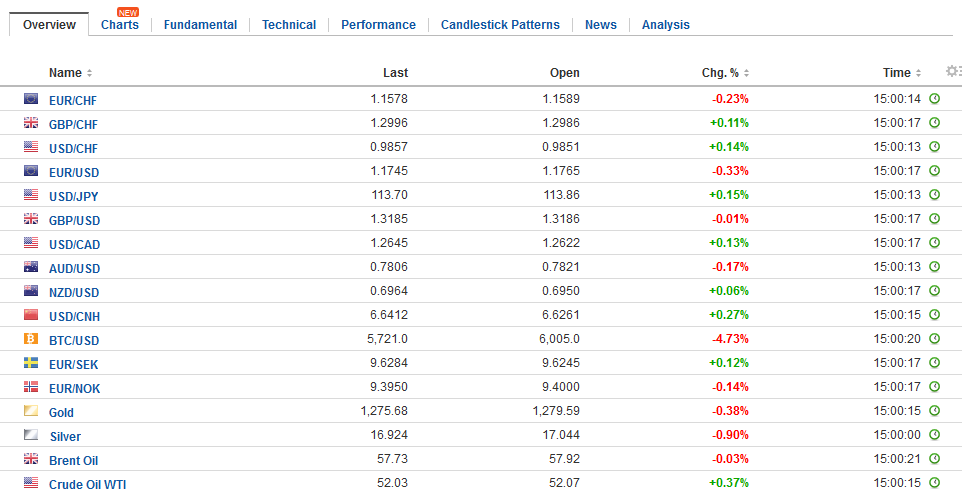

Swiss Franc The Euro has fallen by 0.04% to 1.1578 CHF. EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying modest gains against most currencies as prospects of both tax reform and additional monetary tightening by the Fed carry over from last week. The strong showing of the Liberal Democrats in Japan, where the governing coalition has maintained its super-majority is seen as confirmation of continuity. This helped lift Japanese shares and weighed on the yen. The Nikkei advanced 1.1%, the most in a month, and extends the advancing streak to a record 15 sessions. The Nikkei is at 20-year highs. The dollar gapped higher

Topics:

Marc Chandler considers the following as important: CAD, China House Prices, EUR, EUR/CHF, Eurozone Consumer Confidence, Featured, FX Trends, JPY, newslettersent, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.04% to 1.1578 CHF. |

EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

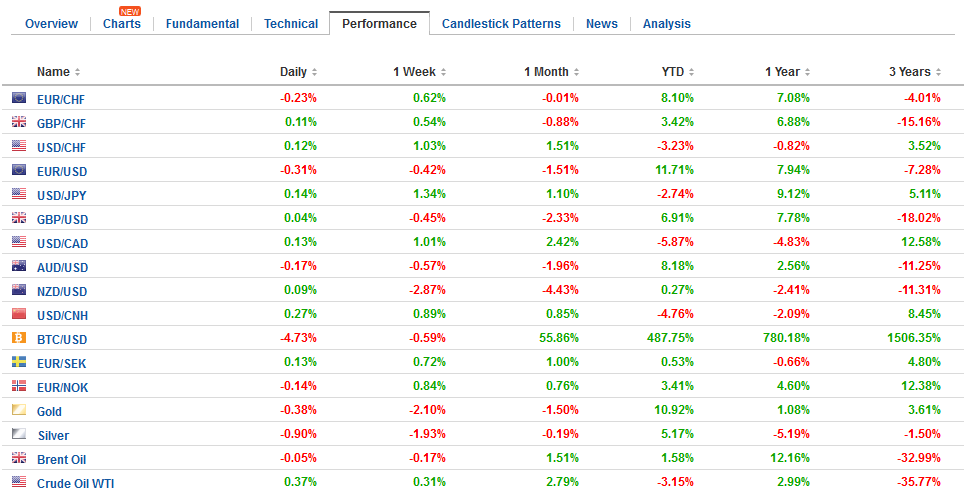

FX RatesThe US dollar is enjoying modest gains against most currencies as prospects of both tax reform and additional monetary tightening by the Fed carry over from last week. The strong showing of the Liberal Democrats in Japan, where the governing coalition has maintained its super-majority is seen as confirmation of continuity. This helped lift Japanese shares and weighed on the yen. The Nikkei advanced 1.1%, the most in a month, and extends the advancing streak to a record 15 sessions. The Nikkei is at 20-year highs. The dollar gapped higher against the yen. The pre-weekend high was JPY113.57 according to Bloomberg, and today’s low has been JPY113.62. The greenback briefly traded to JPY114.10 in early Asian turnover, the highest since mid-July. The low was recorded late in the Asian session. |

FX Daily Rates, October 23 |

| Abe’s victory is seen as giving his constitutional reforms new impetus. However, polls suggest the LDP is more popular than Abe and polls show the public still needs to be persuaded about the need for the constitutional changes. A Yomiuri polls earlier this month found a little less than half of the public support the changes and a survey by Asahi last month found a little more than a third favored the changes. Recall that constitutional changes need to be approved in a public referendum.

The euro is trading heavily as follow-through selling after the poor close before the weekend brings the single currency back toward last week’s lows (~$1.1730). The euro is seen in a little more than a two-cent range between roughly $1.6660 and $1.1880. The widening rate differentials continue to weigh on the euro. The US premium on two-year money is above 230 bp today, a new high since 1999, when it peaked near 270 bp, almost 20 bp shy of the modern peak in 1997. The 10-year differential is knocking on 195 bp, the most in four months. The Dollar Index is flirting with important resistance in the 94.00-94.25 area, which corresponds with a neckline of a bottoming pattern that would project toward 97.00, where the 200-day moving average is presently found. The 97.40 area matches the 50% retracement of this year’s decline. |

FX Performance, October 23 |

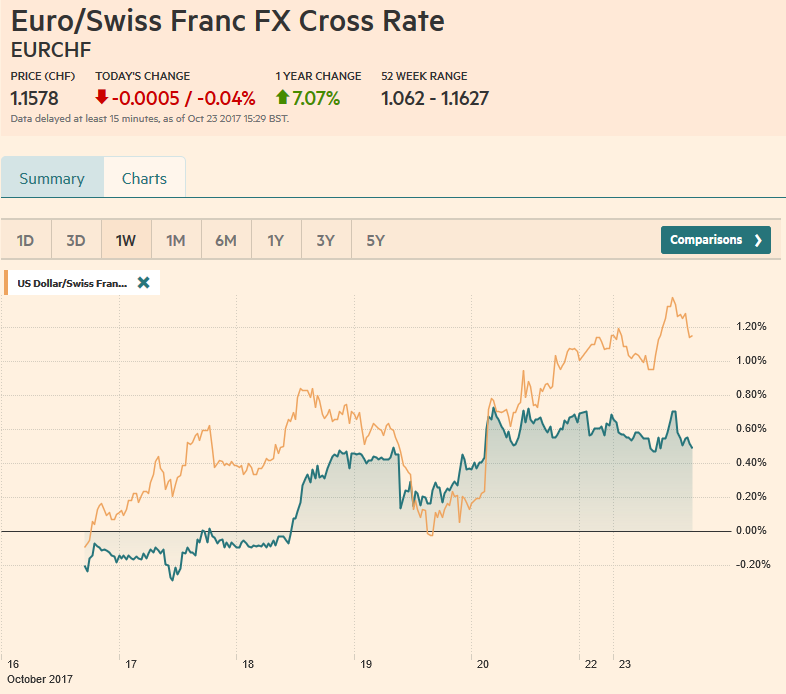

China |

China House Prices, Sep 2017(see more posts on China House Prices, ) Source: Investing.com - Click to enlarge |

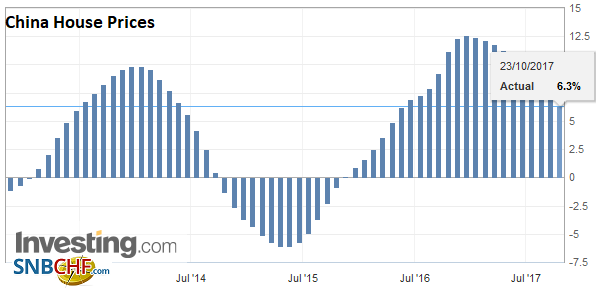

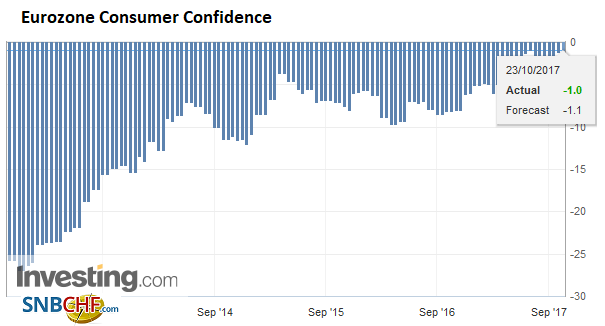

Eurozone |

Eurozone Consumer Confidence, Oct 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

The debt markets are giving little hint that Spain’s government is set to proceed with removing Catalonia’s autonomy or that the Catalans are going to resist. The 10-year Spanish bond yield is off nearly three basis points, and the premium over Germany is edging down. Prime Minister Rajoy, who heads up a minority government has the support of the Socialists, Ciudadanos, many businesses in the region (which accounts for 20% of Spain’s GDP) and the army. To invoke Article 155, Rajoy needs the approval of the Senate, which is expected over the coming weekend.

With the law on its side, the Spanish government faces a dilemma over the appropriate level of force that can be effective to stop the push toward secession without alienating the public and political support. The Basque Nationalists who supported the minority government earlier has begun abandoning it, and this appears to be delaying the 2018 budget plans.

Spanish equities are trading heavily. The 0.35% decline contrasts with a small upside bias of the Dow Jones Stoxx 600.Financials and industrials are the largest drags on Spain’s equity market, while materials and information technology sectors are moving are offsetting part of the decline.

The shift to the right in the Czech Republic as a result of the weekend election failed to impress the market. The Czech koruna is unchanged, while most of the central and eastern European currencies are lower. The yield on the 10-year Czech bond is off almost a single basis point, but other regional bond yields are 1-2 basis points higher. The two-year yield is off four bp, among the most in Europe.

We make the same point about Italy. Two regions (Lombardy and Veneto) held non-binding referendums seeking greater financial autonomy. The referendums won easily, but the markets have not paid much notice. Italy bonds and stocks are holding their own.

There is a nearly 900 mln euro option struck at $1.1730 that expires today. There is also 605 mln euros struck at $1.1785 that are on the bubble. While the yen’s sell-off clears the options deck, the is a $1.6 bln option struck at JPY114 that expires Wednesday.

The US and Canadian calendars begin off quietly, without much in the way of tier one data on tap today. The highlight of the week for the US include the Oct ISM/PMI which will give a sense of how Q4 has begun, but also the first look at Q3 GDP. Economists look for a modest slowing from the 3.1% pace in Q2 to 2.5%, which, for the record, remains above trend. A pullback in consumption after a 3.3% annualized pace in Q2 is expected to be the main drag. The highlight of the week for Canada is the central bank meeting. Not only has speculation of a rate hike eased considerably, but the market is giving up on a hike this year.

The Canadian dollar was sold ahead of the weekend on the back of disappointing retail sales and the smaller than expected rise in CPI. The US dollar closed above CAD1.26. Follow through Canadian dollar selling has seen the greenback rise toward CAD1.2640. The next immediate target is the late August high near CAD1.2660 and then the CAD1.2725, the 38.2% retracement of this year’s decline. We suggest that among the best contemporaneous indicators for the USD-CAD exchange rate is the two-year interest rate differential. Initially today, the two-year rates are moving in opposite directions, with the US yield up slightly and Canada’s yield off a basis point. The 11 bp premium the US offers is the most in two months.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CAD,$EUR,$JPY,$TLT,China House Prices,EUR/CHF,Eurozone Consumer Confidence,Featured,newslettersent,USD/CHF