Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before. Celebrating the milestone might’ve been the proposed purpose behind the state...

Read More »China’s Eurodollar Story Reaches Its Final Chapters

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream. Only, you can see just on the other side of the hill the bright reflective lights of one of China’s many glittering modern cities. Not only are you reminded of the stark difference between what...

Read More »The Relevant Word Is ‘Decline’

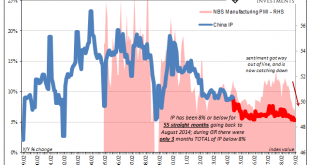

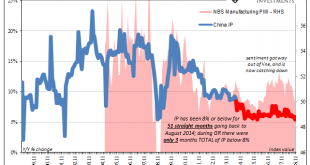

The English language headline for China’s National Bureau of Statistics’ press release on November 2018’s Big 3 was, National Economy Maintained Stable and Sound Momentum of Development in November. For those who, as noted yesterday, are wishing China’s economy bad news so as to lead to the supposed good news of a coordinated “stimulus” response this was itself a bad news/good news situation. If the Communist State...

Read More »Anchoring Globally Synchronized Growth, Or We Gave Up Long Ago?

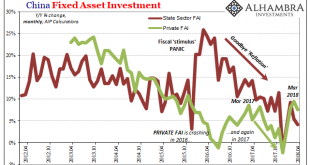

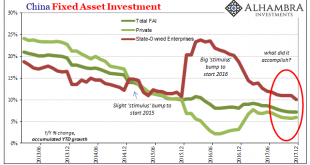

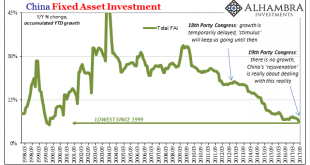

January was the last month in which China’s National Bureau of Statistics (NBS) specifically mentioned Fixed Asset Investment (FAI) of state holding enterprises (or SOE’s). For the month of December 2017, the NBS reported accumulated growth (meaning for all of 2017) in this channel of 10.1%. Through FAI of SOE’s, Chinese authorities in early 2016 had panicked themselves into unleashing considerable “stimulus.” There...

Read More »China’s Questionable Start to 2018

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week). Despite this attempt to offset them, there remains...

Read More »The Blatant Dishonesty of the ‘Boom’

Why do humans tend to behave in herds? It’s a fundamental question that only recently have researchers been able to better understand. On the one hand, it doesn’t take an advanced degree in some neurological science to see the basis behind it; survival for our ancestors often meant getting along with the crowd. There are times when that very trait applies still. In 2009, neurologists in the UK conducted function...

Read More »The Dea(r)th of Economic Momentum

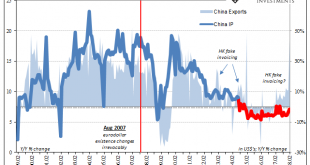

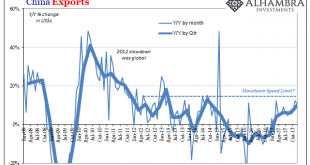

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape. China Exports,...

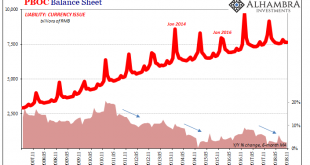

Read More »Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

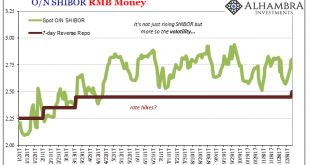

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the...

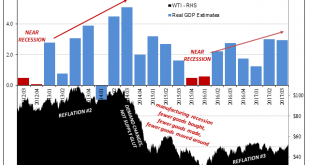

Read More »Globally Synchronized Downside Risks

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have...

Read More »An Unexpected (And Rotten) Branch of the Maestro’s Legacy

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied. Without any objection,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org