Here is the link for the replay of the conference call I hosted earlier today. I shared two ways in which this crisis is different from what we have seen in the last generation. Unlike the Great Financial Crisis, the tech bubble, and the S&L Crisis, the current crisis did not begin in the financial sector, but the real economy. Also, what follows from that is that this crisis is about liquidity, while the GFC was about counter-party risk. In the call, I covered...

Read More »Helicopter Money: Short-Term Relief Won’t Cure our Financial Disease

Gordon and I discuss these topics in this 37-minute video: The collateral supporting the global mountain of debt is crumbling as speculative bubbles deflate. A great many freebies are being tossed in the Helicopter Money basket. That households experiencing declines in income need immediate support is obvious, as is the need to throw credit lifelines to small businesses. But beyond those essentials, the open-ended nature of Helicopter Money has unleashed a frenzy of...

Read More »Regime Change

Stocks took another beating last week as the scope of the coronavirus shutdown started to sink in. The S&P 500 was down 15% last week with most of that coming on Monday after the Fed’s emergency rate cuts. Our accounts performed much better than that, but were still down on the week as corporate and municipal bonds continued to get marked down. Municipals recovered slightly at the end of the week as the Fed announced they would be buying highly-rated bonds with...

Read More »Cash is Toilet Paper, Market Report 23 March

The price of gold dropped $31, and that of silver fell even more by proportion, $2.14. The gold-silver ratio hit a hit of over 126 before closing the week around 119. This exceeds the high in the ratio last hit in the George H.W. Bush recession. Last week, we were warming up to silver, if not recommending it. We said: “While we would not recommend betting on silver with leverage at this moment, we certainly would not be short silver right now. If you don’t own any,...

Read More »Sygnum bank creates digital version of Swiss franc for trading

A number of projects around the world aim to create digital versions of money. (© Keystone / Gaetan Bally) Sygnum bank has launched a digital version of the Swiss franc (DCHF) to allow faster payments when trading a new breed of securities. The DCHF digital tokens will be backed by the corresponding amount of Swiss francs that Sygnum will hold at the Swiss National Bank (SNB). Sygnum is part of a consortium of companies taking part in the SDX digital assets trading...

Read More »FX Daily, March 23: Greenback Demand Not Satisfied by Swap Lines

Swiss Franc The Euro has risen by 0.45% to 1.0587 EUR/CHF and USD/CHF, March 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: In HG Wells’ “War of the Worlds,” the common cold repelled a Martian invasion. Now, a novel coronavirus is disrupting everything and everywhere. Global equities continue to get hammered, though the apparent relative resilience of Japan may have spurred some buying of Japanese equities....

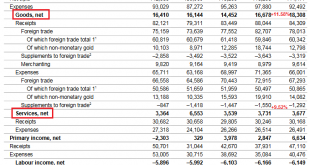

Read More »Swiss Balance of Payments and International Investment Position: Q4 2019 and review of the year 2019

Key developments in 2019 The current account surplus for 2019 was CHF 86 billion, CHF 29 billion more than the previous year. This increase was principally due to growth in primary income (labour and investment income). In the year under review, receipts exceeded expenses by CHF 14 billion, whereas in the two previous years, expenses had significantly exceeded receipts. The main contributors to this development had been finance and holding companies, which had...

Read More »Further billions may be needed to save Swiss companies

Many high street stores have been told to close their doors. (Keystone / Jean-christophe Bott) A CHF42 billion coronavirus financial aid package may not be enough to save firms from extinction, warn business leaders and economists. The state could be saddled with a bill three times higher if the crisis drags on until the end of the year. Earlier this week, the government increased its emergency funding from CHF10 billion to CHF42 billion ($42.6 billion). Some CHF14...

Read More »Swiss hospitals take French coronavirus patients

The Swiss healthcare system will be tested over the coming weeks, experts warn. (© Keystone / Gaetan Bally) Three Swiss hospitals have agreed to provide intensive care treatment for six seriously ill coronavirus patients from the neighbouring Alsace region of France. However, experts fear that Switzerland’s health infrastructure will soon be stretched by the rising number of pandemic victims. Two hospitals in Basel and one in Jura, in northwestern Switzerland, said...

Read More »The System Will Not Return to “Normal,” and That’s Good; We Can Do Better

Essential home lockdown reading. The pandemic is revealing to all what many of us have known for a long time: the status quo was designed to fail and so its failure was not just predictable but inevitable. We’ve propped up a dysfunctional, wasteful and unsustainable system by pouring trillions of dollars in borrowed money down a multitude of ratholes to avoid a reckoning and a re-set. And very predictably, that’s the “solution” to the unraveling triggered by the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org