless, a managerial capitalism that reduces economics to mathematics and separates it from human action and human creativity.” – From the post: “For the Sake of Capitalism,...

Read More »“Globalization has acquired a bitter aftertaste”

The world stands at a turning point, says historian Harold James. We live in dangerous times, and the outcome is uncertain. A gloomy discussion, with a spark of hope at the end. Professor James, are we living in a more stable or more unstable world than twenty or thirty years ago? Howard James:...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More »As Central Bankers Spin

Posted with permission and written by Tim Taschler, Sprott Global I know that I resemble the old guy in this cartoon, standing by helplessly as I watch central bankers experiment with the global economy. Bubbles are blown, again, in several asset classes. Negative interest rates have become an acceptable concept, as if they are just words and have no real economic meaning. Stock markets trade based on the next set...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org