Social Security is an important part of almost every retirement plan, whether you’ve saved enough or not. That’s why it’s important to know as much about your Social Security situation as possible. And you don’t want to wait until you’re about to retire to gather the facts and take appropriate steps. Social Security planning needs to start 5 years before your target retirement date. Check your estimated benefit amount The easiest way to check Social Security’s...

Read More »The Insatiable Appetite to Tax Social Security Benefits

First, it was 10%, then 20%, and today more than 50% of U.S. retirees pay taxes on their Social Security benefits, and the number is expected to go even higher. The cause seems to be that one government hand doesn’t know, or care, what the other government hand is doing. The rub comes because income tax brackets are adjusted for inflation each year. But income thresholds determine if you pay taxes on Social Security, and how much, haven’t been adjusted for inflation...

Read More »Take Advantage of These COVID Estate Planning Opportunities by the End of 2020

May you live in interesting times. Although that sounds like an ancient blessing, it’s believed to be a Chinese curse casting instability and uncertainty on the person who hears it. Blessing or curse, it’s a great description of the year we’ve just come through, and in spite of all the turmoil, there are some things you can do before the end of 2020 to take advantage of all the madness. Strauss Attorneys PLLC has come up with a list of estate planning insights,...

Read More »How Much Taxes Will Retirees Owe on Their Retirement Income

Planning for retirement. We spend most of our working career preparing for it, saving for it, covering every contingency. When you finally wave goodbye to the company, you’re ready for all that planning to take over. But does your planning take into account the taxes you’ll have to pay on your retirement income? It’s one of the biggest retirement planning mistakes people make. Anqui Chen and Alicia H. Munnell at the Center for Retirement Research at Boston College...

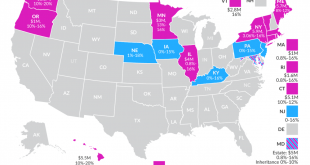

Read More »17 States that Charge Estate or Inheritance Taxes

Death tax, inheritance tax, estate tax—call it what you will, they all mean that some government entity wants to put its hand in your pocket or your heirs’ pockets, after your demise. On the federal level, the estate tax issue is not as big a deal as it was back in the day. Today individuals can pass on more than $11 million and couples can pass on more than $23 million before Washington comes after your money. 17 states, on the other hand, have not moderated their...

Read More »5 Estate Planning Myths That Can Derail Your Estate Plan

You spend a lifetime earning, saving, acquiring. But the old adage is true—you can’t take it with you. So, what do you do with your assets when you’re gone? How do you want them distributed? That’s where a good estate plan comes in. However, some estate plans are based on ideas that just aren’t true. Plans are made based on emotion rather than logic, and that’s where the best-laid estate plans can go wrong. Christopher D. Wright, JD is a CPA at Marks Paneth LLP. In...

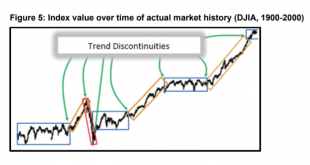

Read More »Retirement Income Planning Truth with Jim Otar. Part 1.

Income is the lifeblood of retirement. In Part 1, wisdom from the early chapters of Jim Otar’s new book about retiree income challenges is explored. A one-person revolutionary. In 2004, I discovered the work of Canadian-based planner and Chartered Market Technician Jim Otar. As a result of his work, I changed my approach to planning. Compared to conventional financial gurus, Jim’s research showcased how stock market cycles changed over time and negatively affected...

Read More »12 States That Keep Retirement Dollars in Your Pocket

“Will I outlive my money?” That’s one of the biggest concerns for most retirees. There’s the high cost of medical care, which gets more expensive all the time. There’s inflation, which raises the cost of goods and services, eating into your retirement budget. And then, there’s taxes, which are as certain as death, and the politicians who want to raise them. So, if taxes are an issue where you live, and you’re thinking about moving to a place that’s more economically...

Read More »Medical Reimbursement Accounts

[embedded content] You Might Also Like 5 Tax Strategies to Help you Hold on to Your Money in Retirement What is retirement, really? We think we know. So, we do our best to prepare for both current circumstances and as many surprises as we can conjure up. After all, with people living longer than ever before your money has to last longer than ever before. Gratuitously Impatient (For a)...

Read More »Is this the Beginning of a Recession?

As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn. The case of recession does seem to be one of those open...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org