Now that the possibility of a war between the US and North Korea seems just one harshly worded tweet away, and the window of opportunity for a diplomatic solution, as well as for the US stopping Kim Jong-Un from obtaining a nuclear-armed ICBM closing fast, analysts have started to analyze President Trump’s military options, what a war between the US and North Korea would look like, and what the global economic...

Read More »Burkhard Varnholt: “Internet has killed inflation”

Why is inflation so low and what is driving the stock market? Find out here. The world economy is growing and stock markets are rising ever higher. However, inflation and capital market yields remain low. Burkhard Varnholt, Global deputy chief investment officer at Credit Suisse, explains the...

Read More »Silver Economy – Investing for Population Aging

Senior population is expected to grow to more than 2 billion people by 2050. Aging society means gains for companies focused on seniors: healthcare and insurance sectors are expected to benefit in particular. The population aging is a global fact. It will strongly influence markets and economies...

Read More »Global Inflation: Low for Longer

Inflation rates in the advanced and developing economies are showing little upside pressure. Global inflation trends remain quite benign. In most of the major advanced economies, headline inflation peaked in the first quarter once the positive base effects from energy price developments had faded....

Read More »UK Election: More Political Volatility

Pound weakness underlines the Conservative Party failing to secure the expected Brexit mandate. Exit polls from the UK general election point to the Conservatives winning just 316 seats, down from their pre-election 330 seats. The Labour Party could win 265 seats, up from 231 before the election....

Read More »Credit Suisse Economic Outlook: Fed Likely to Raise Rates in June

The global economy remains robust. Nevertheless, the Fed is still the only major central bank that is tightening its monetary policy. The world economy looks to be in very robust shape in the current quarter too; after a significant recovery in the last six months, however, global business...

Read More »Trying To Reconcile Accounts; China

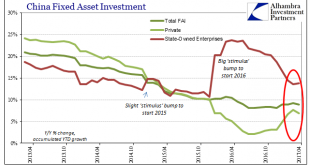

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern. Industrial Production had seemingly accelerated in March, rising to a 7.6%...

Read More »Election: Expect Positive Market Reaction

France chooses the centrist path forward. With Emmanuel Macron, the French have elected an outspoken defender of European integration. The result is positive for both Europe and markets. French voters have elected Emmanuel Macron as their next president. With more than 65 percent of the vote, Mr....

Read More »Cautious First Steps in Further Development of Financial Markets

Asian countries have high savings rates, but investments are predominantly short-term. However, they have embarked on the path to longer investment horizons and deeper capital market integration. Asia's investment needs are enormous and will likely continue to grow over the coming years....

Read More »US Fed Hikes Rates, Sounds Less Hawkish Than Feared

The US Federal Reserve raised the policy rate by 25 basis points in mid-March, but left its outlook largely unchanged. We continue to expect two more rate hikes in 2017. After hawkish comments from Federal Reserve (Fed) officials in recent weeks, the 25 basis point hike in the target range for the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org