Alles im Griff? Janet Yellen informiert am Mittwoch, 13. Dezember über die Zinsanhebung. Foto: Carolyn Kaster (Keystone) Janet Yellen mag keine Überraschungen. Die abtretende Chefin der US-Notenbank (Fed) hat am Mittwoch ihre letzte Zinserhöhung durchgesetzt: Wie von den Finanzmärkten allgemein erwartet, hat die Notenbank den Leitzins, die Fed Funds Rate, um 0,25 Prozentpunkte auf ein Zielband von 1,25 bis 1,5 Prozent erhöht. Für 2018 stellt das Fed-Führungsgremium – es wird ab Februar...

Read More »Das verflixte siebte Jahr

Wird sie mit ihrer Zinserhöhung womöglich eine weitere Krise auslösen? Fed-Präsidentin Janet Yellen. (Foto: Chip Somodevilla/Getty Images) In den letzten dreissig Jahren fand immer im siebten Jahr der Dekade eine grössere Finanzkrise statt. Ist das blosser Zufall, oder steckt dahinter eine Regelmässigkeit, die wir ernst nehmen müssen? Auf den ersten Blick haben die Finanzkrisen nichts Gemeinsames, denn sie gehören unterschiedlichen Typen an. Die Krise von 1987 bestand in einem...

Read More »Keine Finanzkrise mehr zu unseren Lebzeiten?

Alles im grünen Bereich, sagt die US-Notenbankchefin: Janet Yellen in London am 27. Juni 2017. Foto: Frank Augstein (Keystone) Zehn Jahre sind seit dem Ausbruch der globalen Finanzkrise vergangen. Im Frühjahr 2007 frassen sich erste Verluste aus dem amerikanischen Subprime-Hypothekenmarkt durch die Bankenwelt, im August 2007 kam es zu einem ersten dramatischen Liquiditätsschock im Finanzsystem. Ein gutes Jahr später, im September 2008, stand die Finanzwelt – und mit ihr die gesamte...

Read More »Keine Finanzkrise mehr zu unseren Lebzeiten?

Alles im grünen Bereich, sagt die US-Notenbankchefin: Janet Yellen in London am 27. Juni 2017. Foto: Frank Augstein (Keystone) Zehn Jahre sind seit dem Ausbruch der globalen Finanzkrise vergangen. Im Frühjahr 2007 frassen sich erste Verluste aus dem amerikanischen Subprime-Hypothekenmarkt durch die Bankenwelt, im August 2007 kam es zu einem ersten dramatischen Liquiditätsschock im Finanzsystem. Ein gutes Jahr später, im September 2008, stand die Finanzwelt – und mit ihr die gesamte...

Read More »Der Bondmarkt vertraut Trump nicht mehr

Das Fed erhöht die Leitzinsen, doch die «Trump Reflation» bleibt aus. Bild: Carlos Barria (Keystone) Janet Yellen ist guten Mutes. Die Vorsitzende der amerikanischen Notenbank (Fed) und ihre Kollegen haben am Mittwoch den Leitzins abermals um 0,25 Prozentpunkte erhöht. Es war die vierte Zinserhöhung, seit das Fed im Dezember 2015 den Pfad der Nullzinsen verlassen hatte. Steigende Leitzinsen – konkret geht es dabei um die Federal Funds Rate, also den Zinssatz, zu dem sich Banken...

Read More »Der Bondmarkt vertraut Trump nicht mehr

Das Fed erhöht die Leitzinsen, doch die «Trump Reflation» bleibt aus. Bild: Carlos Barria (Keystone) Janet Yellen ist guten Mutes. Die Vorsitzende der amerikanischen Notenbank (Fed) und ihre Kollegen haben am Mittwoch den Leitzins abermals um 0,25 Prozentpunkte erhöht. Es war die vierte Zinserhöhung, seit das Fed im Dezember 2015 den Pfad der Nullzinsen verlassen hatte. Steigende Leitzinsen – konkret geht es dabei um die Federal Funds Rate, also den Zinssatz, zu dem sich Banken...

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

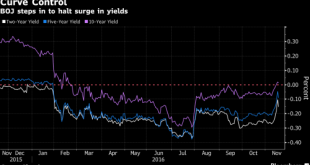

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials were preparing the market for a summer hike. Risks of a new downturn in Japan spurred speculation that BOJ would ease policy. On the other hand, the neither the Bank of England nor the Swiss National Bank were expected to move ahead of the UK referendum on June 23. Besides...

Read More »The Fed is likely to wait until September before hiking rates

As widely expected, core personal consumer expenditure (PCE) inflation dropped back slightly in March in the US, while wage increases remained subdued in Q1. We now expect that the Federal Open Market Committee (FOMC) will hike rates only once in 2016, probably in September. Read the full report here In Friday's report on income and consumption, data were also published on the PCE deflator, the price measure targeted by the Fed in gauging inflation. The core PCE price index (excluding...

Read More »Four Keys to The Week Ahead

There are four events that will shape market psychology in the week ahead. They are Yellen's speech to the NY Economic Club, US jobs data, eurozone March CPI and PMI, and Japan's Tankan Survey. The broad backdrop is characterized by the rebuilding of risk appetites since the middle of February, though the MSCI emerging market equity index put in its low on January 20, as did the CRB Index. The price of oil appeared to bottom then as well, but it retested the lows in mid-February and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org