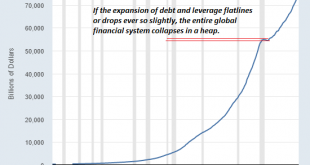

Subtract their immense debts and they have negative net worth, and therefore the market value of their stock is zero. To understand why the financial dominoes toppled by the Covid-19 pandemic lead to global insolvency, let’s start with a household example. The point of this exercise is to distinguish between the market value of assets and net worth, which is what’s left after debts are subtracted from the market value of assets. Let’s say the household has done very...

Read More »Swiss industry fears consequences of US travel ban

SWISS International Air Lines has been forced to reduce flights to the US and other parts of the world. (© Keystone / Gaetan Bally) A United States ban on travellers from Europe has been condemned as “incomprehensible” by leading Swiss manufacturing association, Swissmem. The Swiss-American Chamber of Commerce has also weighed in, saying firms would seriously suffer if borders remain closed for longer than a month. The US is Switzerland’s second-largest trade...

Read More »Coronavirus: Swiss hospitals have around 750 breathing ventilators

© Ryzhov Sergey | Dreamstime.com One of the biggest challenges during the coronavirus outbreak will be ensuring there are enough qualified staff and equipment to keep the worst affected patients alive. Thierry Fumeaux, head of the Swiss Society of Intensive Medicine, told RTS there are 82 intensive care units (ICU) across Switzerland. These have a combined 850 places, of which 750 are equipped with breathing equipment. It is not clear how many of these places are...

Read More »EM Preview for the Week Ahead

Market sentiment is likely to open this week on an upswing after the Fed’s emergency rate cut and expanded QE were announced Sunday afternoon local time. Yet as we have seen time and again this past couple of weeks, added stimulus has had little lasting impact on markets as the virus numbers continue to worsen. Europe is now reporting more daily cases than China did at its peak. We remain negative on EM until the global growth outlook becomes clearer. AMERICAS...

Read More »Coronavirus: an estimate of the real number of infections in Switzerland

Today, according to the Federal Office of Public Health (FOPH), there were 815 confirmed cases in Switzerland. There are obvious challenges to this figure. Possibly the most important is the time lag between infection and a confirmed case. On average, there are 5.1 days between catching the virus and the onset of symptoms. If you look at the chart above from a WHO report on COVID-19 in China, which shows new coronavirus cases from 8 December until 20 February for...

Read More »Swiss lawyers seek to keep special ‘advisor’ status in the shadow economy

The Panama Papers leaked by Panamanian law firm Mossack Fonseca revealed that 1,339 Swiss lawyers, financial advisers and other middlemen had set up more than 38,000 offshore entities over the last 40 years. (Keystone / Alejandro Bolivar) The Swiss government faces resistance to efforts to tighten anti-money laundering rules that close loopholes for lawyers who act as “advisors” in setting up offshore financial structures. Anti-corruption expert Mark Pieth writes...

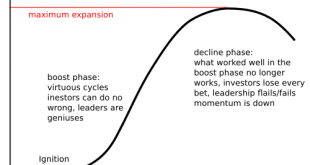

Read More »Goodbye to All That: The Demise of Globalization and Imperial Pretensions

The decline phase of the S-Curve is just beginning. Globalization and Imperial Pretensions have been decaying for years; now the tide has turned definitively against them. The Covid-19 pandemic didn’t cause the demise of globalization and Imperial Pretensions; it merely pushed the rickety structures over the edge. It’s human nature to reckon the current trend will continue running more or less forever, and that temporal, contingent structures are...

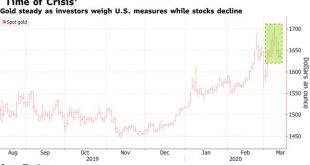

Read More »Gold Hedging Stock Market Crash: Euro Stoxx -6%, FTSE -5.7% and DAX -5.6%

◆ Stock markets around the world are collapsing today as the financial and economic implications of the impact of the pandemic on already massively indebted companies and governments is realised. ◆ Investors are liquidating en masse risk assets from equities to industrial commodities, while gold has held its ground. ◆ The FTSE 100 is down 5.8% in early trade, while Frankfurt’s DAX 30 plunged 6.8% the CAC 40 tumbled 6.5% and Dublin’s ISEQ index collapsed another...

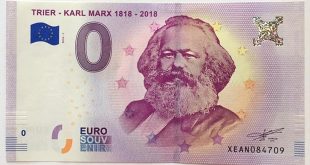

Read More »Modern Monetary Theory Is an Old Marxist Idea

Modern monetary theory, or MMT, has been getting a lot of attention lately, often celebrated as a revolutionary breakthrough. However, there is absolutely nothing new about it. The very basis of the theory, the idea that governments can finance their expenditures themselves and that therefore deficits don’t matter, actually goes back to the Polish Marxist economist Michael Kalecki (1899–1970). MMT as a Centralization Tool MMT says that the national debt means that...

Read More »Aktienmärkte erneut im Panikmodus

Der SMI ist heute morgen teilweise über 6% abgesackt. (Bild: Shutterstock.com/Pavel Ignatov) Die Aktienmärkte erlebten heute erneut einen schwarzen Tag mit Rekordverlusten: Der SMI stürzte um -9,64% auf 8270 Punkte ab, der Euro STOXX 50 um sage und schreibe -12,4% und der DAX tauchte ebenfalls zweistellig um -12,24%. Der Dow Jones lag kurz nach 18 Uhr mit -9,3% ebenfalls im tiefroten Bereich. Bereits am Morgen hatten die Börsen mit einem Kurssturz auf das...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org