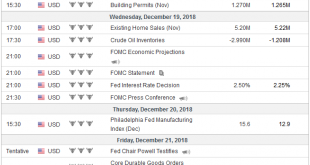

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise. The famous dot plot of the Summary of Economic Projections has long shown that...

Read More »McAndrews on Narrow Banking

At an AEI event in Washington, James McAndrews discussed narrow banking and the Federal Reserve’s opposition to McAndrews’ “The Narrow Bank USA Inc.” His slides emphasize the fact that a narrow bank can help achieve goals that Federal Reserve representatives themselves promoted in the past.

Read More »McAndrews on Narrow Banking

At an AEI event in Washington, James McAndrews discussed narrow banking and the Federal Reserve’s opposition to McAndrews’ “The Narrow Bank USA Inc.” His slides emphasize the fact that a narrow bank can help achieve goals that Federal Reserve representatives themselves promoted in the past.

Read More »US Banks Haven’t Behaved Like This Since 2009

If there is one thing Ben Bernanke got right, it was this. In 2009 during the worst of the worst monetary crisis in four generations, the Federal Reserve’s Chairman was asked in front of Congress if we all should be worried about zombies. Senator Bob Corker wasn’t talking about the literal undead, rather a scenario much like Japan where the financial system entered a period of sustained agony – leading to the same in...

Read More »Cool Video: Bloomberg Economic Discussion

I joined Chris Wolfe from First Republic Wealth Management on the set of Bloomberg’s Daybreak to discuss market developments and the outlook for the US economy. We generally agreed that while the economy is slowing it is doing so from unsustainably strong levels. We also are both highly convinced that the Fed will increase rates later this month, and anticipate two hikes next year. Investors, understandably with scar...

Read More »US November job numbers paint a strong macro picture

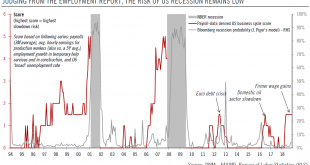

But there is some softness at the microeconomic level.US employment rose by 155,000 in November (+1.7% year on year (y-o-y), decelerating from +237,000 in October. The three-month average dropped as well, but is still a healthy 170,000/month (it was 214,000 up to October 2018). November’s wage growth was unchanged from October’s pace of 3.1% y-o-y.Most cyclical indicators continue to flash green, and there are limited signs of a downturn in the US economy right now; the solid macro picture...

Read More »FX Daily, November 29: Reluctant to Extend Dollar Losses

Swiss Franc The Euro has risen by 0.39% at 1.1337 EUR/CHF and USD/CHF, November 29 Source: markets.ft.com - Click to enlarge FX Rates Overview: The biggest US equity advance since Q1 has helped lift global markets today. The MSCI Asia Pacific Index rose for the fourth session, and nearly all the bourses in the region rallied with the notable exception of China and Hong Kong. Almost all the sectors in Europe are...

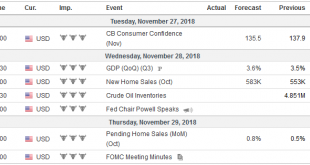

Read More »FX Weekly Preview: Powell and Draghi, Xi and Trump

The investment climate will be shaped by three events next week. ECB President Draghi’s testimony before the European Parliament to kick-off the week. Fed Chairman Powell speaks to the NY Economic Club in the middle of the week. Presidents Trump and Xi are to meet at the G20 meeting to end the week in hopes of dialing back the escalating trade conflict. Also at the G20 summit, the NAFTA2.0 is expected to be signed, and...

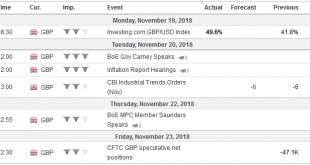

Read More »FX Weekly Preview: Unfinished Business

Often, and apparently wrongly attributed to Mark Twain is the observation that it is not what we know that gets into trouble, but “what we know that just ain’t so.” Now though, investors suffer from a different problem. Several processes are in motion, and there is little confidence in their outcomes. Among these are Brexit, US-China trade, the trajectory of Fed policy, and the EC’s efforts to enforce the agreed-upon...

Read More »Cool Video: Fox Biz TV Broad Economic Discussion

I joined Charles Payne on Fox Business TV for a broad economic discussion today. Payne, like many, are concerned that the Fed continues to tighten and worries this is going to end the business cycle. He also argued that the strong dollar was a significant threat of US multinational earnings. Charles Payne on Fox Business TV In this roughly 6.5 minute clip of the entire discussion (here), I suggest that the best...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org