The Federal Reserve’s confidence in the economy and its need to continue to gradually increase interest rates stands in sharp contrast to most of the other major central banks. The European Central Bank will finish its asset purchases at the end of the year, but it is in no position to begin to normalize interest rates. Indeed, the risk is that it may feel compelled to off another Targeted Long-Term Repo, which would,...

Read More »FX Weekly Preview: Stocks, Trade, and the Fed in the Week Ahead

Last month’s downdraft in equities spooked investors. The fear that is often expressed is that the end of the business cycle may coincide with the end of a credit cycle and a return to 2008-2009 crisis. It seems like an increasing number of economists agree with the sentiment expressed by President Trump that the Fed is too aggressive. Of course, they do not think the president should comment on Fed policy, but they...

Read More »Cool Video: Bloomberg Discussion of Late US Cycle

An assessment of the US economy is an important input into the expectations of the dollar’s behavior in the foreign exchange market. As a currency strategist, my views of the US economy are often subsumed in discussions or talked about indirectly by talking about Fed policy. However, in this clip with Alix Steel and David Westin, I have an opportunity to sketch outlook for the US economy. I agree with those that do...

Read More »Fed Delivers, Market Yawns

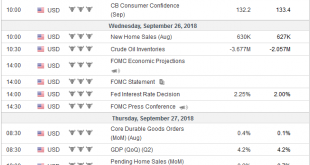

The Federal Reserve did what it was widely to do. The fed funds target range was lifted 25 bp to 2.00-2.25%. Three-quarters of Fed officials anticipate a hike in December. The market had discounted around an 80% chance. The Fed sticks with the three rate hikes in 2019 and one in 2020. The year-end rate in 2021 is the same as in 2020. The Fed is signaling that it does not expect the fed funds target to move above...

Read More »We Need a Free Market in Interest Rates

We do not have a free market in interest rates today. We have not had one since the creation of the Fed in 1913. The Fed began buying bonds almost immediately, which pushes up the price and hence pushes down the interest rate. However, as I discuss in my theory of interest and prices, the Fed creates a resonant system with positive feedback loops. It wants lower rates (so the government can borrow more, more cheaply)...

Read More »FX Weekly Preview: Next Week’s Drivers

It is a testament to the Federal Reserves communication and the evolution of investors’ understanding that we can say that the rate hike that the central bank will deliver is not as important as what it says. A rate hike is a foregone conclusion. According to the CME’s model, there is about an 85% chance of December hike discounted as well. The effective Fed funds rate is 1.92% with the target range of 1.75%-2.00%. The...

Read More »Why the Fed Denied the Narrow Bank, Report 9 Sep 2018

It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week. A company called TNB applied for a Master Account with the Federal Reserve Bank of New York. Their application was denied. They have sued....

Read More »Three Things that may Disappoint Investors

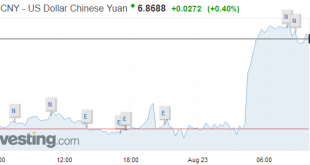

There are three areas that we suspect that many investors are vulnerable to disappointment. NAFTA, trade talks with China, and Powell speech at Jackson Hole on Friday. With problems elsewhere, the Trump Administration has been playing up the likelihood of an agreement as early as today with Mexico, which would be used, apparently to deliver a fait accompli to Canada. It is not clear what a “handshake agreement” really...

Read More »Germany, or the Bundesbank Caves In

In the FAZ, Philip Plickert reports that Deutsche Bundesbank changed its terms of business. Starting August 25, the Bundesbank may refuse cash transactions with a bank if the Bundesbank fears that, counter to the bank’s assurances, the cash transaction might help the bank or its customers evade sanctions or restrictions with the aim to impede money laundering or terrorism finance. Conveniently, this will allow the Bundesbank to reject a request by European-Iranian Handelsbank to withdraw...

Read More »Germany, or the Bundesbank Caves In

In the FAZ, Philip Plickert reports that Deutsche Bundesbank changed its terms of business. Starting August 25, the Bundesbank may refuse cash transactions with a bank if the Bundesbank fears that, counter to the bank’s assurances, the cash transaction might help the bank or its customers evade sanctions or restrictions with the aim to impede money laundering or terrorism finance. Conveniently, this will allow the Bundesbank to reject a request by European-Iranian Handelsbank to withdraw...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org