How would you like to waste a lot of the money you spend on Medicare coverage and miss a bunch of the benefits Medicare provides? Crazy question. But that’s exactly what’s happening to millions of Medicare beneficiaries. In October 2021, the insurance website MedicareAdvantage.com published the results of its most recent survey of Medicare beneficiaries. What it found was disturbing. Three out of four Medicare beneficiaries describe the program as “confusing and...

Read More »Letting Retirees Save for Healthcare Tax-Free

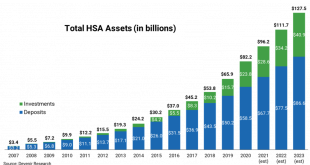

Health Savings Accounts (HSA) for retired folks. Isn’t that a novel idea? But it’s being considered in Congress—The Health Savings for Seniors Act, H.R. 3796. As it stands right now, the only people eligible for an HSA are those aged 65 years and younger who have a high-deductible health insurance plan meaning you have to pay $1,400 out-of-pocket for an individual or $2,800 for a family before the insurance plan pays anything. You get to deduct your contributions to...

Read More »Sky High Inflation May Mean Another Hefty Social Security Increase in 2023

In 2022, Social Security recipients got a 5.9% cost-of-living adjustment (COLA). That was the largest increase in 40 years. The COLA coming in 2023 may be even bigger. Social Security calculates cost-of-living increases based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from September to September each year. According to the Bureau of Labor Statistics, the CPI-W has increased 9.4% from March 2021 to March 2022. So,...

Read More »Baby Boomer Retirement at Risk

The seven deadliest words in the English language—We’ve never done it this way before. And that certainly applies to Baby Boomers whose prospects for retirement are different than any preceding generation. Many Boomers, those born between 1946 and 1964, have made their retirement plans based on their parent’s generation. The World War II crowd retired with income from Social Security and, in most cases, a generous pension, providing non-stop income that lasted the...

Read More »How the IRS Taxes Your Retirement Income

Oh, the day you can hang up your career and ease into that status you’ve been working toward most of your adult life, the place that brings a smile to your face, your happy place where you no longer answer to an employer, where you set your own schedule—that magical place called “Retirement.” You’ve been saving and planning and getting things in place. But have you planned for the taxes you have to pay on retirement income? Many retirees don’t take that into...

Read More »Medicare Eats Up Most of the 2022 Social Security Raise

There was dancing in the streets when Social Security announced that 2022 checks will go up by 5.9%, the biggest Cost of Living Adjustment (COLA) in 40 years. But now, the streets are empty and the cheering is gone. Most of that Social Security COLA will be eaten up by increases in Medicare. Medicare Part B, which covers doctor services and outpatient care, will go up by 14.5% which is the largest Medicare increase ever. This year the monthly premium for Medicare...

Read More »10 Smart Money Moves to Make Right Now.

2021 isn’t over yet. So here are 10 smart money moves to make right now. Saving money should be a year-round endeavor, but life gets in the way just like anything else. So with 2021 coming to a swift, thankful end, take advantage of the fourth quarter to accelerate your financial acumen, bolster your balance sheet and successfully springboard into the new year. Tip One: Max Out HSA Contributions for 2021. A Health Savings Account is a pre-tax savings miracle...

Read More »Ask Bob – What Do I Do If I Choose The Wrong Medicare Plan?

Alhambra’s Bob Williams answers the question, “What do I do if I choose the wrong Medicare Plan?”. [embedded content] [embedded content] You Might Also Like Weekly Market Pulse: Perception vs Reality 2021-10-18 It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too...

Read More »Ask Bob: Withholding Taxes From Social Security

[embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise 2021-07-19 Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars. RRP No Collateral Coincidences As Bills Quirk, Too 2021-07-12 So much going on this week in the bond market, it actually...

Read More »Don’t Be the Victim of These 20 IRA Mistakes

Hey! It’s just an IRA. What is there to know? You put money in and it’s a tax deduction, you get to take it out after 59 ½ without paying a penalty, and at 72 the IRS makes you take some out. What else could there be? In reality, there’s a lot more. Besides being able to contribute $6,000 every year, or $7,000 if you’re over 50, IRAs make up one of the major sources of retirement savings in the United States. The Investment Company Institute says there was more than...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org