I had the privilege of joining the set of anchors Julie Cchatterley, ScarletFu, and Joe Weisenthal on the set of “What’d You Miss” today. The unrehearsed discussion took an unexpected turn when Joe asked about the low volatility. The anchors were patient and gave me time to provide a sketch of the thesis of my book, Political Economy of Tomorrow, where I suggest a under appreciated factor in the low price of capital is...

Read More »FX Daily, October 27: Greenback Finishing Week on Firm Note

Swiss Franc The Euro has fallen by 0.16% to 1.1602 CHF. EUR/CHF and USD/CHF, October 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates This has been a good week for the US dollar. The Dollar Index’s 1.25% gain this week is the largest of the year. The driver is two-fold: positive developments in the US and negative developments abroad. The positive developments in the US...

Read More »FX Daily, October 26: Draghi’s Day

Swiss Franc The Euro has fallen by 0.27% to 1.1656 CHF. EUR/CHF and USD/CHF, October 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It is all about the ECB meeting today. The market was hoping for more details last month, but Draghi pointed to today. The broad issue is well known. While growth has been strong, price pressures are still not, according to the ECB, on a...

Read More »FX Daily, October 25: Sterling and Aussie Interrupt the Waiting Game

Swiss Franc The Euro has risen by 0.32% to 1.1689 CHF. EUR/CHF and USD/CHF, October 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Most participants seemed comfortable marking time ahead of tomorrow’s ECB meeting, and an announcement President Trump’s nominations to the Federal Reserve. However, softer than expected Australian Q3 CPI and a stronger than expected UK Q3...

Read More »FX Daily, October 24: Dollar Treads Water as 10-year Yield Knocks on 2.40percent

Swiss Franc The Euro has risen by 0.51% to 1.1627 CHF. EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed in mostly uneventful turnover in the foreign exchange market. There is a palpable sense of anticipation. Anticipation for the ECB meeting on Thursday, which is expected to see a six or nine-month extension of...

Read More »Canada: Monetary and Fiscal Updates This Week

Summary: Divergence between US and Canada’s two-year rates is key for USD-CAD exchange rate. Canada’s 2 hikes in Q3 were not part of a sustained tightening sequence. Policy mix considerations also favor the greenback if US policy becomes more stimulative. Many observers saw Canada as one of the canaries in the coal mine, warning that the divergence theme was over. The Bank of Canada did hike rates twice in...

Read More »Weekly Technical Analysis: 23/10/2017 – USDJPY, EURUSD, GBPUSD, USDCAD

USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: Investing.com - Click to enlarge USD/JPY [embedded content] USD/JPY with Technical Indicators, October 23(see more posts on USD/JPY, ) - Click to enlarge EUR/USD [embedded content] EUR/USD with Technical Indicators, October 23(see more posts on EUR/USD, ) - Click to enlarge GBP/USD [embedded content] GBP/USD...

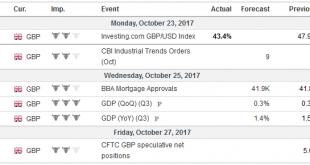

Read More »FX Daily, October 23: US Dollar Starts New Week on Firm Note

Swiss Franc The Euro has fallen by 0.04% to 1.1578 CHF. EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying modest gains against most currencies as prospects of both tax reform and additional monetary tightening by the Fed carry over from last week. The strong showing of the Liberal Democrats in Japan, where the...

Read More »FX Weekly Preview: Three on a Match: US Tax Reform, ECB and Bank of Canada Meetings

Summary: Busy week of economic data and central bank meetings, and reaction to Spanish developments and Japan and Czech elections. Focus below is on the Bank of Canada and ECB meetings and tax reform in the US. The biggest challenge to tax reform is unlikely on the committee level but on the floor votes, especially in the Senate, in a similar way the stymied health care reform. US and German 2-year rates are...

Read More »FX Weekly Preview: Three on a Match: US Tax Reform, ECB and Bank of Canada Meetings

Summary: Busy week of economic data and central bank meetings, and reaction to Spanish developments and Japan and Czech elections. Focus below is on the Bank of Canada and ECB meetings and tax reform in the US. The biggest challenge to tax reform is unlikely on the committee level but on the floor votes, especially in the Senate, in a similar way the stymied health care reform. US and German 2-year rates are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org