“Perhaps they think that they will exercise power for the generall good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep...

Read More »The Fed’s Capitulation: What It Means For Gold Investors

“Perhaps they think that they will exercise power for the general good, but that is what all those with power have believed. Power is evil in itself, regardless of who exercises it.” – Ludwig von Mises, Nation, State, and Economy After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep...

Read More »Ein bedrohliches Zins-Szenario

Die Zinsen bleiben rekordtief: US-Notenbank Federal Reserve in Washington. Foto: Mark Wilson (Getty Images) Fast sechs Jahre ist es her, seit der einstige Finanzminister der USA und Topökonom Larry Summers im November 2013 in einer nur viertelstündigen Rede beim Internationalen Währungsfonds einem beinahe vergessenen Begriff wieder neue Prominenz verschafft hat: «Secular Stagnation» – Jahrhundert-Stagnation. Bekannt gemacht hat den Begriff Ende der 1930er-Jahre der US-Ökonom Alvin...

Read More »Die «Masters of the Universe» sind zurück

Im März schloss die EZB aus, die Minuszinspolitik vor 2020 zu beenden: Präsident Mario Draghi tritt in Frankfurt vor die Medien. Foto: Armando Babani (Keystone) Es ist wie ein Déjà-vu: Zentralbanken haben sich wieder einmal aufgemacht, die Weltwirtschaft zu retten. Als 2008 die globale Finanzkrise ausbrach, wurden die Zentralbanken zu den Protagonisten der Wirtschaftspolitik. Sie streiften ihre traditionelle Rolle als Schiedsrichter ab, der möglichst neutrale Rahmenbedingungen...

Read More »Sind Reformen nun doch das richtige Rezept?

Heil oder Übel? Protest gegen Macrons Arbeiterreform im September 2017. (Foto: Keystone/Francois Mori) Vor gut fünf Jahren löste eine Studie ein mittelgrosses Beben unter Politikberatern in Europa aus. Ökonomen wiesen wissenschaftlich nach, dass Wirtschaftsreformen in den hoch verschuldeten und stagnierenden Ländern Südeuropas nichts bringen. Dabei pochten doch Regierungsvertreter und Mainstream-Ökonomen seit langem darauf, dass Länder wie Italien, Griechenland und Spanien...

Read More »Weiche und harte Landungen

Die US-Wirtschaft wächst seit längerem überdurchschnittlich: Jerome Powells Fed ist gefordert. Foto: Kevin Wolf (Keystone) Der deutsch-amerikanische Ökonom Rudi Dornbusch schrieb 1998, kein Aufschwung sterbe eines natürlichen Todes. Stets mache ihm die Zentralbank den Garaus. In den markigen Worten des 2002 verstorbenen Dornbusch: «None of the postwar expansions died of natural causes, they were all be murdered by the Fed.» In den kommenden zwei Wochen werden alle wichtigen Zentralbanken...

Read More »Review of the Federal Reserve’s January meeting

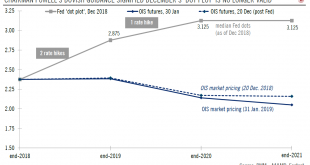

Fed signals end of rate hikes and that bank reserve liquidity tightening is near.Dovishness was on full display at the Fed meeting on 30 January. The Fed removed its rate tightening bias, and emphasised its “patience” until the next rate move.Chairman Powell seemed particularly anxious about the global growth backdrop and explained the more dovish stance is just “common sense risk management”.Another key focus was the balance sheet reduction as Powell hinted that a decision about ceasing the...

Read More »US macro and Federal reserve forecast update

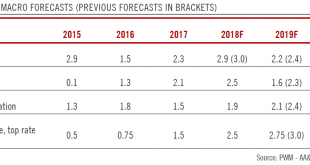

Near-term recession risks remain limited, and a dovish Fed offers supportWe are reducing our 2019 US growth forecast to 2.2%, from 2.4% previously, mostly to account for the partial government shutdown. New York Fed president John Williams has stated that the impact of the shutdown could reach 1% of Q1 GDP.Despite the lower forecast, we remain confident about the underlying fundamentals of the US economy and still regard near-term recession risks as limited. Furthermore, US GDP tends to be...

Read More »Extraordinary times for the US economy

Fed officials compete to trumpet about the health of the US economy.We have long-highlighted how solid the US economy is, in-line with our ongoing scenario of 3% GDP growth for the year. That strong corporate investment is driving this offers still better news, given its potential to ultimately feed stronger productivity growth.Another positive lately is that US firms’ solid optimism about investment is coupled with strong hiring intentions. This is all the more striking given that hiring...

Read More »Throw the textbook away: US inflation is still modest

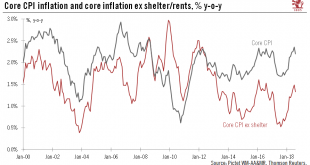

August CPI data once again underscores ongoing puzzle of a strong US economy creating little inflationary pressure.Core CPI inflation was relatively modest in August, rising only 0.08% month on month, while the year-over-year (y-o-y) rate slowed to 2.2% from 2.4% in July. Core inflation was up only 0.08% m-o-m, and the y-o-y reading slowed to 2.2% from 2.4% in July. This means that for all its recent strength of the economy (underlying growth of 3% and unemployment below 4%), the US is still...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org